Updated on May 23, 2025

Introduction

Every parent dreams of giving their daughter a bright and secure future. Whether it’s higher education, marriage, or financial independence, planning ahead is crucial. But with rising expenses, how can you ensure that your daughter’s dreams aren’t held back by financial constraints?

That’s where the LIC Kanyadan Policy comes in—a customised life insurance plan designed to help parents save systematically for their daughter’s future. This long-term savings and protection plan ensures that even in uncertain times, your daughter’s financial well-being remains secure.

So, how does this policy work, and why is it a great investment for your daughter’s future? Let’s explore.

What is the LIC Kanyadan Policy?

The LIC Kanyadan Policy is a specially designed life insurance and savings plan offered by the Life Insurance Corporation of India (LIC). It helps parents systematically save money while ensuring financial security for their daughters, even in the unfortunate event of the policyholder’s demise.

Unlike a standard LIC policy, this plan includes:

- A savings component to accumulate funds for major life events.

- A life insurance component to provide financial security.

- Premium waiver in case of the policyholder’s death, ensuring that the daughter receives the full maturity benefit.

What Are The Benefits Of LIC Kanyadan Policy?

The LIC Kanyadan Policy offers various benefits to secure a daughter’s financial future. Let’s take a look at how this policy ensures protection, maturity benefits, and financial stability.

During Death

If the policyholder passes away during the policy term, their family will receive a death benefit. This amount is calculated as 7 times the yearly premium paid or 110% of the Basic Sum Assured, whichever is higher.

The death benefit can be paid in two ways:

✔ Lump sum payout at maturity: a single payment at the end of the policy term.

✔ Annual payouts: The family receives 10% of the Basic Sum Assured every year until maturity.

Maturity Benefit

If the policyholder survives the policy term, they receive a maturity benefit, which includes:

- Basic Sum Assured: The guaranteed maturity amount.

- Bonuses earned during the policy term, such as

✔ Simple Reversionary Bonus: Annual bonuses declared by LIC.

✔ Final Additional Bonus (if any): An extra bonus added at maturity.

This amount can be used for higher education, marriage expenses, or other financial goals.

Assured Protection for the Family

One of the biggest advantages of this policy is its assured financial protection. If the policyholder passes away:

- All future premiums are waived—the family doesn’t have to pay any more premiums.

- Immediate financial support is provided, ensuring no financial burden on the family.

- Additional protection in case of accidental death:

✔ ₹10 lakh payout if the death is due to an accident.

✔ ₹5 lakh payout if the death is due to natural causes.

✔ ₹50,000 per year is paid to the family until the policy matures.

This ensures that the daughter’s future remains financially secure, no matter what.

Flexible Payouts

Under the LIC Kanyadan Policy, the insured person can choose how they want to receive the death benefit or maturity benefit.

✔ Lump Sum Payout: A one-time payment.

✔ Installments Over Time: Payments can be received monthly, quarterly, half-yearly, or yearly, ensuring a steady income flow.

This flexibility allows families to plan financial expenses effectively.

Loan Facility

Life is unpredictable, and sometimes emergencies arise. That’s why LIC Kanyadan Policy offers a loan facility. However, a policyholder can only apply for a loan if:

- They have paid at least two years of premiums.

- The loan amount depends on the policy status:

✔ Up to 80% of the surrender value for paid-up policies.

✔ Up to 90% of the surrender value for active policies.

This feature ensures financial liquidity in times of need.

Tax Benefits

One of the best things about the LIC Kanyadan Policy is that it offers tax-saving benefits under the Income Tax Act, 1961.

✔ Section 80C: Premiums paid for the policy qualify for tax deductions up to ₹1.5 lakh per year.

✔ Section 10(10D): The maturity amount and death benefits received are tax-free.

(Reference: Probus Insurance)

Eligibility Criteria for LIC Kanyadan Policy

To enrol in the LIC Kanyadan Policy, the following conditions must be met:

✔ Parent’s Age: Minimum 18 years, maximum 50 years.

✔ Daughter’s Age: Must be below 18 years at the time of policy purchase.

✔ Policy Term: Minimum 13 years, maximum 25 years.

✔ Sum Assured: A minimum of ₹1 lakh, with no upper limit.

This makes it a flexible plan that parents can customise based on their financial goals.

How to Apply for the LIC Kanyadan Policy?

Applying for the LIC Kanyadan Policy is a straightforward process. Parents can purchase the policy in two ways:

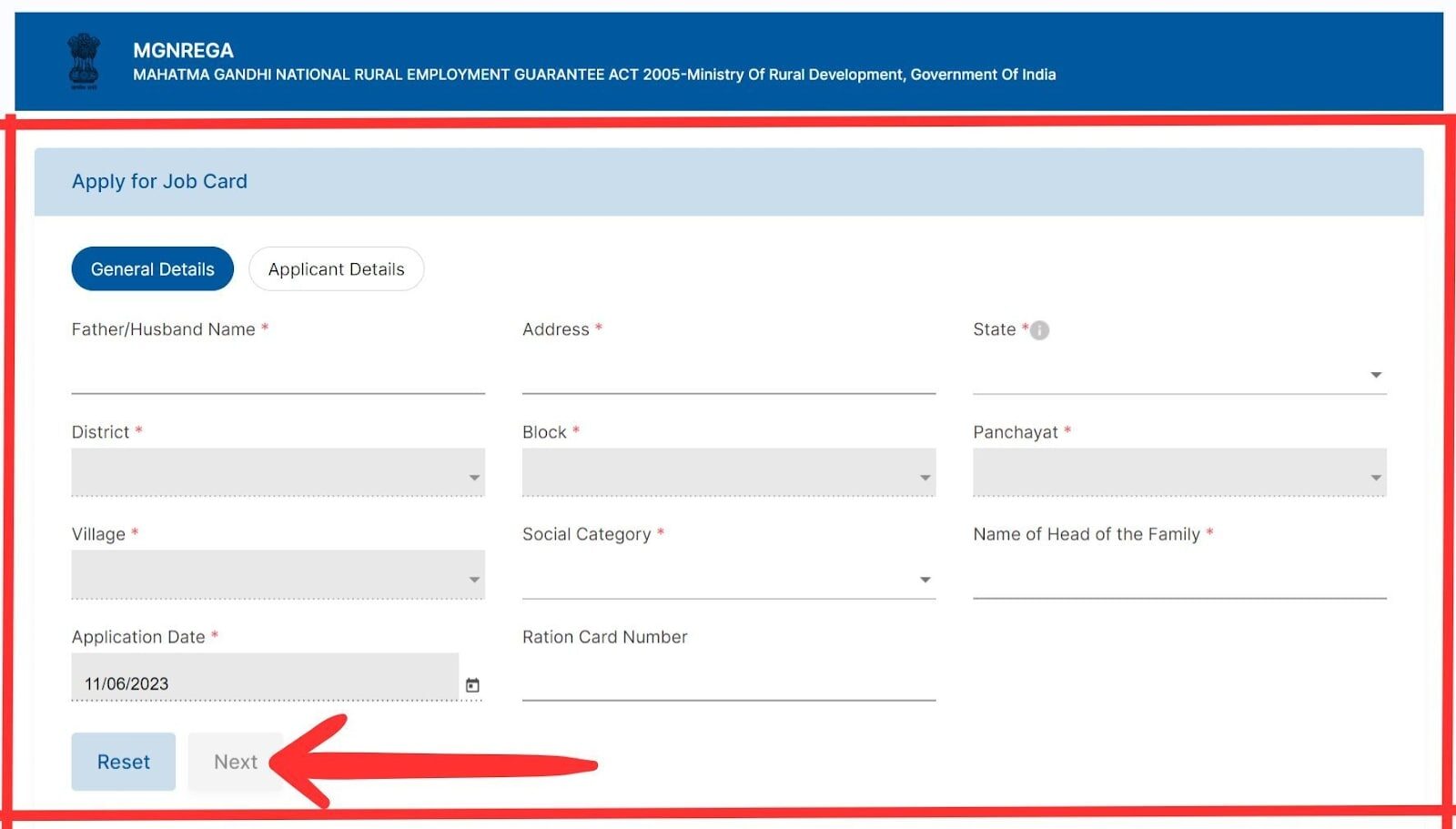

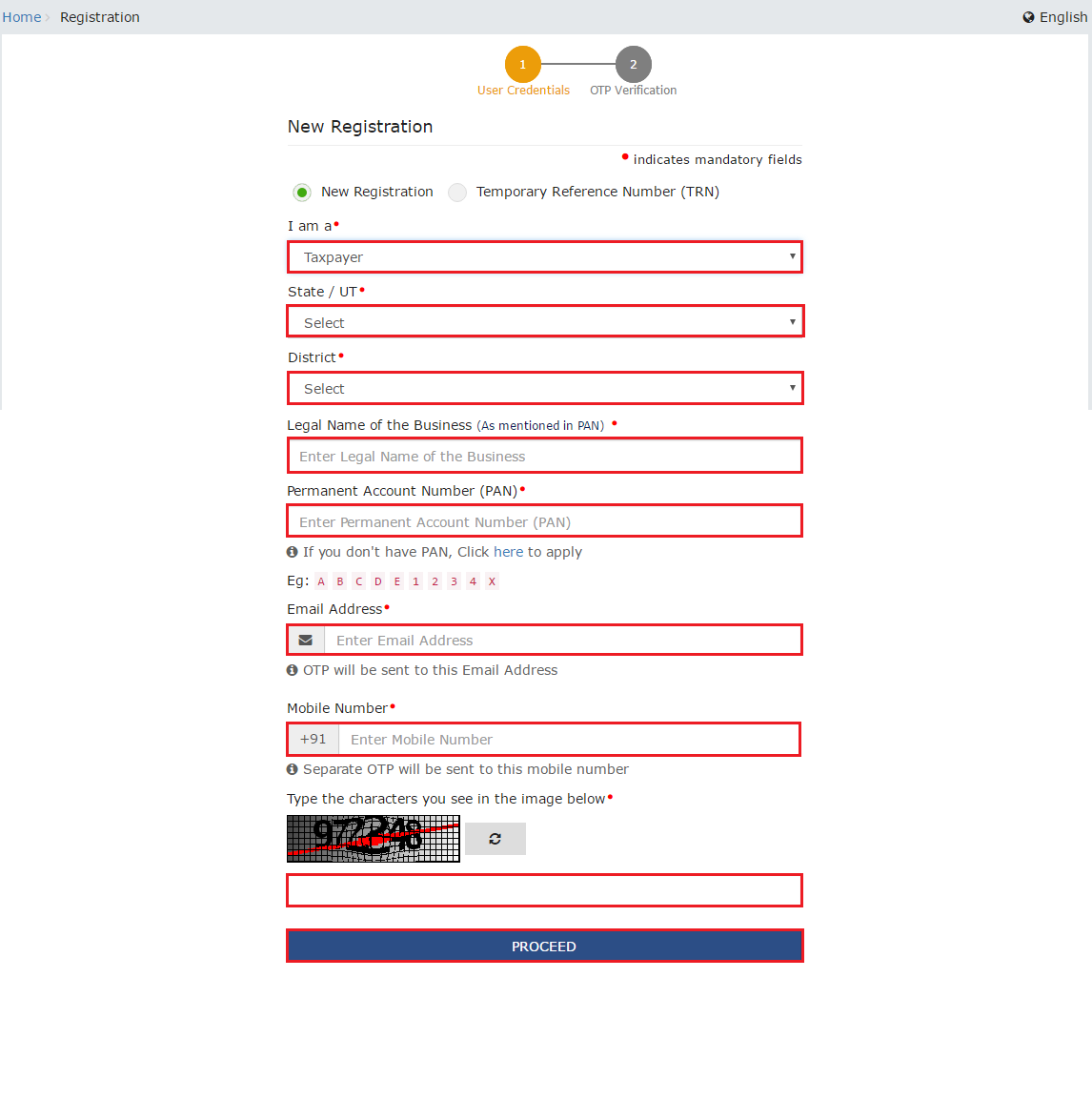

Online Application Process

- Visit the LIC Official Website. Go to the LIC India portal.

- Choose the LIC Kanyadan Policy. Navigate to the savings plans section.

- Enter Your Details Provide your age, daughter’s age, and the desired policy term.

- Calculate Premium & Sum Assured: Use the online calculator to determine the best plan for you.

- Submit the Application and Make payment. Complete the registration process and pay the first premium online.

Offline Application Process

- Visit the nearest LIC branch or contact an LIC agent.

- Fill out the policy application form and submit required documents.

- Make the initial premium payment to activate the policy.

- Receive the policy bond and confirmation from LIC.

Final Thoughts: A Smart Investment for Your Daughter’s Future

The LIC Kanyadan Policy is more than just an insurance plan—it’s a financial safety net for your daughter’s future. Whether you’re planning for her higher education, marriage, or financial independence, this policy ensures she gets the support she needs.

With benefits like life cover, premium waivers, flexible payouts, and tax savings, this plan is a must-have for every parent.

So, why wait? Start your LIC Kanyadan policy today and secure your daughter’s bright future!

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![LIC Kanyadan Policy Complete Guide : LIC Policy for Girl Child - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)