Updated on November 4, 2025

MNSSBY Bihar Student Credit Card Scheme is an education program of the Bihar government to grant students loans for higher studies. Launched in the year 2016. The objective of this government scheme is to ensure that students do not miss out on their education due to the fees. Under this scheme, students can avail of a loan of up to ₹ 4 lakh with lower interest rates.

MNNSBY Bihar Student Credit Card (BSCC) Scheme Overview

- The Gross Enrollment Ratio (GER) in higher education in Bihar is lower than the national average (14% vs. ~24%). The government aims to increase it to 30%.

- To achieve this, the Bihar Student Credit Card Scheme has been revised and reintroduced to provide financial assistance to students for higher education.

Feature Details Scheme Name MNSSBY Bihar Student Credit Card Scheme Launched In 2016 Maximum Loan Amount ₹4 lakh Applicable For Technical, Polytechnic, and General Courses Interest Rate for Special Categories As low as 1% for Divyang, Girls, Transgender students Official Website mnssby.bihar.gov.in Loan Repayment Starts After Completion of the course & securing a job Read More: All Schemes Under MBOCWW

What Is the MNSSBY Bihar Student Credit Card Scheme?

Introduction & Background

- The Gross Enrollment Ratio (GER) in higher education in Bihar is currently 14%, whereas the national average is approximately 24%.

- The Government of Bihar aims to increase the GER to 30% to match the national average and improve higher education accessibility.

- To achieve this, the Bihar Student Credit Card (BSCC) Scheme was launched under the Good Governance Program (2015-2020).

- This scheme was introduced to provide financial assistance to students who are unable to afford higher education due to financial constraints.

Objectives of the Scheme

- Increase the enrollment ratio (GER) in higher education.

- Provide financial assistance to students for pursuing undergraduate and professional courses.

- Reduce dependency on private loans and eliminate financial barriers to education.

- Enhance employment opportunities for students in Bihar.

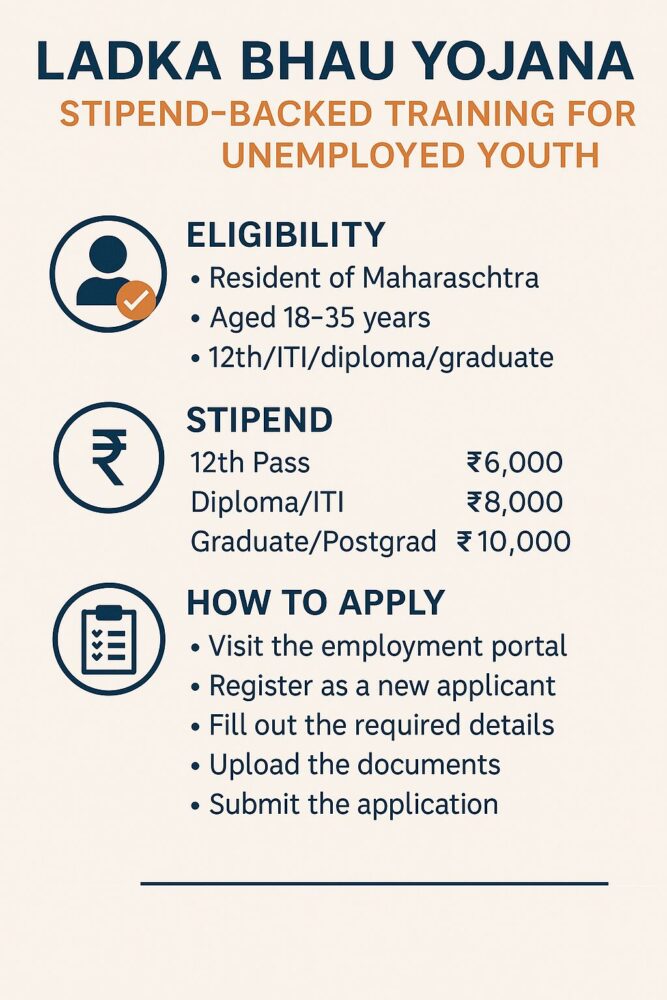

Government Schemes for India’s Unemployed Youth

Recent Update on the Bihar Credit Card Yojana

- On September 16, 2025, Nitish Kumar announced that under the scheme, all education loans will now be interest-free for eligible students in Bihar.

- An official district-level page (Saran district) notes that the scheme page was updated on June 23, 2025.

- The official portal for the scheme lists a comprehensive approved-college list (as of 2025) and reminds institutions about verification and safeguards against phishing emails.

MNSSBY Bihar Student Credit Card Target & Beneficiaries

The goal is to support all eligible students who wish to pursue higher education but face financial difficulties.

The scheme aims to benefit 50,000 students in 2018-19, 75,000 in 2019-20, and 1,00,000 students in 2020-21.

Benefits And Features Of the MNSSBY Bihar Student Credit Card Scheme

The MNSSBY Bihar Student Credit Card Scheme offers a range of features aimed at making higher education accessible to all students in Bihar. Below are the primary benefits:

- Maximum Loan Limit of 4 Lakhs: People can avail of education loans up to and as much as ₹4 lakh to carry out expenditures towards education, such as fees, books, laptops, and other related items.

- Wide Courses of Study: The scheme is relevant for undergraduate degree courses that are technical or else polytechnic or general degrees.

- Minimum Interest Rates: Special categories like Divyang, transgender, and girl students avail the rate of interest, which is as low as 1%.

- Simple Repayment: The repayment schedule of education loans commences only when the student completes their course and gets a job, thus ensuring ease of repayment during the period of study.

- Flexible Purpose: The loan can be used in payment of tuition for studies, purchasing of study materials, as well as hostel accommodation charges.

Read More: भारत सरकार ने एलपीजी उपभोक्ताओं के लिए ई-केवाईसी किया अनिवार्य

MNSSBY Bihar Student Credit Card Eligibility Criteria

To apply for the Bihar Student Credit Card (BSCC) Scheme, students must meet the following requirements:

- Residence Requirement:

- The student must be a permanent resident of Bihar.

- Students who have completed Class 12 from Bihar or other neighbouring states such as Jharkhand, Uttar Pradesh, and West Bengal are also eligible.

- Academic Qualifications:

- The student must have passed Class 12 from a recognized board.

- The student must have secured admission to a recognized higher education institution.

- The list of approved courses and institutions is mentioned in Annexure-3.

- Age Limit:

- For general undergraduate courses: The Maximum age is 25 years.

- For professional courses (MBA, MCA, etc.): Maximum age is 30 years.

- Course Eligibility:

- The loan will be provided for general undergraduate degrees (BA, BSc, BCom) and professional courses (BTech, MBBS, LLB, BPharm, etc.).

- The loan will not be provided for a second-degree course (e.g., if a student has already completed a BSc, they cannot apply for another BSc, but they can apply for an MSc or MBA).

- Loan Usage:

- The loan can be used for tuition fees, hostel expenses, books, and other academic materials.

- The student must be enrolled in a course that leads to employment opportunities.

12 Government Schemes for Urban Poor Must Know About [2025 Guide]

Required Documents for MNSSBY Bihar Student Credit Card Scheme

To apply for the MNSSBY Bihar Student Credit Card, the following documents must be submitted:

- Complete the application form.

- PAN card of the applicant and the co-applicant.

- The latest income certificate of the applicant.

- 10th and 12th standard report cards.

- Proof of joining an approved institution.

- Aadhaar card, including address proof.

- A bank passbook is used for making financial transactions.

- The student’s uncle/guardian/parent’s picture and the student’s picture.

Read More: Union Budget 2025-26

How To Check The Status Of The MNSSBY Bihar Student Credit Card Application?

Once you’ve successfully submitted your application for the MNSSBY Bihar Student Credit Card, it’s important to track the progress. You can easily check the status of your application online. Follow these simple steps to see where your application stands:

- Log In to the Portal: Go to the official page and type your username and password to register.

- View Application Status: In your dashboard, select the ‘Application Status’ section to view the application status.

- Check Status: Check if any documents are missing or if the application is under review.

Read More: Operation Amanat

List Of Eligible Courses And Colleges For The MNSSBY Scheme

The MNSSBY Bihar Student Credit Card Scheme covers a variety of undergraduate, diploma, and technical courses, including but not limited to:

- B.Tech

- B.Sc

- M.B.B.S.

- B.A.

- Diploma in Engineering

For a complete list of eligible courses and colleges, visit the official website MNSSBY Eligible Courses.

This article will describe the operational aspects of the software with a view to assisting all those MNSSBY BSCC applicants who will be using the software. The document provides step-wise instructions for various aspects of the application with visual screens for easy and better understanding. It also describes the error messages encountered while working with the software, with appropriate remedial actions required.

Simple Guide to Using the EPFO UAN Member Portal (For Employees)

Objectives of the Bihar Student Credit Card (BSCC) Application Portal

Web-based application ‘BSCC Applicant Portal’ will be used by MNSSBY BSCC applicants to achieve the following objectives:

- Student Login and View Account Summary

- View Loan Request Status

- View Disbursement details notification

- The system will display the Guidelines with the FAQ

The minimum system requirements for accessing the website are:

- Google Chrome

- Internet Explorer-11.0

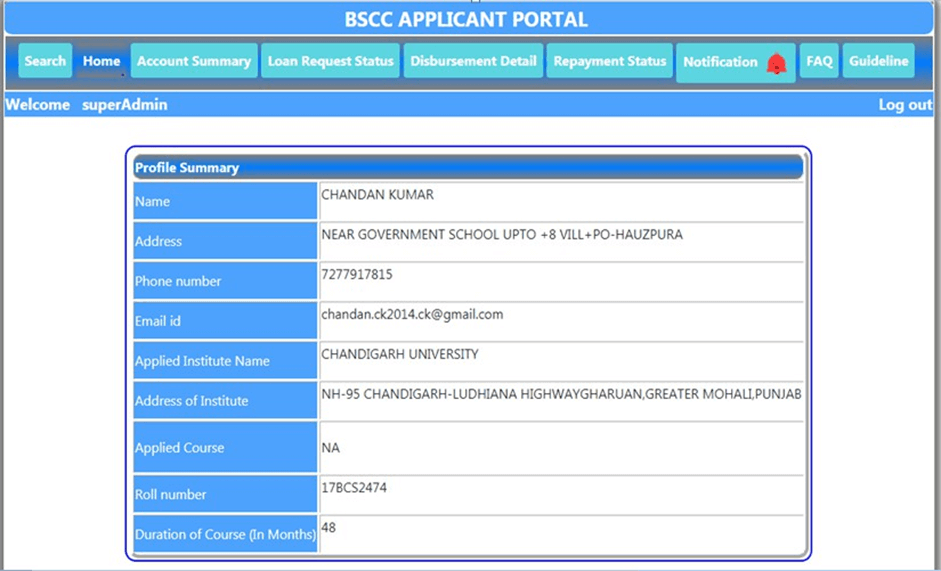

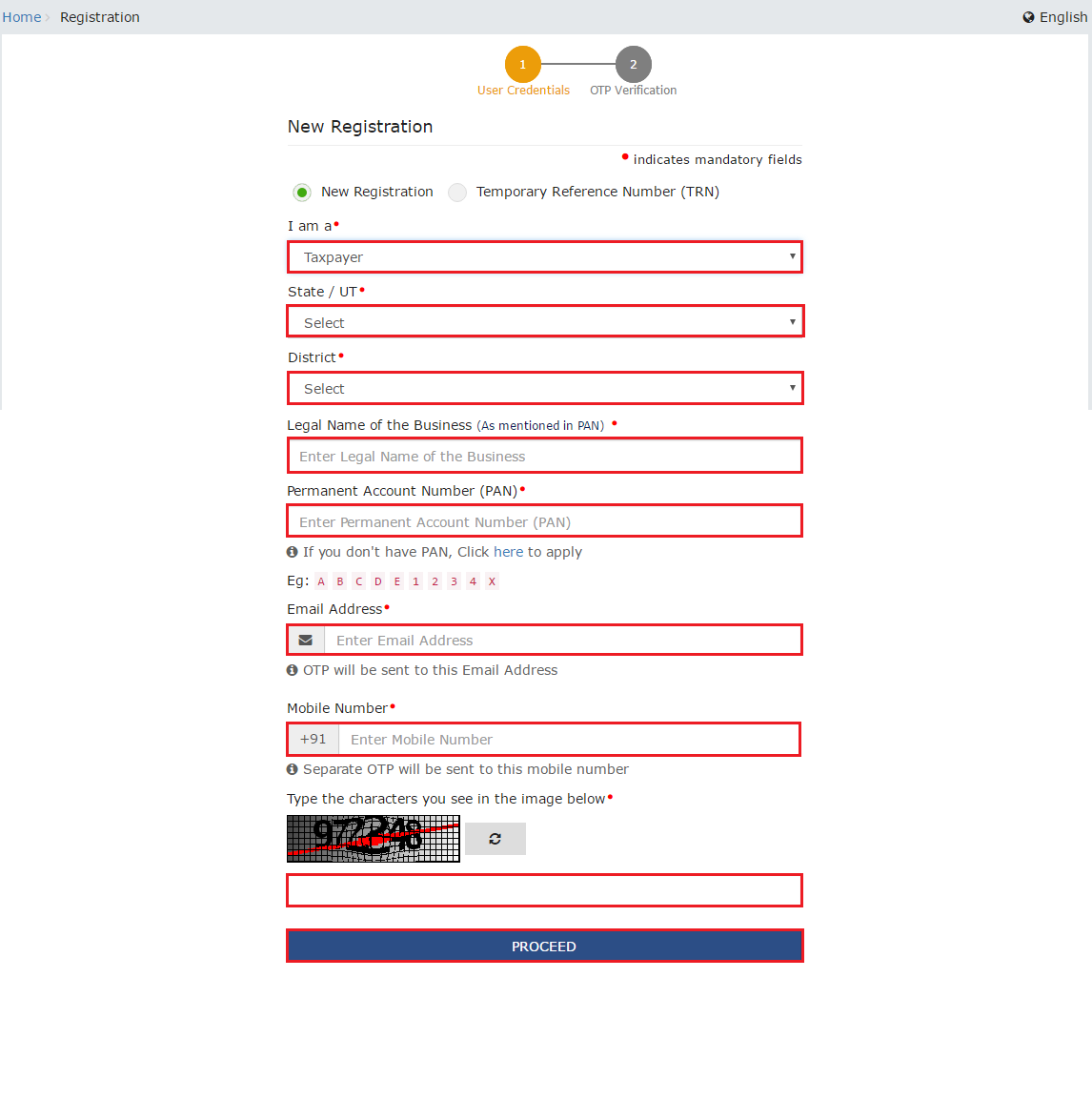

In the student login page, the User has the provision to log in to the portal by using their credentials. The Applicant needs to open the website of the application www.bsefcl.bihar.gov.in and perform the following actions:

- Open the website and click on the Student Login.

- Open the website and enter the following details:

- Username (same as used in MNSSBY)

- Password

- Capcha

- 3 In case the application enters an incorrect Username, the System will display an error message “Invalid User”.

- In case the Applicant forgets the password, he/she can click the option Forgot Password.

- Applicant needs to enter the following details:

- Registration Id

- First Name

- Email Id

- Mobile number

- Applicant will receive an OTP on their registered mobile, and he/she can reset the password.

- On successful Login, the System will display the Applicant’s Profile Summary. The applicant can view the following details:

- Name

- Address

- Phone Number

- Emil Id

- Applied Institute Name

- Address of the Institute

- Applied Course

- Roll Number

- Duration of Course

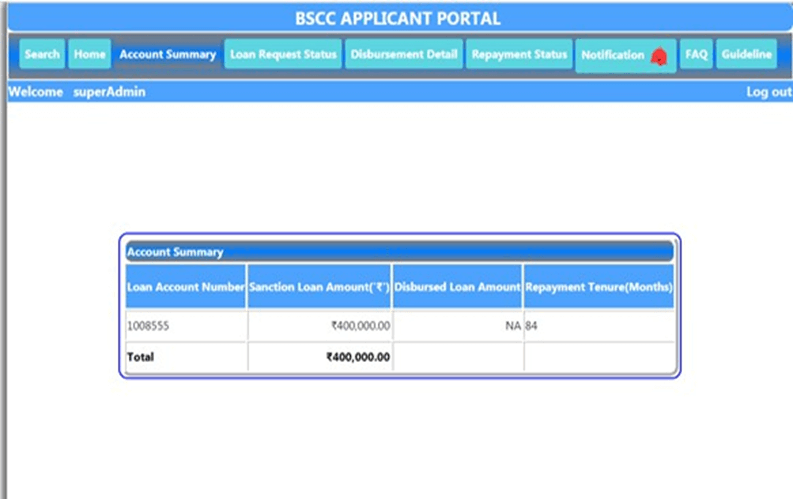

- In this feature, the user can view the details related to the Loan sanctioned to him and the disbursed loan amount. The user can also view the period of the sanctioned loan amount.

- Applicant needs to click ‘Account Summary’ to view the following details:

- Loan Account Number

- Sanctioned Loan Amount

- Disbursed Loan Amount

- Repayment Tenure in Months

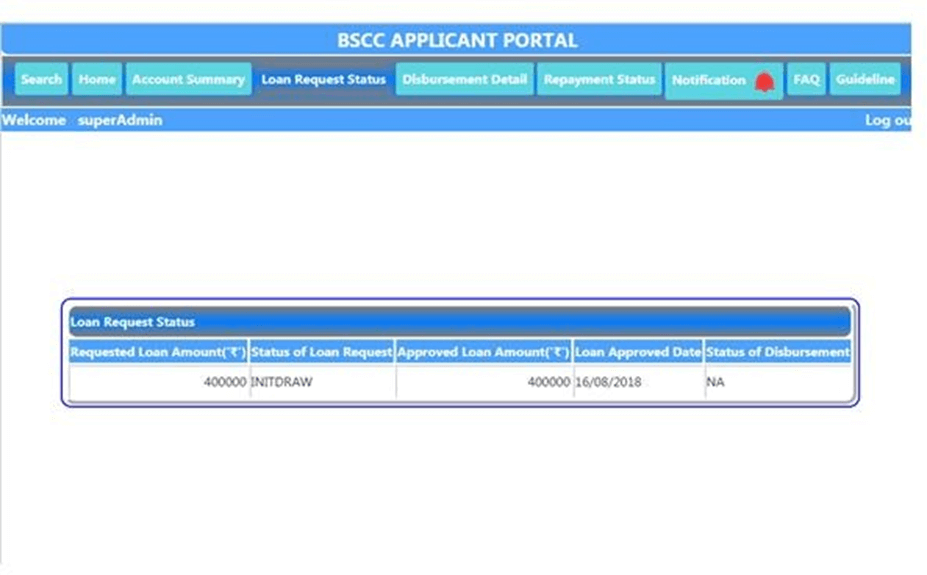

- In this feature, the user can view the status of the Loan sanctioned to him. The status includes three names :

- Pending

- In progress

- Rejected

- In case the applicant wants to view the Loan Status, they need to click ‘Loan Request Status’. The system will display the following information:

- Requested Loan Amount

- Status of Loan Request

- Approved Loan amount

- Loan approved date

- Status of Disbursement

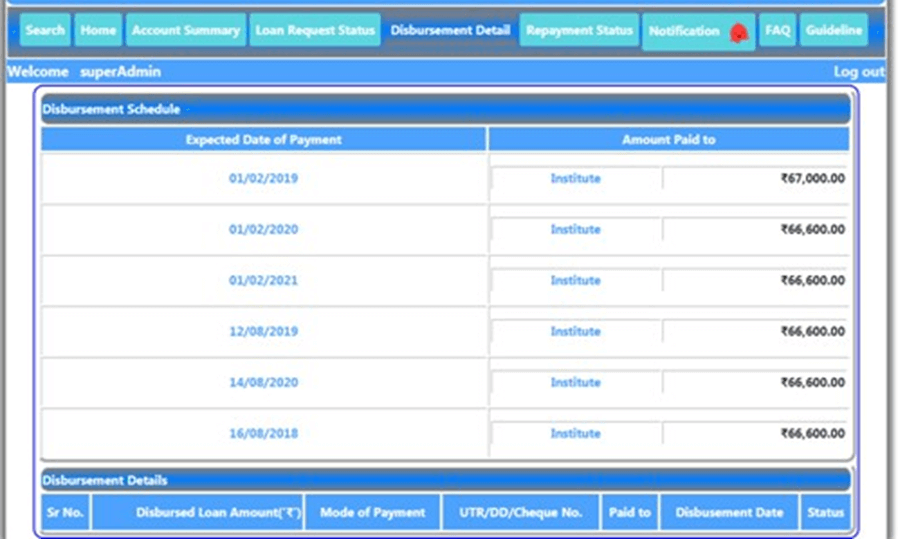

- The applicant can view the Disbursement schedule from the page ‘Disbursement Details’. The user can view the ‘Expected Date of payment’ with ‘Amount Paid To’.

- Students can easily download the computer-generated ‘Disbursement Details’

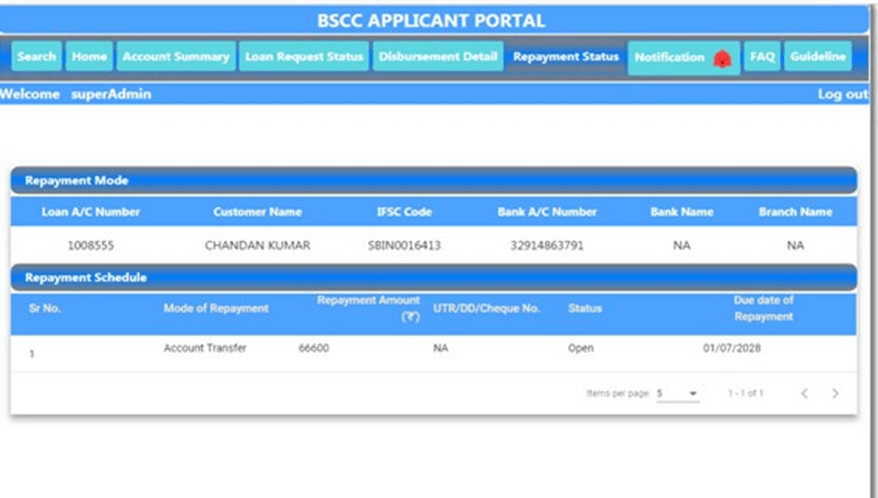

- The applicant can view the ‘Repayment Status’ with the Repayment Schedule. The applicant can view the following details:

- Mode of Repayment

- Repayment Amount

- UTR/DD/Cheque No

- Status

- Due Date of Repayment

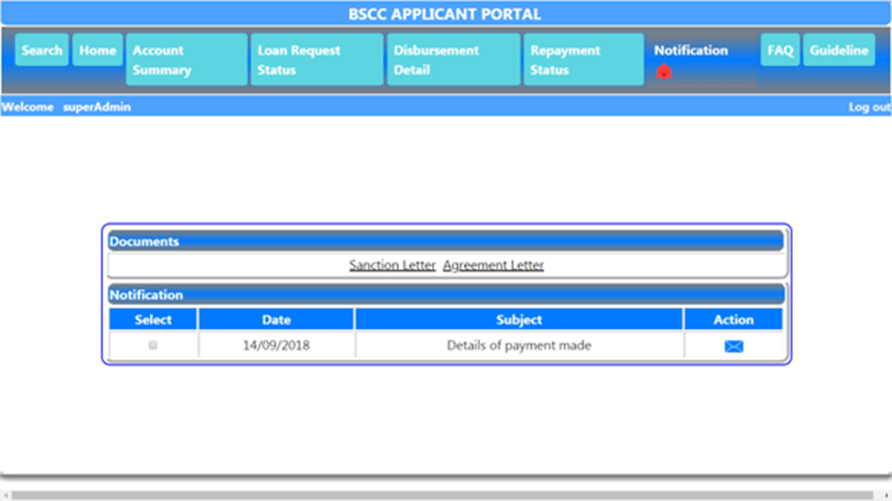

- Applicants can view the supportive documents, such as the Sanctioned and Agreement letter, from this page. Clicking on ‘Action’, the system will display the notification to the specific applicant.

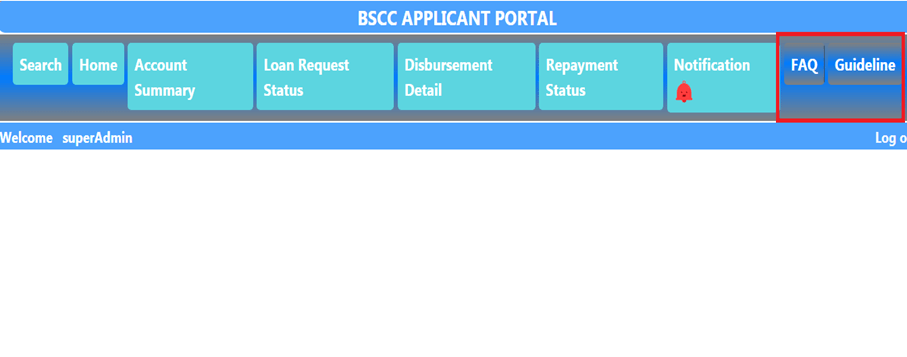

- This feature includes the general guidelines provided by the government about the schemes.

- To view the Guidelines and Frequently Asked Questions, the applicant needs to click on the button FAQ or Guidelines.

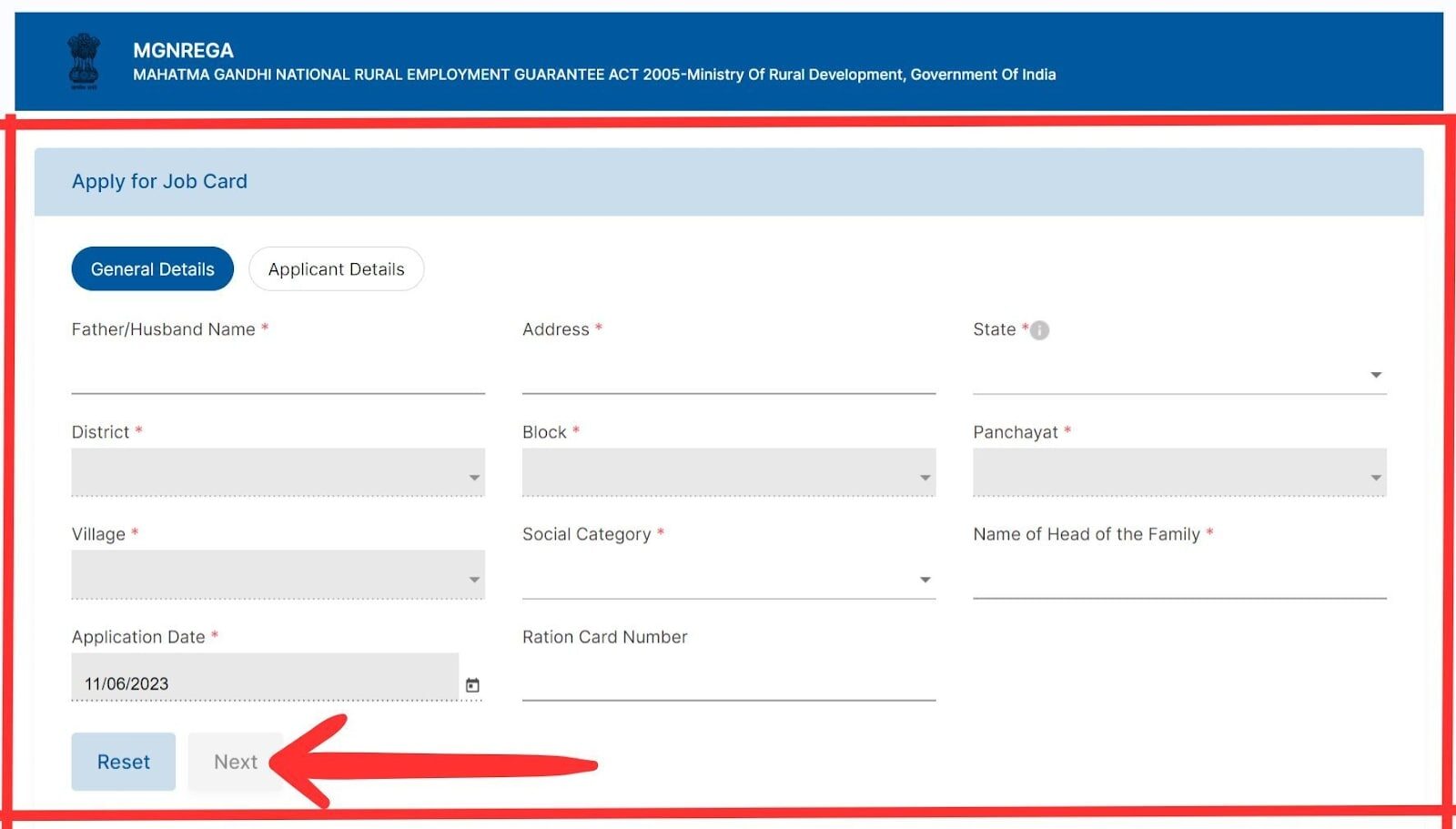

Step-By-Step Guide to the Application Process

Applying for the MNSSBY Bihar Student Credit Card Scheme is simple. Here’s how you can do it:

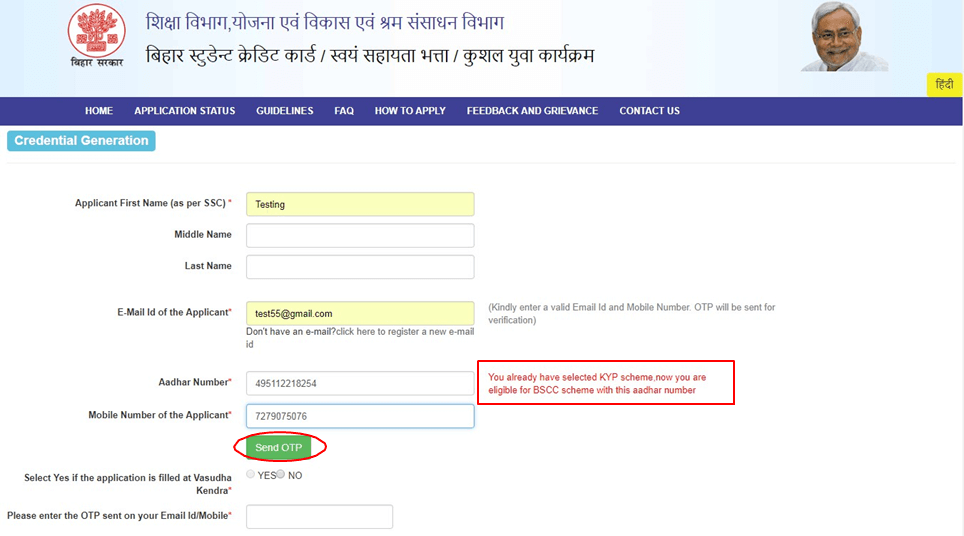

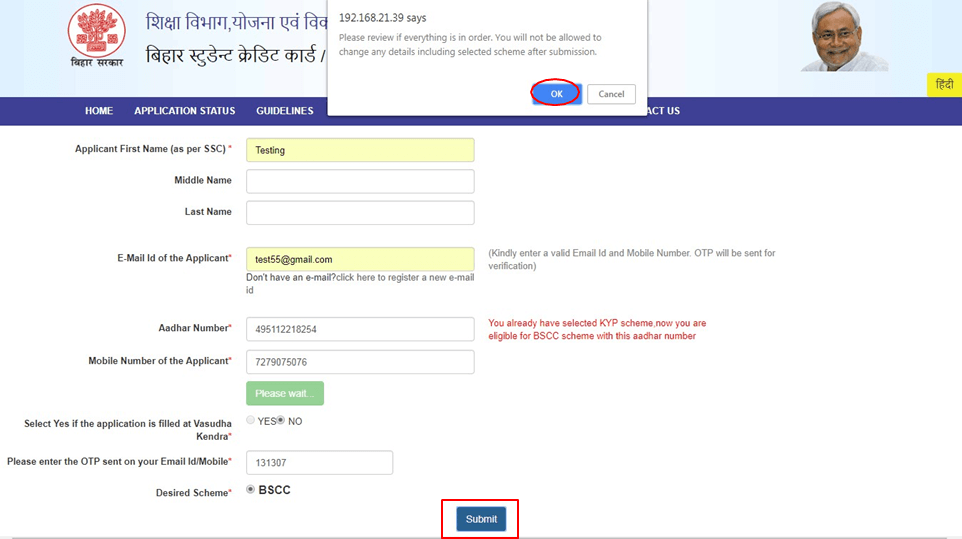

- Click on the New Applicant Registration Link

- Enter the details for First Time Registration and click on the Send OTP link

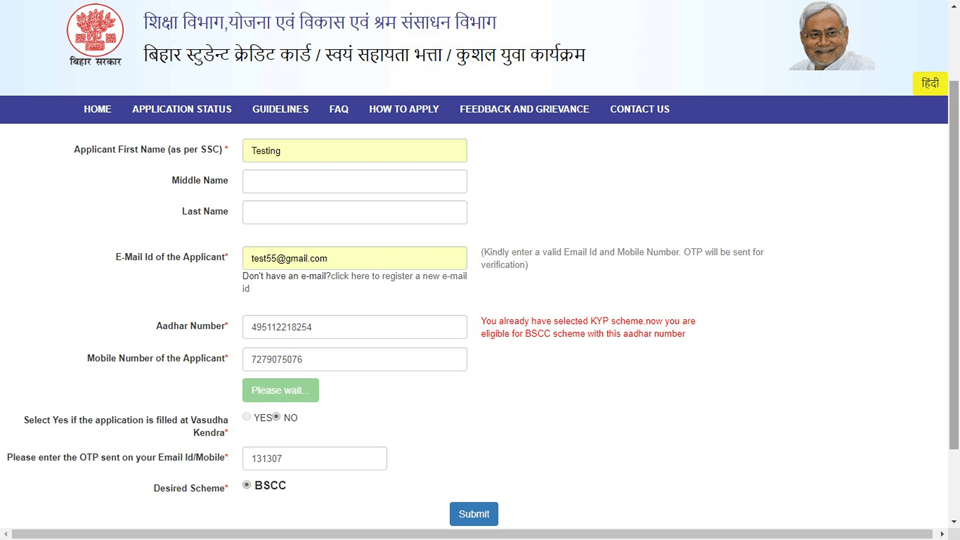

- After entering the Aadhar, if already enrolled in the KYP scheme, A message will be displayed that “You already have selected the KYP scheme, now you are eligible for the BSCC scheme with this Aadhar Number”

- Now, enter the OTP and select the scheme as BSCC

- Click on the Submit button

- On click to submit, an alert pop-up will display as “Please review if everything is in order, you will not be allowed to change any details, including the selected scheme, after submission.”

- So, if everything is ok in the First time Registration details, then click on “OK”, then a Pop-up

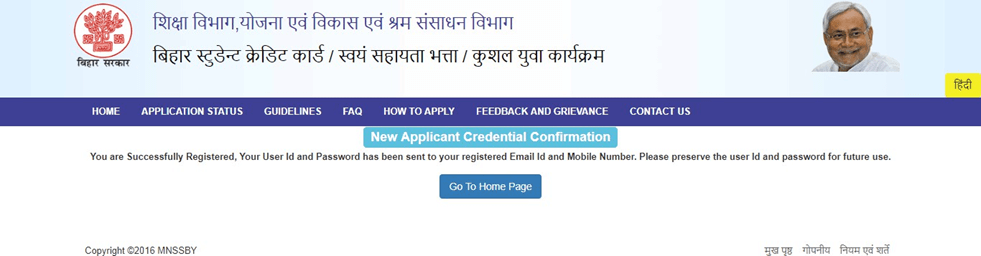

- The system will display the successful completion message of the first-time Registration as below

- Now the applicant has to enter their login credentials for the applicant login and then click on Login

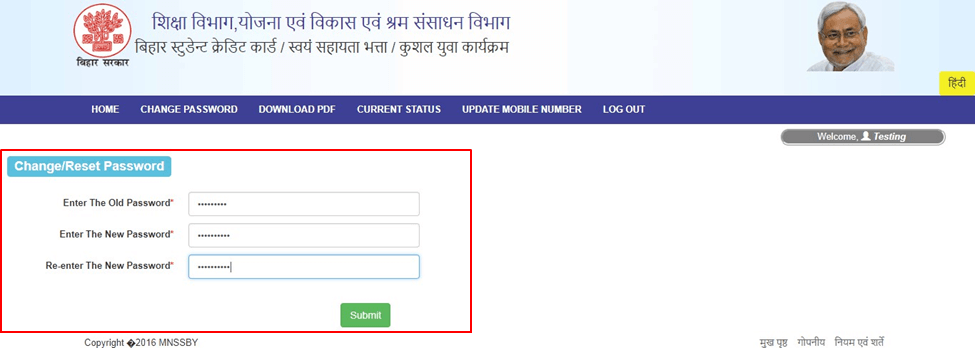

- After logging in, the Applicant has to change their Password from appeared screen of Change Password screen and click on Submit

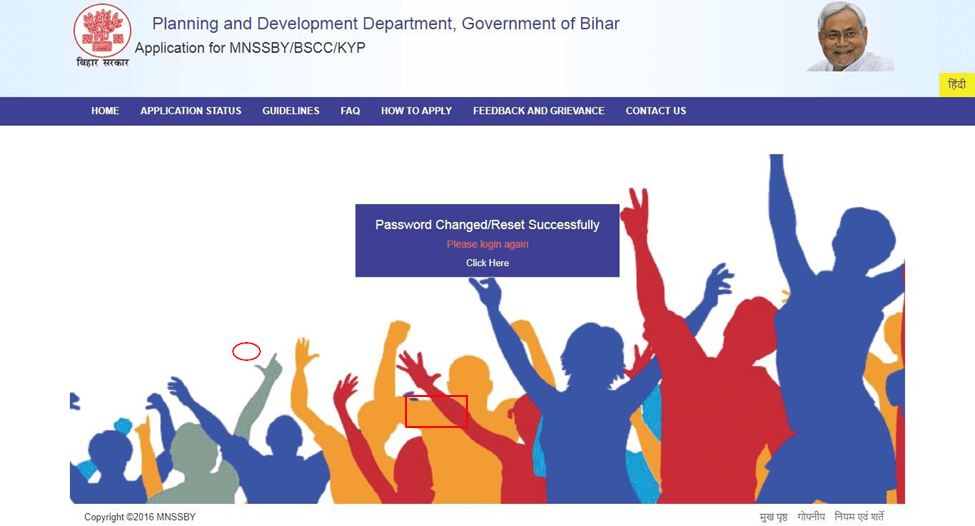

- On click to Submit, A successful message as “Password changed/Reset Successfully,” will display

- The applicant has to log in once again with their updated Password

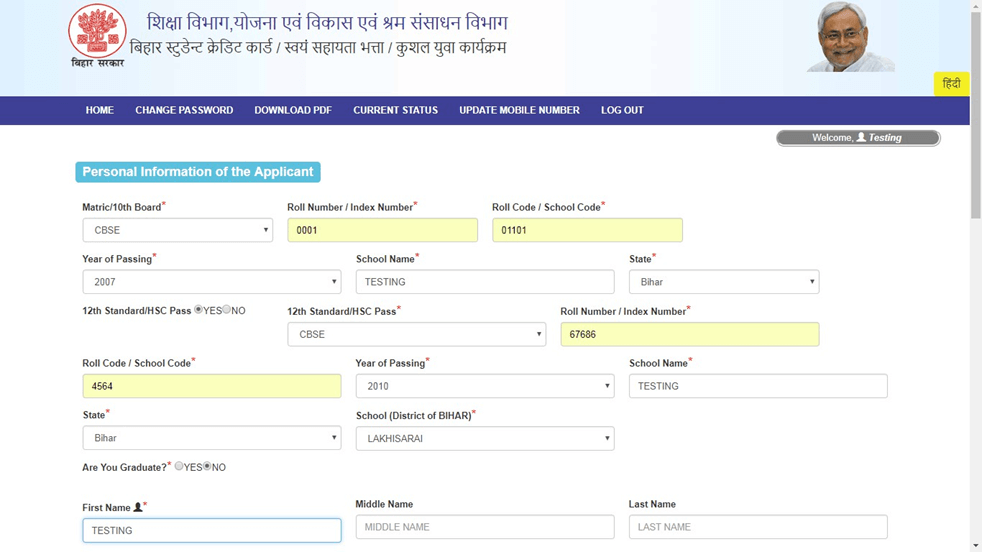

- The applicant has to fill in all the mandatory details for the successful submission of the BSCC application

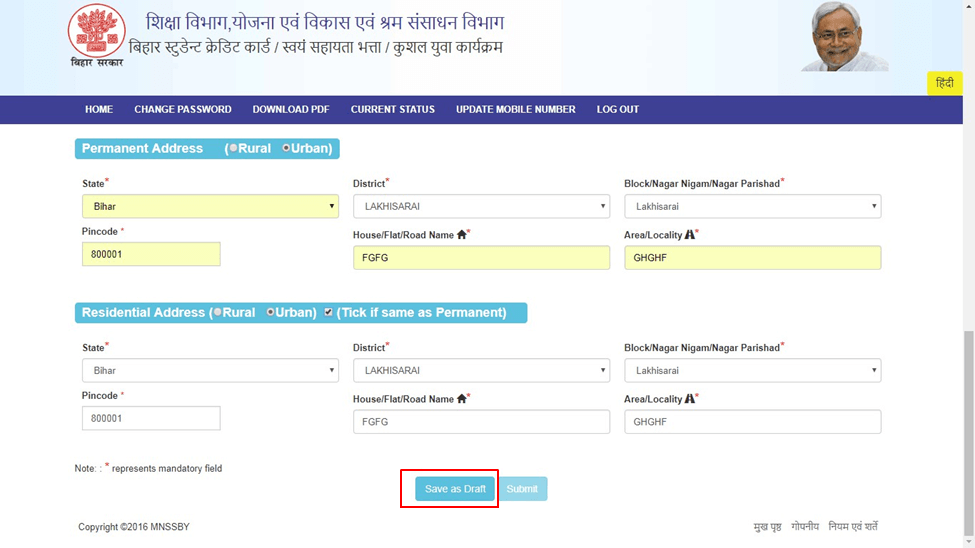

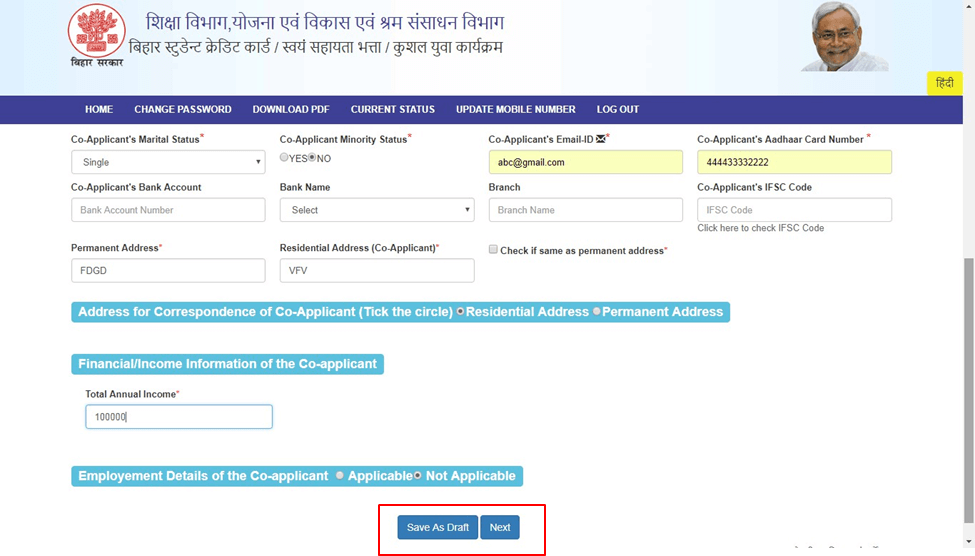

- Click on “Save as Draft.”

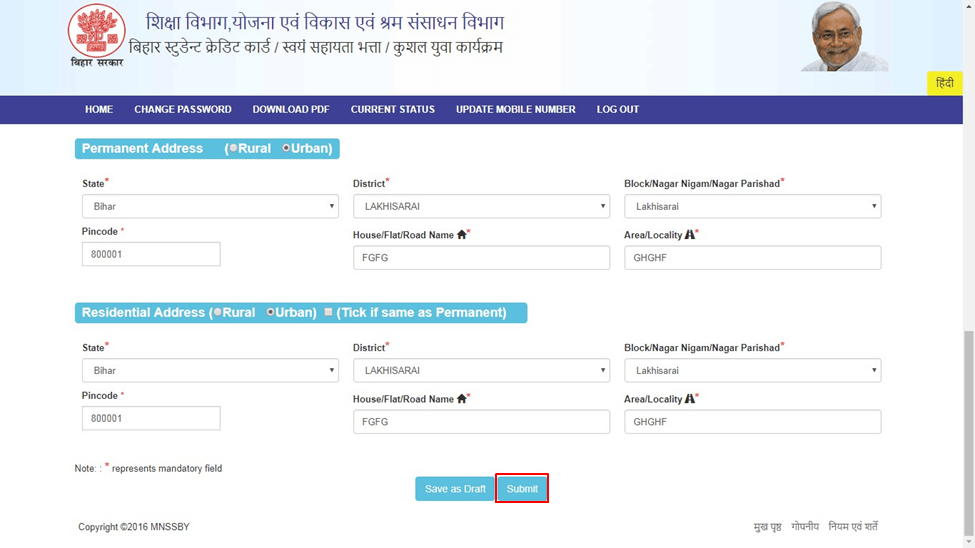

- After Save as Draft, click on the Submit button

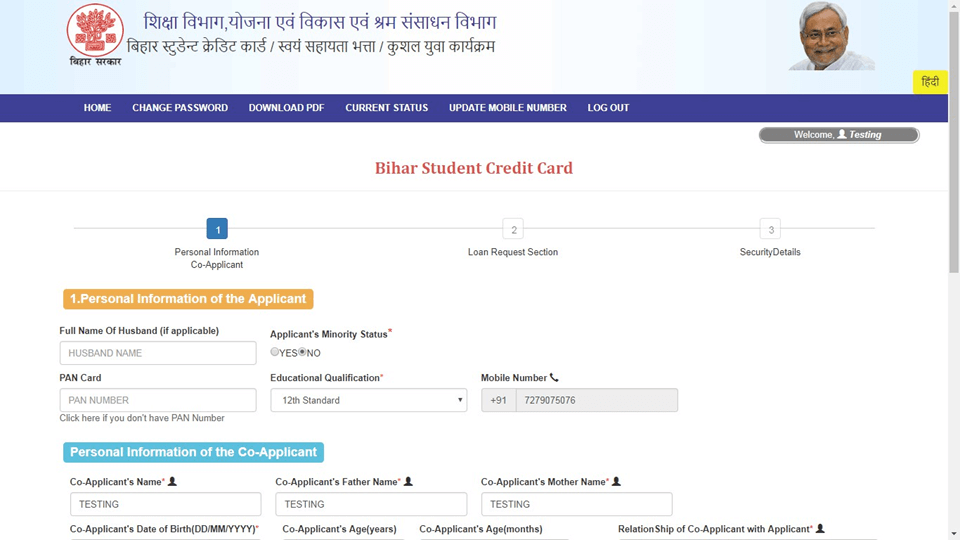

- On clicking Submit, the Applicant has to enter all the mandatory personal details as below

- Click on “Save as Draft” and then “Next.”

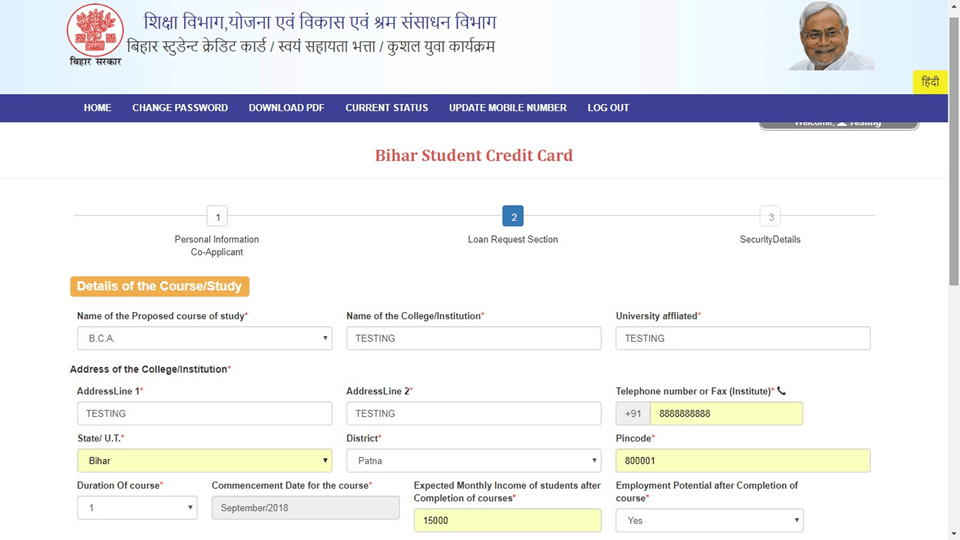

- Enter the Course details of the BSCC application

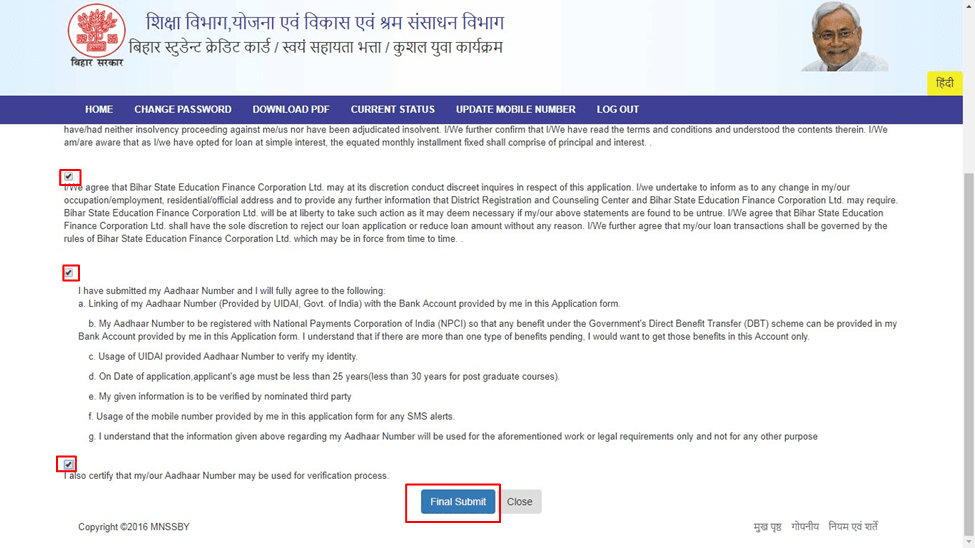

- Tick all the checkboxes before final submission of the BSCC application

- Click on “Final submit” if everything is in order

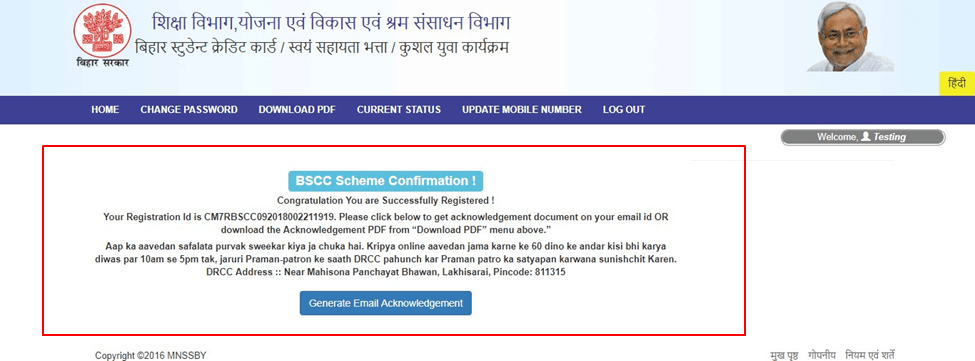

- The system will display the successful message as “Congratulations, You are Successfully Registered!”

Conclusion

Students from every corner of the state have found that the MNSSBY Bihar Student Credit Card beneficial scheme, has in particular made it easier for their preparation for education at a higher level. This is a very good initiative to provide higher education to everyone, irrespective of their financial status.

Other Financial Assistance

- Living Expenses Allowance

- ₹5000 per month for metropolitan cities.

- ₹4000 per month for tier-2 cities.

- ₹3000 per month for rural areas.

- Book & Study Material Allowance: ₹10,000 per year.

Important Links

Official website: https://www.7nishchay-yuvaupmission.bihar.gov.in/

Contact Information: https://www.7nishchay-yuvaupmission.bihar.gov.in/drccContactDetails

Grievance & Support

- A State-Level Call Center has been established to help students with application issues.

- May I Help You counters at DRCC centers assist students with queries.

- A dedicated helpline number and email support are available for grievance redressal.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![MNSSBY Bihar Student Credit Card Yojana: Check Status and Apply Online - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)