Updated on August 12, 2025

Waiting on your PM Mudra loan? Here’s how to check PM Mudra loan status online in 2025 quickly, track approvals, and handle rejections with ease.

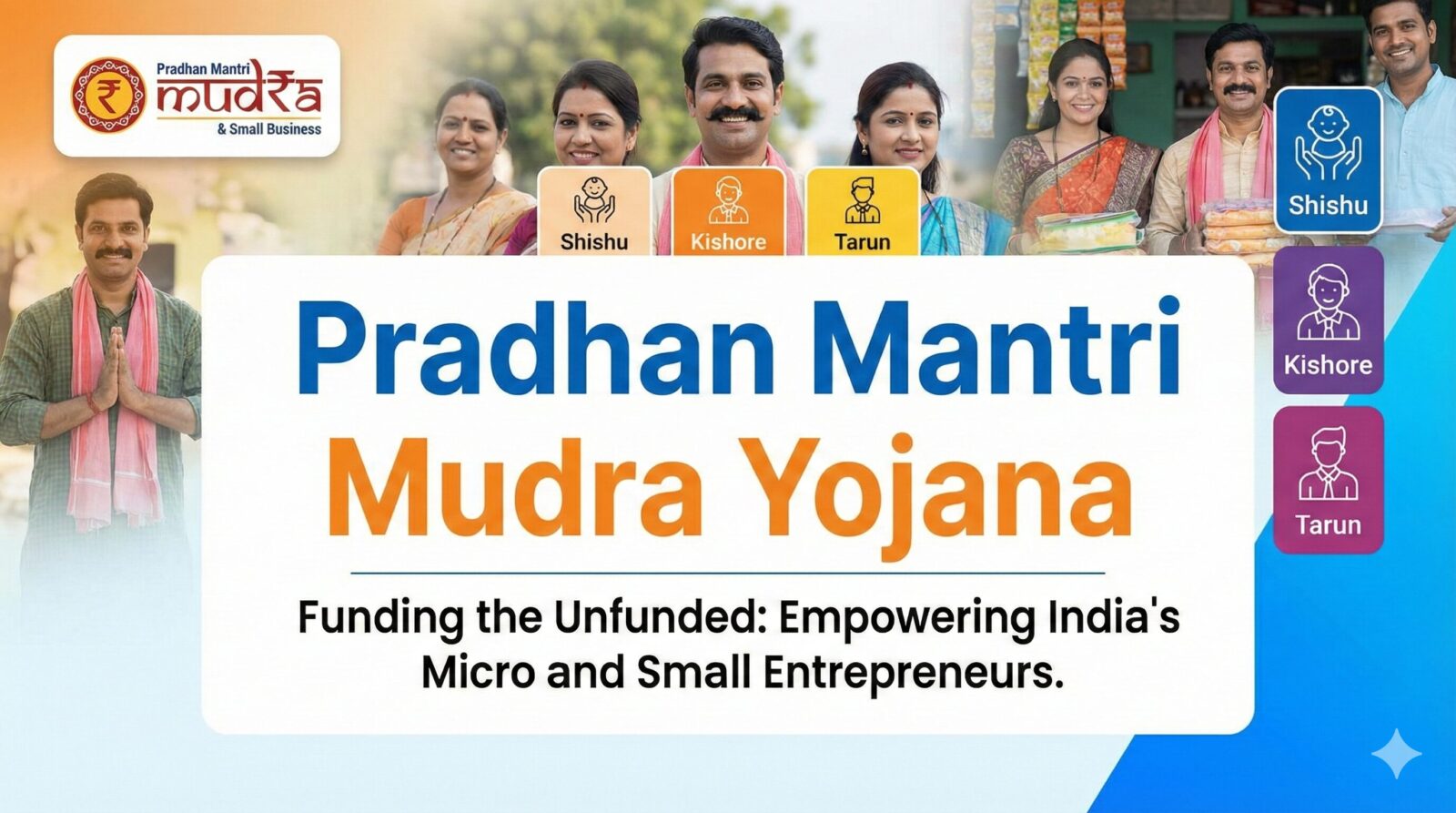

Launched in 2015 under the Pradhan Mantri MUDRA Yojana (PMMY), the PM Mudra loan is a flagship initiative that provides financial support to micro and small enterprises, especially those without access to formal banking.

The scheme is tailored to empower:

- Small shopkeepers

- Artisans

- Street vendors

- Service providers

- Women entrepreneurs

- Small-scale manufacturers

Types of PM Mudra Loans:

- Shishu (Loans up to ₹50,000) – Ideal for startups or tiny businesses.

- Kishor (₹50,001 to ₹5 lakh) – For growing businesses with moderate needs.

- Tarun (₹5 lakh to ₹10 lakh) – For more established businesses seeking expansion.

Applicants can avail of the loans through banks, NBFCs, MFIs, and online aggregators. Once the application is submitted, tracking the PM Mudra loan status becomes the next critical step.

Why Tracking Your PM Mudra Loan Status is Important

Getting a business loan under a government scheme like PMMY can open up massive opportunities. But many applicants forget to track the status after submitting the application, which can lead to

- Missed updates or important notices

- Delay in document submissions

- Miscommunication from banks

- Rejections that go unnoticed

By regularly checking your PM Mudra loan status, you can:

- Stay informed on approvals and disbursements

- Know if additional documents are needed

- Spot any rejection reasons early and rectify them

- Improve your chances of timely loan processing

Whether you applied online or through a physical bank branch, it’s crucial to track your loan’s journey step-by-step to stay ahead.

Step-by-Step Process to Check PM Mudra Loan Status Online

Tracking your PM Mudra loan status in 2025 is easier than ever, thanks to digitization by both banks and government portals.

Option 1: Through the Lending Bank’s Official Website

Most public and private sector banks that issue Mudra loans allow applicants to track their status online. Here’s the typical flow:

- Visit the Official Bank Website

Go to the website of the bank where you submitted your Mudra loan application. - Navigate to the ‘Loan Status’ Section

Look for a section labelled ‘Track Loan Application’ or ‘Loan Status’ under personal/business banking. - Enter Required Details

- Application reference number

- Mobile number

- Date of birth or PAN (if prompted)

- View Your Status

The portal will show the live status of your loan — whether it’s under review, approved, rejected, or disbursed.

Note: If you applied via an offline branch, call the branch manager directly with your application number for updates.

Option 2: Using the PM Mudra Portal (mudra.org.in)

While the main Mudra portal doesn’t track specific applications directly, it offers resources and redirection to partner banks and institutions. You can:

- Find bank-specific links to track Mudra applications

- Access bank helplines

- Download application forms if needed

Option 3: Udyam Registration Portal (For Registered MSMEs)

If your business is registered under Udyam, you may receive updates or tracking integration with your registered number and business ID. Use the Udyam portal to cross-verify status updates.

Common Statuses You Might See and What They Mean

While tracking your PM Mudra loan status, you may come across various terms. Here’s what they mean:

| Status | Meaning |

|---|---|

| Application Received | Your application is submitted and awaiting review. |

| Under Process | Your documents are being verified by the bank. |

| Approved | Your application is successful; loan sanctioning is in progress. |

| Rejected | Application denied – check reasons with the branch or portal. |

| Disbursed | Funds have been released to your linked bank account. |

| On Hold | Awaiting more documents or clarification from the applicant. |

If your application status doesn’t change for more than 7–10 days, it’s advisable to contact your branch manager or raise a service request through the bank’s grievance cell.

Troubleshooting & Next Steps If Your Loan Status Is Stuck or Rejected

If your application is stuck, delayed, or rejected, don’t panic—there are actionable steps you can take.

1. Contact the Branch or Bank Official

Visit or call the branch where you applied. Ask for an explanation and request feedback on missing or incorrect documentation.

2. Review Common Reasons for Rejection:

- Mismatch in Aadhaar or PAN details

- Incomplete business plan or projections

- Poor credit history or existing unpaid loans

- Lack of necessary licenses or Udyam registration

3. Rectify & Reapply

Fix the issue by:

- Updating your KYC details

- Preparing a better business proposal

- Adding collateral if required (for Tarun category)

- Applying under a different category or bank

4. File a Grievance

If you believe your application was unfairly denied, you can:

- Raise a complaint via the bank’s official grievance portal.

- Escalate the issue to the Banking Officer if unresolved.

5. Try Other Lending Institutions

Remember, PM Mudra loans can be availed from various NBFCs and MFIs apart from banks. Trying another lender could fast-track approval.

Conclusion

The PM Mudra Yojana is a lifeline for India’s small business sector, offering accessible financing with minimal red tape. But the journey doesn’t end with submitting an application—tracking your PM Mudra loan status is equally critical to ensure timely approval, avoid rejection, and resolve delays.

In 2025, the tools for tracking your Mudra application are more streamlined than ever, with bank portals, Udyam links, and even direct branch support available for every applicant. By staying informed and proactive, you can make the most of the Mudra scheme and take your business to the next level.

So whether you’re a street vendor, startup founder, or growing trader—stay updated, stay funded, and stay empowered.

FAQs

How long does it take to get a PM Mudra loan after applying?

Typically 7 to 15 working days, depending on document verification and bank workload.

Can I check my Mudra loan status without a reference number?

Some banks allow tracking via mobile number and DOB, but the reference number is ideal.

What should I do if my Mudra loan status says ‘On Hold’?

Contact your bank. It likely means additional documents are needed for processing.

Is there a toll-free number to check the PM Mudra loan status?

Each bank has its helpline. Visit their official site for contact details.

Can I reapply if my Mudra loan is rejected?

Yes, after correcting the reasons for rejection, you can reapply with the same or a different bank.

Do I need to visit the bank to track my Mudra loan?

Not always. Many banks now allow online tracking via their website or app.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![How to Check PM Mudra Loan Status Online in 2025 – Complete Guide - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)