Updated on June 14, 2025

The Stree Shakti Scheme is a powerful initiative introduced by the Government of India to empower women entrepreneurs across the country. Tailored specifically for women who aspire to start or expand their businesses, this scheme provides easy and affordable access to credit with added benefits such as reduced interest rates, low processing fees, and minimal collateral.

If you’re wondering how to apply for a loan under Stree Shakti, this detailed guide walks you through everything—from eligibility and benefits to the step-by-step application process.

What is the Stree Shakti Scheme?

The Stree Shakti Scheme is part of the broader vision of women’s empowerment through financial independence. It is mostly operated through public sector banks like the State Bank of India (SBI) and other government-supported financial institutions.

Its main objective is to:

- Promote entrepreneurship among women.

- Provide financial support with flexible repayment options.

- Encourage more women to become financially self-reliant by running businesses.

Under this scheme, women can avail loans for starting micro or small enterprises in sectors like manufacturing, retail, services, agriculture, or trade.

Key Benefits of Loan Under Stree Shakti

Choosing the loan under Stree Shakti comes with a host of benefits designed specifically for female applicants:

- Lower Interest Rates: Women receive a concession of 0.5% on interest rates compared to regular business loans.

- No Processing Fees: For loans up to ₹5 lakh, many banks waive the processing charges.

- Collateral-Free Loans: Loans under ₹10 lakh may be available without collateral under CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises).

- Flexible Tenure: The repayment period is designed to be flexible and manageable.

- Easy Application Process: Banks assist in paperwork, documentation, and approval to simplify the process for women applicants.

| Feature | Details |

|---|---|

| Loan Amount | Up to ₹50 lakhs for eligible women entrepreneurs. |

| Interest Rate Concession | 0.5% reduction for loans exceeding ₹2 lakhs. |

| Collateral Requirement | No collateral for loans up to ₹10 lakhs under CGTMSE coverage. |

| Processing Fee | Waived for loans up to ₹5 lakhs. |

| Repayment Tenure | Flexible repayment options, typically up to 36 months with a moratorium. |

| Ownership Criteria | Minimum 50% ownership of the business by the woman applicant. |

| Eligible Sectors | Manufacturing, services, trading, agriculture, and allied activities. |

Eligibility Criteria

To apply for a loan under this scheme, you must meet certain conditions:

- Gender: The applicant must be a woman.

- Ownership: Women must own at least 51% of the business or enterprise.

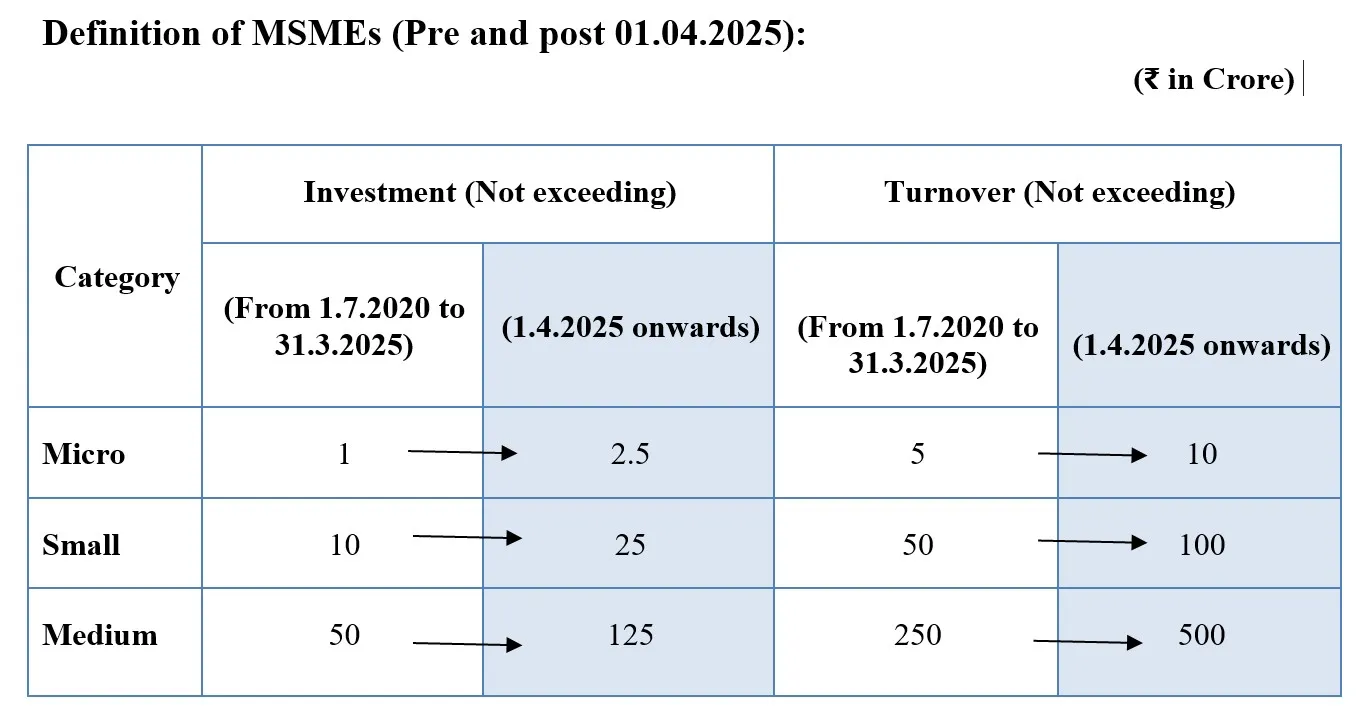

- Business Type: It should fall under small-scale industries (SSI) or Micro, Small, and Medium Enterprises (MSME).

- Loan Amount: The scheme generally supports loans from ₹50,000 to ₹25 lakhs, depending on the nature and size of the business.

- Credit History: A good credit score or clean financial history increases the chance of loan approval.

- Group Support: Preference is often given to women working in Self Help Groups (SHGs) or Women Cooperative Societies.

Documents Required

While applying for a loan under Stree Shakti, you will typically need the following documents:

- Identity Proof – Aadhaar Card, Voter ID, or Passport

- Address Proof – Utility bills, Ration Card, or Lease Agreement

- Business Plan – Detailed project report outlining the business idea, target market, financials, etc.

- Ownership Proof – Documents proving women’s ownership of the business

- Bank Statements – Last 6–12 months, if already in business

- Income Tax Returns – If applicable

- Passport-sized Photographs

Some banks may ask for additional documentation depending on the loan amount and business type.

How to Apply for a Loan Under the Stree Shakti Scheme

Applying for a loan under this scheme is relatively simple. Here’s how you can go about it:

Step 1: Choose the Right Bank

Identify banks that offer the Stree Shakti loan scheme. Major public sector banks like SBI, Punjab National Bank, Bank of Baroda, and Canara Bank actively promote this scheme. Visit their nearest branch or check their official website for updates.

Step 2: Prepare Your Business Plan

Have a solid business plan ready. This should include:

- Nature of business

- Financial projections

- Market analysis

- Capital requirements

- Employment generation potential

Banks evaluate the feasibility of the business before approving the loan.

Step 3: Gather Documents

Collect all necessary documents. Make sure everything is up-to-date and error-free, especially identity proof and bank details.

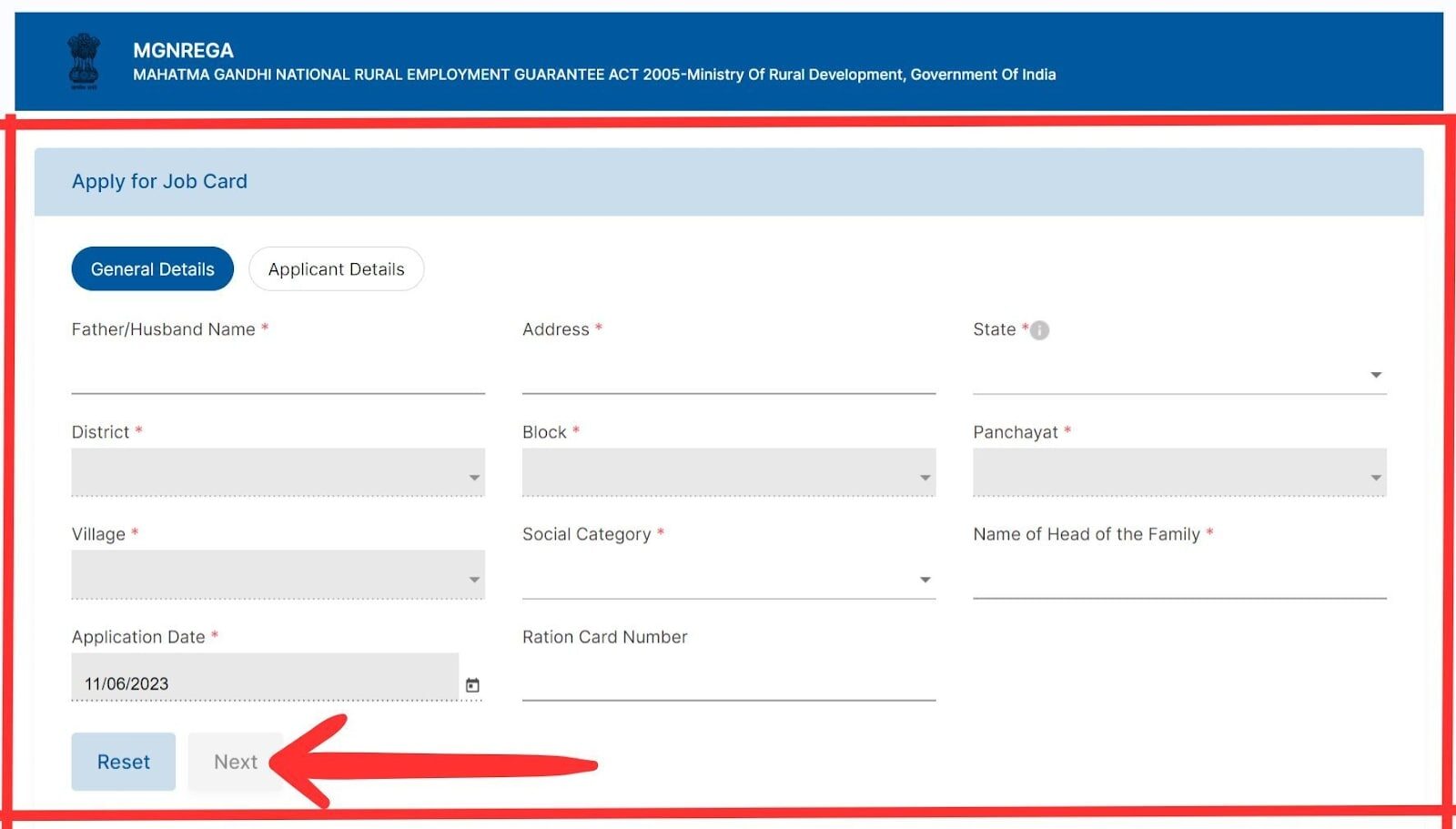

Step 4: Submit the Application

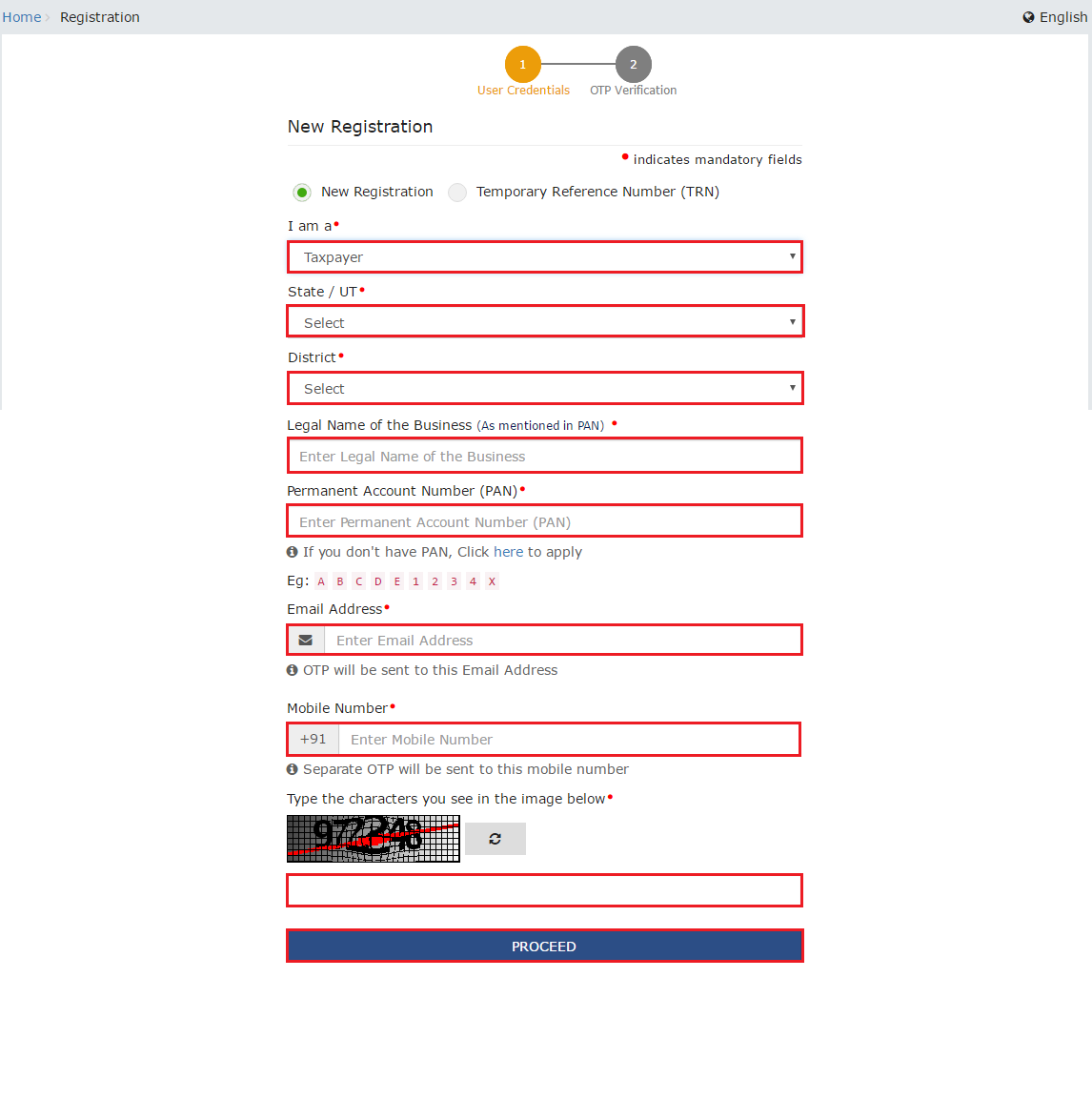

Fill out the loan application form either online through the bank’s portal or offline at a branch. Attach your documents and apply for review.

Step 5: Verification and Approval

The bank will conduct a verification of your documents and may call you for an interview or site visit. Once the evaluation is successful, your loan will be sanctioned and disbursed to your account.

Tips for a Successful Loan Application

- Maintain a good credit score: A higher score increases the chances of approval.

- Apply with a co-guarantor: If you’re applying for a larger loan, having a guarantor can strengthen your profile.

- Highlight social impact: If your business helps local women or the community, mention it—it adds credibility.

- Seek guidance from SHGs or NGOs: Many women’s organizations offer support in preparing your application.

Common Business Ideas Financed Under Stree Shakti

The Stree Shakti Scheme can be used to fund a variety of businesses, including:

- Boutique or tailoring units

- Beauty salons or wellness centers

- Home-based food businesses

- Small-scale manufacturing (e.g., handicrafts, pickles, papad, garments)

- Grocery shops or retail stores

- Agriculture-related activities

- Digital and online services

- Educational or day-care centers

These businesses not only generate income but also create employment opportunities for other women in the community.

Recent Developments

Jammu & Kashmir Initiatives

In a significant move to bolster women’s entrepreneurship, Jammu & Kashmir Bank, in collaboration with the Jammu & Kashmir Rural Livelihoods Mission (JKRLM), launched the Lal Ded Stree Shakti Loan Scheme. This initiative aims to provide financial support to rural women, enhancing their participation in the region’s socio-economic development.

Success Stories

Empowering Rural Artisans

Kalpana, a resident of Uttar Pradesh, transformed her life through the Stree Shakti Scheme. With the financial assistance received, she established a home-based enterprise producing handcrafted bags and wall hangings. Her venture not only provided her with financial independence but also created employment opportunities for six other women in her village.

From Local to Global

Meera Sharma, a textile entrepreneur from Rajasthan, utilized the Stree Shakti loan to expand her small-scale business. The infusion of capital enabled her to enhance production capabilities, hire additional staff, and tap into international markets, thereby elevating her enterprise to new heights.

Expert Insights

“The Stree Shakti Scheme is more than just a financial aid program; it’s a catalyst for change, enabling women to break barriers and lead economic transformations in their communities.”

— Dr. L. Mynavathi, Associate Professor, Christ University

Final Thoughts

The Stree Shakti Loan Scheme is not just about funding—it’s about freedom. Freedom to start your own business, to be financially independent, and to become a leader in your community.

If you’re a woman with a dream of starting something of your own, this scheme gives you the financial push you need. With government-backed support, flexible terms, and lower interest rates, the loan under Stree Shakti can truly turn your aspirations into achievements.

So, don’t let financial barriers hold you back. Prepare your plan, walk into your nearest bank branch, and take the first step toward entrepreneurship today.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![How to Get a Loan Under Stree Shakti Scheme? - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)