Updated on June 27, 2025

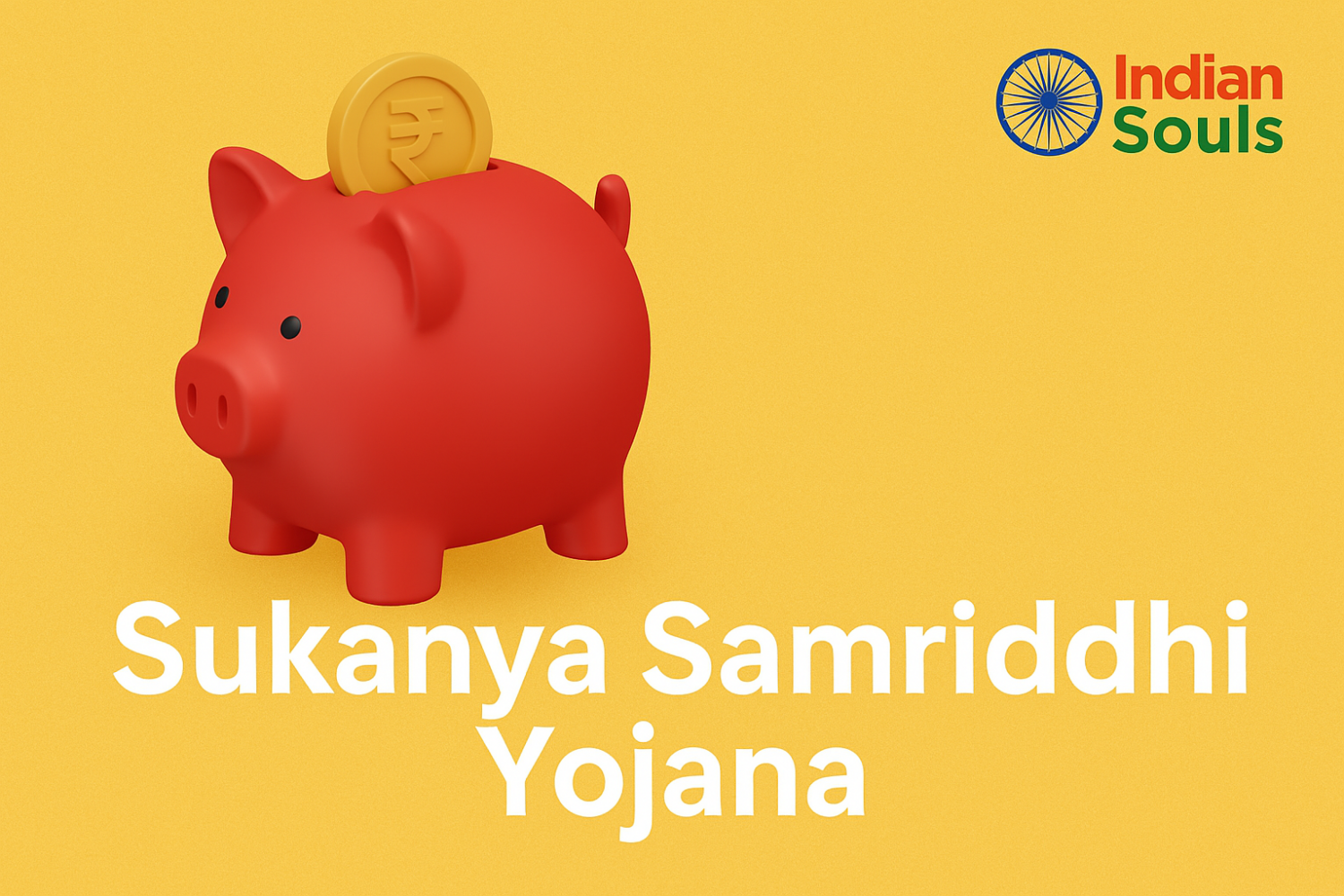

Discover the full benefits of Sukanya Samriddhi Yojana (SSY) and how to apply. Learn the step-by-step Sukanya Samriddhi application process, eligibility, documents, and tax advantages.

India has taken several steps to uplift the girl child, and one of the most powerful initiatives among them is the Sukanya Samriddhi Yojana (SSY), also known as the Kanya Samriddhi Yojana. Launched under the Beti Bachao Beti Padhao campaign, SSY is a government-backed small savings scheme focused on securing the future of girls.

What is the Sukanya Samriddhi Yojana?

The Sukanya scheme, or the Sukanya Samriddhi Account Scheme, is a savings plan designed to provide financial stability and long-term benefits for the girl child. This girl child savings scheme encourages parents or legal guardians to start saving for their daughter’s education and marriage as early as possible. The SSY offers one of the highest interest rates among small savings schemes—currently at 8.2% per annum (as of Q1 FY 2025)—and includes tax exemptions under Section 80C of the Income Tax Act.

Who is Eligible for the Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana eligibility criteria are simple:

- The girl child must be below 10 years of age at the time of account opening. This is known as the Sukanya age limit.

- Only one SSY account per girl child is allowed.

- A family can open up to two accounts (for two girls). In special cases like twins or triplets, more accounts may be allowed.

- The account must be opened by the parent or legal guardian of the girl.

This makes it an ideal tool for early financial planning, ensuring a bright and independent future for daughters across India.

Key Benefits of Sukanya Samriddhi Yojana (SSY)

Many parents wonder why they should consider SSY over other savings instruments. Here’s why this government-backed scheme stands out:

Tax Advantages and Interest Rates

Tax Deduction under Section 80C: Up to ₹1.5 lakh invested annually is eligible for tax deduction.

Interest is Tax-Free: Unlike Fixed Deposits or Recurring Deposits, SSY interest earnings are completely exempt from tax.

Maturity is Tax-Free: At maturity (21 years from account opening), the full amount, including interest, is 100% tax-exempt.

This makes SSY a Triple E (Exempt-Exempt-Exempt) category investment—ideal for tax-savvy families. The Sukanya Samriddhi Yojana tax benefits include Section 10 exemption and Section 80C deduction.

Long-Term Financial Planning for the Girl Child

Secure Future Education: Withdrawals up to 50% are allowed for higher education expenses once the girl turns 18. Marriage Planning: The maturity period (21 years) aligns well with marriage expenses timelines. Guaranteed Returns: Being a government-backed scheme, the returns are risk-free and guaranteed.

In short, SSY empowers families to plan systematically for a daughter’s critical life milestones. The SSY scheme details provide a comprehensive framework for long-term financial security.

Documents Required to Apply for Sukanya Samriddhi Yojana

When preparing for the Sukanya Samriddhi account application, it’s essential to gather the correct documentation. This ensures quick processing and minimizes rejection chances. Here are the Sukanya Samriddhi Yojana documents required:

Identification and Age Proofs

- Birth Certificate of the girl child (mandatory)

- Aadhaar card or PAN card of the parent/guardian

- Address proof (Aadhaar, utility bills, passport, etc.)

Additional Paperwork for Guardianship Cases

- Guardianship certificate (if the applicant is not the biological parent)

- Photographs of the girl child and guardian

- A declaration form stating the number of existing SSY accounts under your name

Ensure all documents are self-attested and copies are clear. Original documents might be required for verification at the time of submission. These KYC documents are crucial for the account opening process.

Step-by-Step Sukanya Samriddhi Application Process

Ready to open a Sukanya Samriddhi account? Here’s how to do it both at post offices and authorized banks.

How to Apply the SSY Scheme at the Post Office?

Visit the Nearest Post Office

Locate the branch that offers Sukanya Samriddhi services. This is also known as the SSA post office scheme.

Collect the SSY Scheme Application Form.

You can also download it from the India Post website.

Fill in the Details

Provide information such as the guardian’s details, the girl’s details, and the nominee’s info.

Attach Documents

Submit the completed form along with the required documents and initial deposit.

Make the First Deposit

Minimum amount: ₹250; Maximum deposit per year: ₹1.5 lakh

Get the Passbook

Once processed, you’ll receive a passbook with the account number and transaction history. This passbook is sometimes referred to as a sukanya khata.

How to Apply the SSY Scheme at Authorized Banks?

Several banks are authorized to open SSY accounts, including:

- SBI

- PNB

- HDFC

- ICICI

- Bank of Baroda

- Axis Bank

Steps are almost the same:

- Visit the nearest authorized branch

- Request or download the SSY application form

- Fill in and submit the form with documents

- Deposit money and receive the passbook

Note: Some banks also offer online appointment booking and partial digital form submission.

How to Manage, Deposit, and Track the Sukanya Account

Opening the account is only the beginning. Managing it wisely over the years is the key to maximizing benefits.

Making Deposits and Withdrawals

Deposit Window: Up to 15 years from the date of opening. Minimum Annual Deposit: ₹250 to keep the account active. Maximum Annual Deposit: ₹1.5 lakh Payment Methods: Cash, cheque, online transfer (in some banks)

Partial Withdrawal Rules:

- Allowed up to 50% of the balance for higher education.

- The girl must be at least 18 years old.

- Proof of admission required.

Account Maturity:

- Matures 21 years from the date of opening.

- Or upon marriage after the age of 18.

Monitoring Account Status and Maturity Options

Passbook Update: Visit the post office or bank regularly for updates. Online Tracking: Some banks provide online tracking via net banking. Premature Closure: Allowed in cases of:

- Death of the account holder

- Marriage after 18

- Medical emergencies (with proof)

Always retain the original passbook and transaction receipts safely, especially near maturity.

SSY Scheme FAQS

Can I open more than one SSY account for the same girl child?

No. Only one SSY account is permitted per girl.

What if I miss deposits in a year?

You can revive the account by paying a penalty of ₹50 along with the minimum deposit of ₹250.

Can I transfer my SSY account to another post office or bank?

Yes. The account transfer is possible across India between banks and post offices.

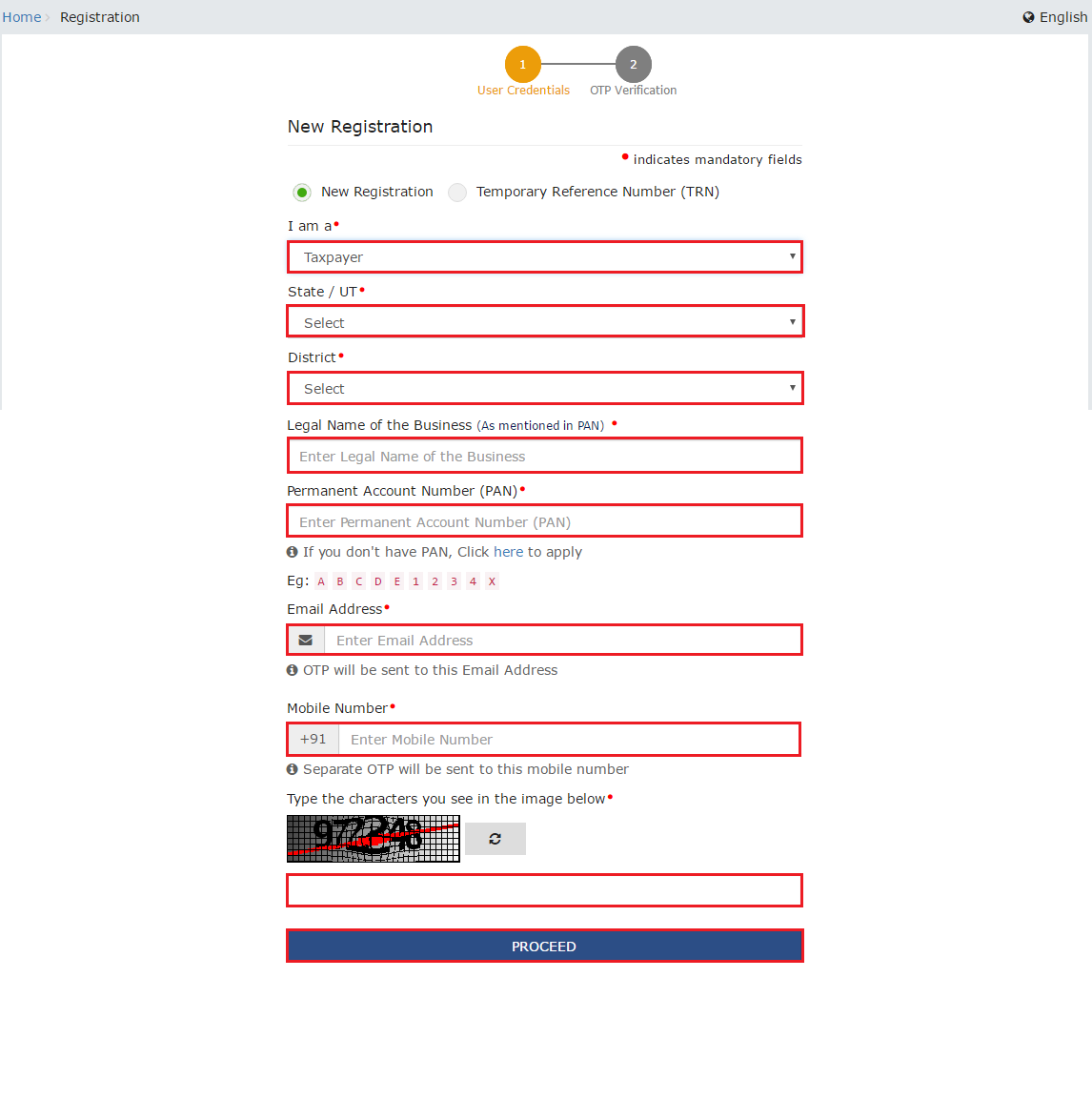

Is it possible to apply online for the Sukanya Samriddhi Yojana?

Currently, a fully online application is not available, but forms can be downloaded and submitted in person.

What happens after the account matures?

The full amount (principal + interest) is paid to the girl child upon application, provided she is 18+ years old.

Is the interest fixed or variable?

The interest rate is revised quarterly by the government but remains higher than most fixed-income schemes. The Sukanya Samriddhi Yojana interest rate 2024 is set at 8.2% per annum.

Conclusion

The Sukanya Samriddhi Yojana (SSY) is not just a savings plan—it’s a vision for the future of every girl in India. This Pradhan Mantri scheme for girl child offers high returns, tax benefits, and unmatched security, making it the perfect tool for planning a daughter’s education or marriage. By understanding the eligibility criteria, benefits, and how to apply for SSY through post offices or banks, you’re ensuring a more stable and empowered future for your child.

So, gather your documents, choose your bank or post office, and get started today with this SSA scheme.

Government Link:

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Sukanya Samriddhi Yojana Application Process & Benefits Explained - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)