Updated on August 31, 2025

Summary: PAN Card 2.0 is India’s upgraded digital identity card for taxpayers, offering faster transactions, better KYC, and enhanced security.

It’s free as an e-PAN and takes just minutes to apply online, with a ₹50 fee only for a physical card. Anyone needing a PAN new or existing users can benefit.

It’s especially useful for seamless banking, tax filing, and digital services. The card features a dynamic QR code, real-time updates, and easy Aadhaar integration. It’s part of India’s Digital India mission to modernize identity systems.

Introduction

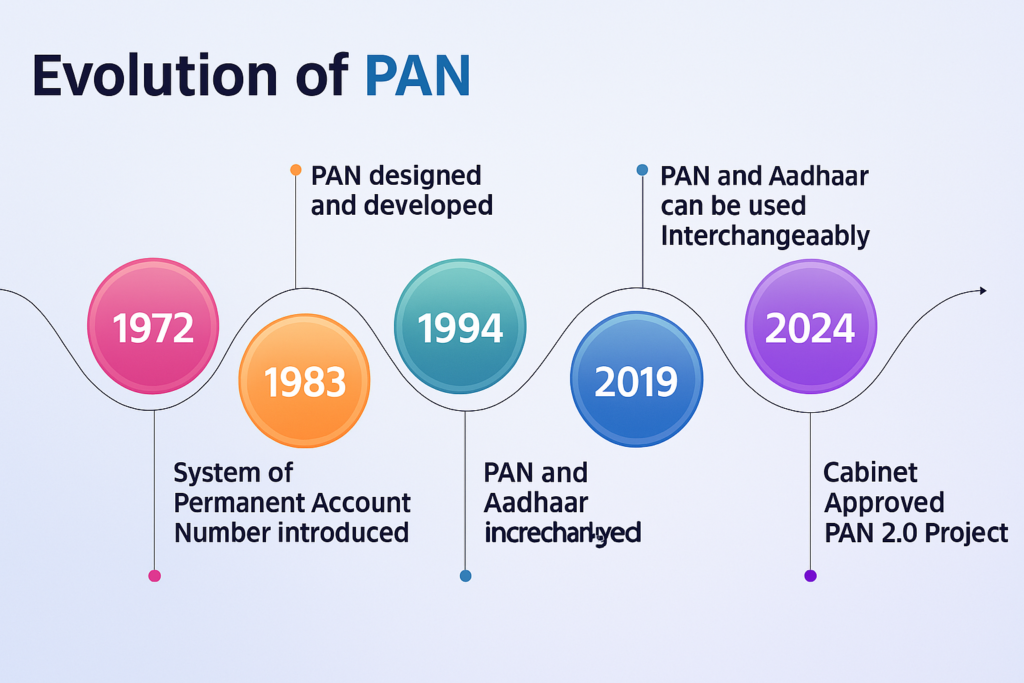

The Permanent Account Number (PAN) is a crucial tax identifier in India that doubles as a proof of identity. Now, the government is ushering in “PAN Card 2.0” – an upgraded, digital-first version of PAN aimed at streamlining financial transactions and modernizing taxpayer services.

PAN 2.0 aligns with the Digital India vision, introducing features like dynamic QR codes, real-time updates, and seamless integration with other platforms.

This article outlines the PAN Card 2.0 concept, government initiatives behind it, technological and policy changes envisioned, public benefits and concerns, practical use cases, expert opinions, and how it compares with global digital identity trends.

Government’s Vision and Initiatives for PAN Card 2.0

Under the PAN 2.0 Project, the Indian government has embarked on a comprehensive overhaul of the PAN system.

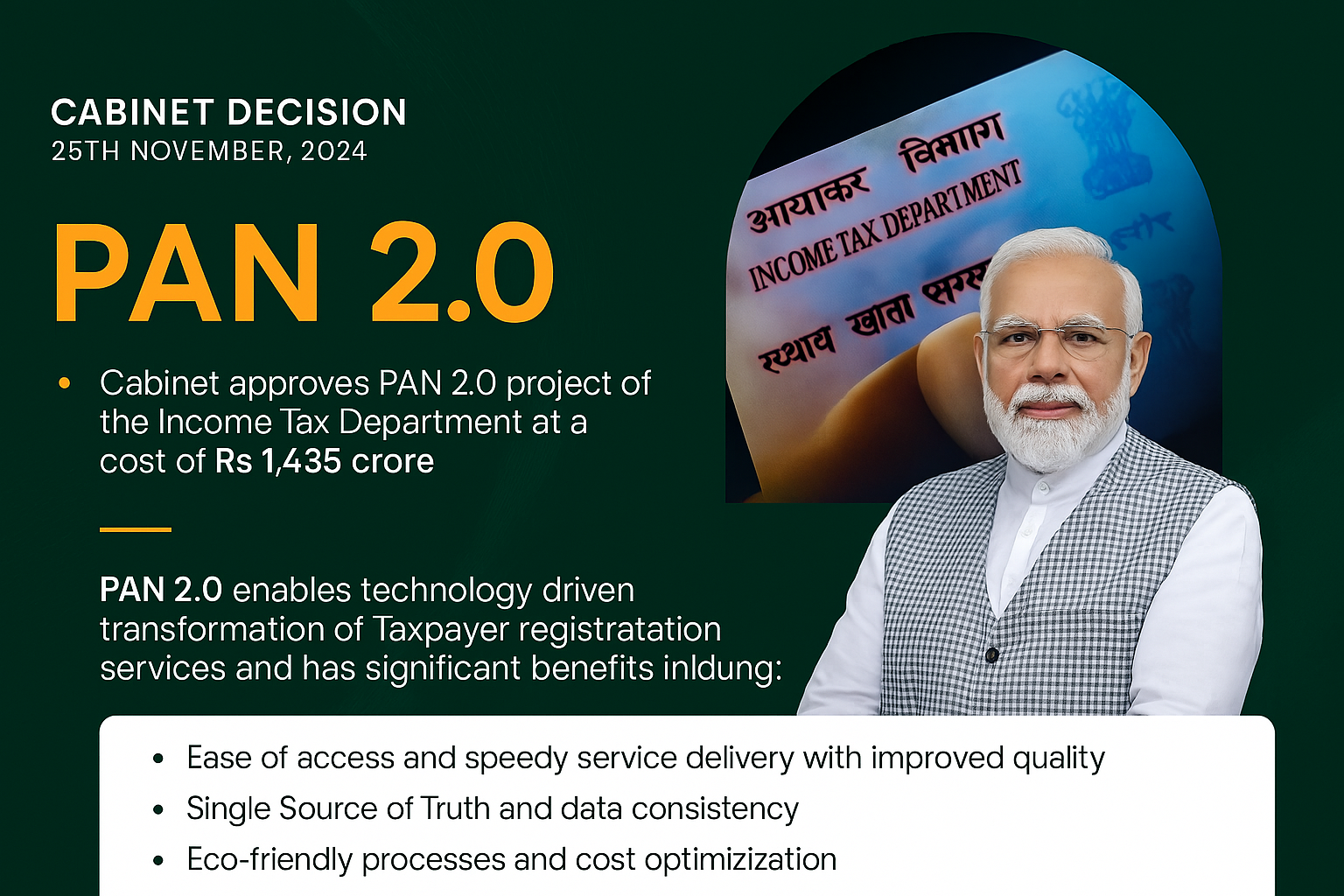

Announced in the Union Budget 2023, the plan positions PAN as the “common business identifier” across digital systems of various government agencies. In late 2024, the Cabinet approved a ₹1,435 crore allocation to implement PAN 2.0, in line with the Digital India mission.

A key goal is paperless, online processes for PAN services, enabling fully digital allotment, updates, and KYC verification.

The Finance Ministry’s November 26, 2024, press release highlighted that PAN 2.0 will be issued free of cost as an e-PAN (sent to one’s email), while physical cards will be optional (available on request for a nominal fee of ₹50).

Crucially, linking PAN with Aadhaar has already been mandated, which lays the groundwork for PAN 2.0 to leverage the authenticated identity that Aadhaar provides.

By upgrading PAN into a digital avatar, the government aims to create a single source of truth for identity and compliance, making PAN the centrepiece of India’s unified digital identity framework.

Key Initiatives & Announcements:

Budget 2023: Proposed PAN as a universal identifier for business entities across government platforms.

Project Approval 2024: Cabinet sanctioned ₹1,435 Cr for PAN 2.0 implementation, consolidating PAN/TAN systems for enhanced taxpayer experience.

Press Release (Nov 2024): Emphasized paperless, free e-PAN issuance, optional physical card, and using technology for speed and security.

Aadhaar Integration: Continued push for linking PAN with Aadhaar to enable real-time e-KYC and avoid duplication.

No Mandatory Reissue: Existing PAN cards remain valid; upgrading to 2.0 (with new features) is voluntary unless corrections are needed.

Technology Upgrades in PAN Card 2.0

PAN Card 2.0 isn’t just a cosmetic update – it brings significant technological enhancements to make identity verification more robust and user-friendly:

- Dynamic QR Code: An enhanced QR code will be embedded on PAN cards, capable of displaying up-to-date information from the PAN database. While QR codes have existed on PAN since 2017, the PAN 2.0 QR will be dynamic – meaning any changes in one’s PAN record (such as updated address or contact details) reflect in the code.

- Scanning the code (via a dedicated app) shows details like the holder’s photo, signature, name, parents’ names, date of birth, and potentially address. This enables instant authenticity checks and could allow PAN to serve as an address proof if address data is included.

- AI and Blockchain Integration: PAN 2.0 is envisioned to leverage modern technologies like Artificial Intelligence (AI) for fraud detection and Blockchain for secure data management. By integrating blockchain, the system could gain a tamper-proof ledger of identity data, enhancing security and transparency in financial operations.

- Though not explicitly detailed in government releases, experts see blockchain-backed ID verification as a way to prevent unauthorized alterations and ensure an immutable audit trail of PAN data.

- PAN Data Vault & Security Standards: In response to rising ID fraud, the government plans to implement a “PAN Data Vault” to safeguard personal and demographic informationindiatoday.in. This vault will store PAN data in encrypted form, minimizing the risks of data theft or manipulation.

- PAN 2.0 adopts global security standards and complies with ISO certifications (like ISO 27001 for information security and ISO 9001 for quality)indiatoday.inpib.gov.in, indicating a strong focus on data protection. These measures come at a critical time – a 2025 identity fraud report found that India’s PAN card was the most forged tax ID worldwide in 2024, involved in 27.1% of tax ID forgeries. By boosting security (dynamic QR, encryption, ISO standards), PAN 2.0 aims to curb identity theft and fraud.

- Real-Time Updates and e-KYC: The upgraded PAN system will facilitate real-time validation and updates. Users can update their PAN details (e.g., address change) online and see it reflected almost immediately in the system.

- This means no more lengthy waits or paperwork for corrections. Real-time PAN validation APIs will let banks and institutions instantly verify a customer’s PAN details online. Together with Aadhaar linkage, this could enable true real-time e-KYC – for example, a bank could instantly confirm identity and address by checking the PAN 2.0 data (including the Aadhaar-verified info) instead of relying on physical documents.

- Unified Database and Systems: Technologically, PAN 2.0 involves re-engineering the backend. Currently, two separate agencies (NSDL, now Protean eGov, and UTIITSL) issue PAN cards and maintain databases.

- PAN 2.0 will merge these into a single central database, creating one unified platform. This unified system – a single portal and data source – is expected to eliminate inconsistencies, reduce duplication, and simplify integration with other government systems. Essentially, PAN 2.0 serves as a single digital key that different services can trust and use for identity verification.

These tech upgrades mean PAN 2.0 will operate more like a digital identity platform than just a card.

Instant e-PAN allotment, dynamic data via QR code, and advanced security protocols collectively aim to make PAN 2.0 a cutting-edge ID system comparable to the best in the world.

Who Can Apply for PAN 2.0

1. New Applicants:

Anyone who does not have a PAN can apply for PAN 2.0. This includes:

- Salaried individuals

- Freelancers and consultants

- Business owners and startups

- Students (above 18 with taxable income)

- Foreign nationals earning income or doing business in India

2. Existing PAN Holders:

If you already have a PAN card, you do not need to apply again. However, you can request an upgrade to the PAN 2.0 version if:

- You want the new QR code-enabled version

- You need to update or correct your details

- You want a digital e-PAN copy for easy access

Existing PANs remain valid. Upgrading is optional unless details need to be changed.

How You Can Apply for PAN Card 2.0?

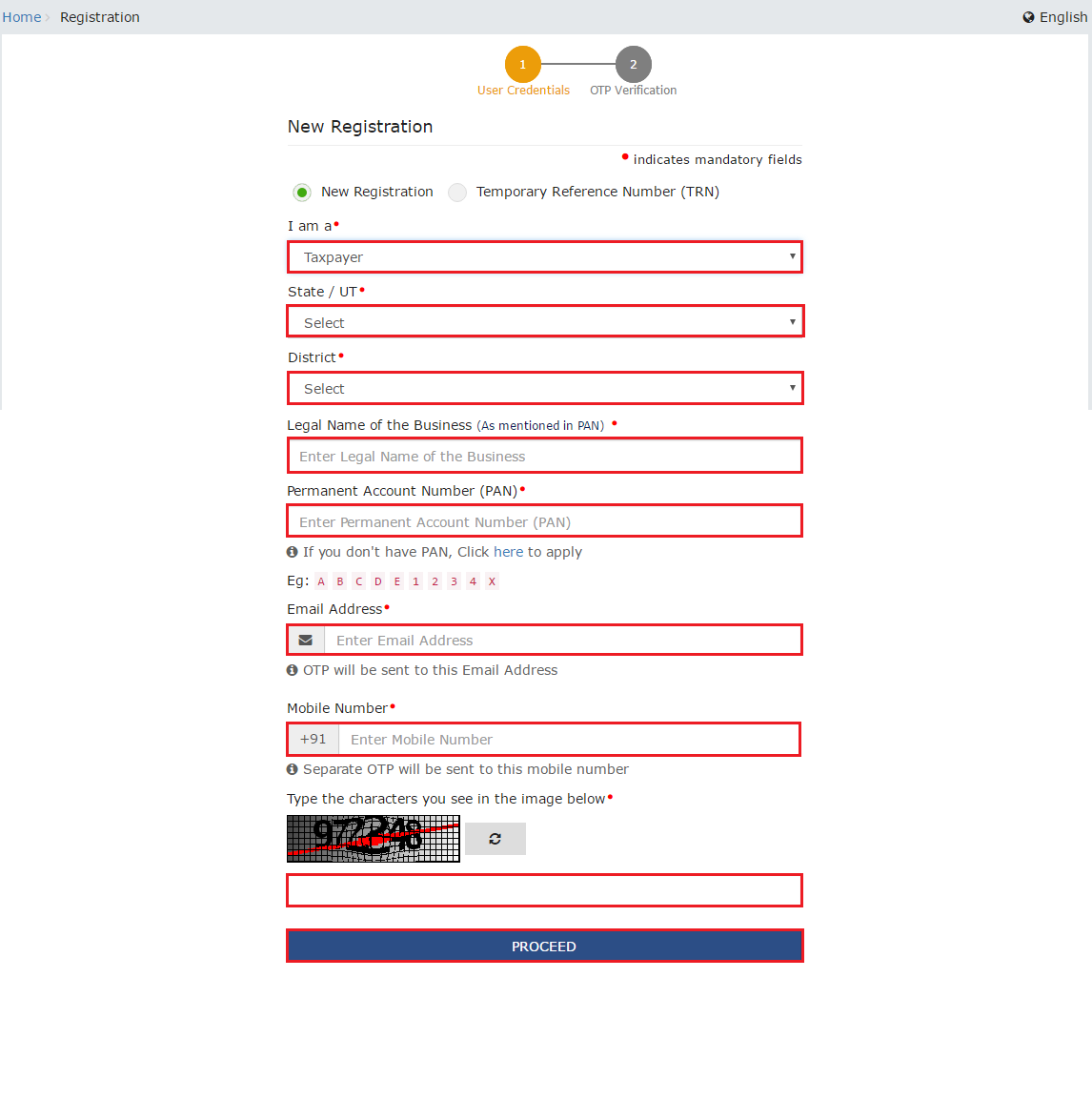

For new applicants:

- Visit the official Income Tax portal or the websites of NSDL or UTIITSL

- Select ‘Apply for PAN (New)’

- Enter basic details like name, date of birth, Aadhaar number, and contact information

- Complete Aadhaar-based e-KYC

- Upload a photo and signature if required

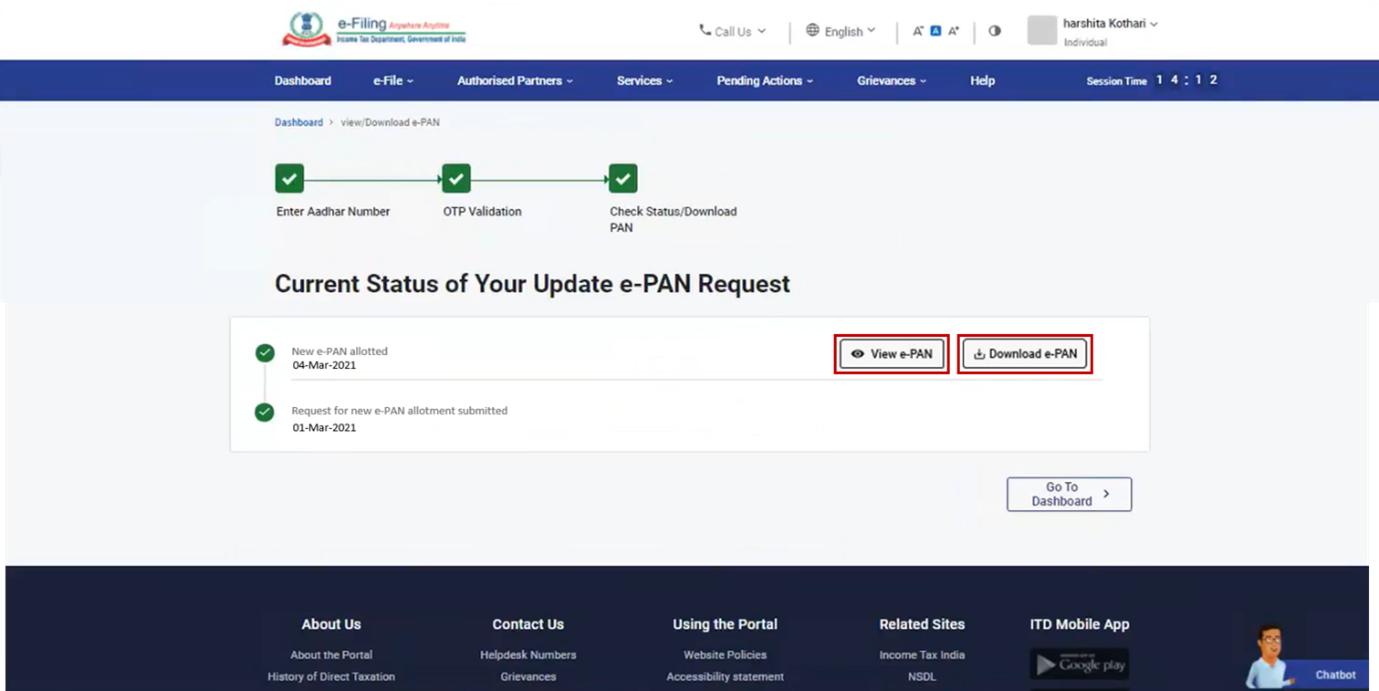

- Submit the form and receive the e-PAN via email

For existing PAN holders (upgrading or reprinting):

- Log in to the Income Tax portal

- Choose ‘Reprint PAN’ or ‘Update PAN Details’

- Confirm your details

- Receive a free updated e-PAN

- Request a physical copy for a small fee (around ₹50)

What Documents are Required for PAN 2.0

For Indian citizens:

- Aadhaar card (mandatory for e-KYC)

- If Aadhaar is not used, other valid ID and address proof documents

For foreign nationals:

- Passport

- Visa

- Proof of address in India

Delivery Timeline

- e-PAN (digital PDF): Instant via email

- Physical PAN 2.0 card: Usually delivered within 7–15 working days

PAN 2.0 Administrative and Policy Changes

To support the technological leap, several administrative and policy changes are being rolled out with PAN Card 2.0:

Common Business Identifier:

A major policy shift is using PAN as the universal business ID. The government is integrating PAN, TAN, and TIN into one identifier. Instead of juggling a PAN for income tax, TAN for TDS, and maybe a separate GSTIN or CIN, businesses could use just the PAN as a master key across agencies.

This was a long-standing industry demand to reduce red tape. Union Minister Ashwini Vaishnaw described this single ID as a way to simplify compliance – one number unlocking all departments. In practice, it means less paperwork and a unified view of an entity’s interactions with government (tax filings, registrations, etc.).

Centralized Portal for PAN/TAN Services:

Administrative processes around PAN are being unified. All services – new applications, corrections, reprints, and status tracking – will be available on one central Income Tax Department portal.

This replaces the earlier system of multiple websites or providers. One-stop service will make it easier for users to apply or update, and for authorities to manage records centrally.

Paperless and Free E-PAN Services:

PAN 2.0 pushes for end-to-end digital processing. Applications, updates, and communications will be paperless and mainly online.

The government has explicitly stated that obtaining or updating a PAN (allotment, correction, etc.) will be free of cost – users will receive an electronic PAN (PDF) by email. Only those who specifically want a physical card will pay a small fee.

This policy not only encourages digital adoption but also removes financial barriers to getting a PAN, thereby improving inclusion.

Retention of Existing PANs:

An important administrative clarification is that existing PAN cards remain valid indefinitely; PAN 2.0 does not invalidate old PANs.

There is no mandatory re-issuance; one can continue using their current PAN card (even the older format without QR), and it will work as before. However, if someone wants the new features (like QR code) or has outdated details, they may optionally apply for an updated PAN card on the new system. This ensures a smooth transition without disrupting any ongoing financial activities.

Data Management Regulations:

With PAN 2.0’s emphasis on security, regulators are introducing rules on how PAN data must be handled by businesses.

For instance, financial institutions may be required to store PAN information in a secure digital vault (complying with the new standards)

This means banks, insurers, fintechs, etc., need to upgrade their data storage practices to align with PAN 2.0 security, ensuring that if they hold PAN data, it’s encrypted and protected per government norms.

Officially Valid Document (OVD) Status:

Currently, PAN is a required ID for financial transactions, but not accepted as an address proof or standalone KYC document in many cases. Policy changes with PAN 2.0 may elevate PAN’s status in the list of OVDs for KYC.

If the dynamic QR code includes address and Aadhaar linkage, regulators could allow PAN 2.0 to serve as a full KYC document (both identity and address proof). This would be a significant policy shift, enabling banks and others to accept just PAN Card 2.0 for KYC in the future, simplifying customer onboarding. However, as of now, more clarity is awaited, and Aadhaar remains the primary OVD for address verification.

In summary, these administrative changes are about simplification and convergence: one number for multiple purposes, one portal for all services, no paper, minimal fees, and updated rules so that PAN’s enhanced digital form can be widely accepted.

Public Benefits of PAN Card 2.0

The PAN Card 2.0 initiative is poised to deliver a range of benefits to both individuals and businesses by making compliance easier and services faster:

Seamless User Experience:

Individuals will find it easier to obtain and use PAN. Instant e-PAN issuance means you can get your PAN within minutes of applying online. No more waiting for weeks or dealing with physical forms. Similarly, if you need to update details (name change, new address), the process is quick and digital. This convenience reduces the friction in complying with tax or KYC requirements.

Improved KYC and Service Access:

With PAN 2.0 acting more like a digital ID, people can complete KYC (Know Your Customer) processes for banks, investments, or telecom services without submitting multiple documents.

For example, opening a bank account could become smoother: banks can verify your PAN online in real-time and, if allowed, use the PAN Card 2.0 QR code to fetch your verified address.

The upgraded PAN will be accepted as ID proof at airports, hotels, train stations, etc., just like the digital PAN 1.0 already is in many places, but with broader acceptance expected.

This means less paperwork for everyday tasks like buying a SIM card, registering a property, or applying for a loan – your PAN 2.0 could suffice where previously you needed PAN + Aadhaar + address proof documents.

Faster Financial Transactions & Approvals:

Real-time PAN verification will speed up processes that used to take days. Loan approvals, credit card issuances, or investment account openings can be faster since lenders and providers instantly confirm identity and financial profile through the PAN system.

Also, tax filings and refunds may see improvements, since PAN is the key to all tax records, the upgraded system can reduce errors (like mismatched PAN info) and thereby expedite processing. Integration of PAN as a common ID across systems could also reduce duplication.

For instance, if you start a business, using PAN as the business ID means when you register for GST or other licenses, the info flows from PAN database, saving time in filling forms.

Cost Savings and Ease for Businesses:

Businesses benefit from having one consolidated identification for various compliance needs. A unified PAN/TAN means companies don’t have to manage multiple numbers or interfaces, which cuts down on administrative overhead.

Fintech companies and banks, in particular, anticipate cost reductions: a unified PAN database and instant verification will lower the expense of customer onboarding and document processing.

Experts note this “single source of truth” will eliminate redundant KYC checks and make regulatory reporting more efficient.

Moreover, free e-PAN issuance removes fees that were earlier involved, indirectly benefiting startups and small businesses that need PAN for registration without incurring extra costs.

Enhanced Security and Trust:

By addressing fraud through dynamic QR codes and secure verification, PAN Card 2.0 increases trust in digital documents. Individuals will have more confidence that their PAN information is safe and hard to forge, while institutions can rely on the authenticity of a PAN 2.0 presented to them.

This trust can encourage more usage of digital IDs – for example, people might be more willing to share a digital PAN for verification knowing it can be instantly validated (reducing the risk of someone using a fake PAN copy).

Overall, it contributes to a more transparent financial ecosystem, where tax evasion and identity fraud are harder. The government expects PAN 2.0 to help prevent tax evasion and errors through better data integration, which ultimately benefits honest taxpayers (less chance of someone misusing your PAN, and possibly more efficient tax administration that could translate into better services).

In essence, PAN 2.0 promises greater ease of compliance for the public – making mandatory processes (tax, bank KYC) less of a hassle – and it strengthens the infrastructure so that everyday financial and identity transactions are quicker and safer.

Potential Concerns and Challenges

While PAN Card 2.0 brings a host of improvements, it also raises several concerns and implementation challenges that need careful attention:

Data Privacy and Security:

Centralizing PAN data and linking it across various platforms means vast amounts of personal data will be stored digitally. This makes the system a high-value target for cyberattacks. A breach in the PAN data vault or misuse of access could expose sensitive information (financial transactions, linked Aadhaar details, etc.).

Even with strong encryption and ISO-certified security, no system is invulnerable. Citizens may worry about privacy – with PAN becoming a universal ID, there’s a fear of increased surveillance or profiling if all their financial activities are tied to one identifier.

It’s crucial that robust privacy safeguards and access controls are in place so that data is used only for legitimate purposes and with consent.

Identity Fraud and Forgery:

Ironically, digitization can create new avenues for fraud if not managed well. Reports indicate that as documents go digital, forgery incidents have spiked globally (a 244% rise in digital document forgeries in the past year).

Additionally, criminals are using AI (deepfakes, generative AI) to produce realistic fake IDs. PAN, being the most forged tax ID in the world in 2024, underscores the challenge. PAN 2.0’s QR code and verification aim to combat this, but fraudsters may attempt to tamper with QR codes or trick people into sharing OTPs/passwords.

There’s also the risk of phishing: as e-PANs circulate via email, scammers might send fake emails with malicious PAN attachments. Public awareness and continued updates to security features (possibly exploring blockchain for tamper-proof verification) will be needed to stay ahead of fraudsters.

Adoption and Transitional Issues: Will everyone accept digital PAN?

Initially, there could be hesitancy. Many banks and employers today still ask for a photocopy of a physical PAN card rather than accepting a digital PDF. Changing long-standing verification procedures takes time.

Even if regulations permit e-KYC via PAN Card 2.0, frontline staff might insist on physical proof out of habit or due to lack of training. The success of PAN Card 2.0 rests on widespread acceptance – government agencies, banks, telcos, etc., all need to update their KYC norms.

The digital divide is another factor: not everyone, especially in rural or older populations, is comfortable with digital documents or has easy internet access. These users may find it hard to download e-PANs or show QR codes on a smartphone.

The government’s choice to still offer physical cards is a nod to this reality, but ensuring no one is left behind in the shift to digital is a challenge.

Integration with Existing Systems:

PAN 2.0 will interface with a host of other systems – Income Tax filing, GST network, banks’ IT systems, securities markets (for demat accounts), etc. Integrating the new PAN database and ensuring all these systems seamlessly talk to each other is a complex task.

There might be teething troubles like data mismatches or system downtime during migration of legacy data into the unified database. Any technical glitches could temporarily disrupt services (e.g., if PAN validation fails during a bank’s KYC, it could inconvenience customers).

Thus, the rollout needs robust testing and a clear contingency plan.

Legal and Regulatory Framework:

To realize the full benefits (like using PAN Card 2.0 as sole KYC), various regulations might need updates – from RBI’s KYC guidelines to SEBI’s investor verification norms.

Lawmakers will need to address questions such as: Can PAN Card 2.0 data be shared across departments under data protection laws? How will user consent be managed when PAN info is pulled for verification?

Also, enforcement of new rules (like mandatory secure vaults for PAN data by businesses) must be monitored to prevent any weak links in the chain.

In summary, building trust is key. The government will have to reassure users that their digital identity is safe and that using PAN 2.0 is as reliable as (if not more than) the old processes.

Gradual adoption, public education on using e-PAN, and strict punishments for misuse will help address these concerns as India navigates this transformation.

Use Cases: How PAN 2.0 Could Transform Transactions

PAN 2.0’s impact will be felt across various domains. Here are some concrete use cases illustrating its potential:

Banking and Financial Services:

Perhaps the biggest change will be in bank account openings, loans, and credit card issuance. Today, to open a bank account, you provide PAN and an address proof (like Aadhaar or utility bill). With PAN 2.0, imagine a fully online account opening: you enter your PAN, the bank’s system pings the PAN Card 2.0 database, instantly verifies your identity and fetches your KYC details (including address, if PAN 2.0 carries that).

No need to upload scanned documents; a QR code scan or a secure API call does the job. Video KYC processes become simpler – as one expert noted, in video calls currently you must show a physical PAN card on camera, but e-PAN on your phone is now acceptable.

This will only get easier when digital PAN is ubiquitous. For loans and credit cards, lenders can do instant PAN verification to check credit histories or tax profiles, speeding up approval times from days to maybe hours.

Taxation and Compliance:

Since PAN is fundamentally a tax ID, the filing of income tax returns and other compliance will be streamlined. Taxpayers can expect pre-filled information and fewer discrepancies, as all relevant data ties back to the singular PAN database.

GST Registration, which currently uses PAN to generate a GSTIN, might be simplified if PAN Card 2.0 serves as a common identifier. Businesses could register for GST or other licenses with one click authorization using their PAN 2.0 credentials, without redundant document uploads.

Also, when you quote PAN for high-value transactions (buying property, investing in stocks, etc.), those transactions can be auto-reconciled to your PAN record in real-time, improving compliance and reducing black money avenues.

Digital Identity Verification:

Beyond financial transactions, PAN 2.0 can become a widely accepted digital ID for everyday needs. For instance, on booking a hotel, you often need to show ID at check-in – with PAN 2.0 on your phone, a quick scan could verify your details.

The same goes for airport security, where PAN (though not a travel document like a passport) is accepted as identity proof: showing a digital PAN 2.0 might become routine, much like some people use m-Aadhaar.

Educational institutions or employers might verify credentials via PAN if needed (since PAN is unique and linked to other databases, it can act as a key to pull verified info like certifications or background checks when authorized).

PAN 2.0 in DigiLocker (the government’s digital document wallet) is another use case – one could store the e-PAN in DigiLocker and share it electronically with any service that needs identity verification.

Capital Markets and Investments:

If you want to invest in mutual funds or stocks, KYC is mandatory (PAN is already a must in these processes). PAN 2.0 can make investment onboarding instantaneous.

Brokerages could use the PAN Card 2.0 API to satisfy KYC requirements without requiring physical documents. Demat account opening could be entirely paperless – the depository can verify your PAN and link it to your Aadhaar electronically.

This not only saves time for investors but also reduces back-office work for financial institutions.

E-Commerce and Payments:

Online payment apps and wallets currently require KYC beyond a certain limit. With PAN 2.0, a user could complete a full KYC for a payment wallet by just providing PAN and OTP authentication linked to it, rather than uploading multiple documents.

Moreover, the government’s push towards a cashless economy could see PAN Card 2.0 integrated with UPI or even the upcoming e-Rupee (CBDC). For example, a large transaction made in e-Rupee might automatically log the PAN of the parties involved for transparency, fighting tax evasion.

Some experts suggest that linking PAN’s digital identity with digital currency could create an auditable trail that deters financial crimes while simplifying user experience.

Business Compliance and Registrations:

Entrepreneurs will benefit from PAN 2.0 being the business Aadhaar. When registering a new company or an MSME, the PAN could double as the company’s ID across ministries.

Need a PF registration with EPFO? Just give PAN – since the systems are linked, your basic details populate automatically (somewhat speculative, but it’s the vision of “inter-departmental communication” mentioned by experts).

Filing TDS returns or obtaining import-export code, everything could center around the PAN 2.0, making the process faster and error-free. Reconciliation and record-keeping become easier if a business uses PAN 2.0 everywhere – all its permits, tax payments, etc., connect back to one ID.

These use cases illustrate that PAN 2.0 is more than just a tax card – it could evolve into a universal digital ID for financial and official purposes.

By integrating with various services, it aims to remove friction, whether you’re checking into a hotel, applying for a loan, investing online, or setting up a business, PAN Card 2.0 could be the one-stop proof of identity and compliance.

Expert Opinions on PAN Card 2.0

The rollout of PAN Card 2.0 has garnered reactions from financial experts, legal analysts, and industry stakeholders. Here’s a snapshot of what experts are saying:

On KYC Sufficiency:

“In its present form, PAN is necessary but not sufficient for KYC… Apart from collecting PAN (the number) the regulated entity still has to collect an ID card (OVD). Aadhaar is a type of OVD,” explains Wriju Ray, CBO of IDfy.

He highlights that historically, PAN alone wasn’t enough for verification. However, Rahul Jain (Associate Counsel, HSA Advocates) points out that since PAN is now linked with Aadhaar, there’s a high possibility the dynamic QR code in PAN 2.0 will include address info, making PAN 2.0 “sufficient for conducting KYC” in the future.

In other words, experts believe PAN 2.0 could graduate to a standalone KYC document if it carries the needed data.

On Physical vs Digital Usage:

Ankit Jain, CA at Ved Jain & Associates, notes that digital PAN (the current e-PAN PDF) is already accepted in many scenarios – “entry points of airports, hotels, trains, etc.,” and for things like GST registration or company incorporation.

He expects PAN 2.0 to continue this trend, reducing the need for physical cards. However, he also cautions from experience that when joining a new job or opening a bank account, institutions “usually insist on a self-attested copy of PAN”. This gap between policy and practice means physical PAN cards might not disappear overnight.

Dip Mehta (Partner, EY) concurs, predicting that organizations will support both digital and physical PAN in the near term, but as trust and acceptance of PAN Card 2.0 grow, reliance on physical cards should “reduce significantly”. Essentially, experts foresee a transition period where education and system upgrades are needed for full digital adoption.

On Technological Impact:

Anand Kumar Bajaj, CEO of PayNearby, lauds the QR code integration, saying the upgraded PAN will “simplify KYC processes, improve data accuracy, and enhance service delivery”.

This reflects an industry view that PAN 2.0 will cut down customer onboarding time and errors. Similarly, CA Anand Bathiya, President of BCAS, calls PAN 2.0’s one-ID-for-business approach a game changer: “PAN will now be the new Business Aadhaar”, he says, noting it will ease running a business by not having to manage multiple IDs.

Bathiya emphasizes that India’s digital public infrastructure (like Aadhaar, UPI, etc.) built over the last decade, provides a strong backbone for PAN Card 2.0, and that the project is “built ground-up on an upgraded technology backbone” to leverage these capabilities.

He hopes the upgrade process for users will be automatic and hassle-free.

On Industry Costs and Efficiency:

From the fintech sector, Sanjeev Mehta (ex-Standard Chartered) welcomes the unified database, calling PAN 2.0 a “transformative move that will help fintech and other companies reduce costs while streamlining operations”. By consolidating the NSDL and UTIITSL systems, he notes, PAN 2.0 creates a “single source of truth” that eliminates duplication and has been an industry demand for years. This should simplify integrations and cut down KYC overheads for companies.

On Security and Fraud Prevention:

Cybersecurity observers and legal experts appreciate the focus on security. The introduction of a PAN data vault and compliance with global standards shows the government’s intent to protect data. However, they also warn that as IDs go digital, criminals might up their game.

The Entrust Identity Fraud Report 2025, cited by India Today, highlighted how PAN cards were heavily targeted for forgery and how AI is fueling new fraud techniques.

Experts in this space argue that, along with tech solutions like QR codes, there should be user education – individuals need to verify who they share their PAN with and use official channels for verification to avoid scams.

In essence, expert sentiment is optimistic about PAN 2.0’s promise (in terms of convenience and integration) but cautious about the execution. They stress on upgrading infrastructure, regulatory clarity, and awareness to ensure the theoretical benefits translate into real-world outcomes. The consensus is that PAN Card 2.0 is a timely step forward in India’s fintech and governance space, provided its rollout is managed well.

Global Context: Digital Identity and PAN Card 2.0

India’s PAN 2.0 initiative can be viewed in the broader context of how countries are leveraging technology for national identification and financial transparency. Several international parallels and contrasts stand out:

Estonia’s Digital ID:

Often cited as the gold standard, Estonia issues digital ID cards to all citizens, enabling access to virtually all government services online.

A key aspect is the use of blockchain-like data integrity measures (KSI Blockchain) to secure its e-governance system. While PAN Card 2.0 is focused on financial identity, it shares a similar ethos of a highly secure, universally accepted digital ID.

India’s approach with PAN Card 2.0 (and Aadhaar separately) is creating a federated digital identity system where different IDs serve different purposes but increasingly interlink. The use of blockchain in PAN 2.0 (as hinted by some experts) could move it closer to Estonia’s model of trust through technology.

United States (SSN) vs India (PAN/Aadhaar):

In the U.S., the Social Security Number (SSN) functions as a tax and identity number but ironically, the U.S. still relies on physical documents like driver’s licenses or passports for ID verification – there is no universal digital ID. India, with PAN 2.0, is leapfrogging by providing a secure digital credential that’s government-backed.

This could reduce problems like SSN identity theft by having QR verification (something the static SSN lacks). On the other hand, it raises similar privacy issues – just as Americans worry about widespread use of SSN, Indians may worry about PAN being used everywhere.

The difference is that India is actively building digital infrastructure (e.g., DigiLocker, electronic KYC) to safely utilize such IDs at scale.

European Union’s Digital Wallet:

The EU is in the process of implementing a European Digital Identity Wallet (planned around 2024-25) which will allow citizens to store and share official IDs (like national ID, driver’s license) via an app, underpinned by strong privacy rules.

PAN 2.0 fits into a comparable vision – an ID that you can carry on your phone and use whenever needed, under your control. The EU model is very privacy-centric (citizens choose what to share).

India’s PAN 2.0 will need to ensure similar principles, especially once the Data Protection law is fully in force, so that individuals can safely use their digital PAN without fear of data misuse.

Other Countries’ Efforts:

Many countries are exploring blockchain and digital IDs – for example, Singapore has a National Digital Identity program, and Australia is working on a digital ID. Pakistan and Bangladesh have faced issues with ID document fraud as well, similar to India’s challenges.

What sets India apart is the scale (over a billion identities) and the pace of innovation like UPI, Aadhaar, and now PAN 2.0. India could become a case study in how to modernize a critical ID system for a large population.

The success of PAN 2.0 could inspire other countries to use technologies like QR codes and unified IDs for their tax or social security systems.

Blockchain-backed Identities:

The concept of self-sovereign identity (SSI) using blockchain is a hot topic globally.

It means individuals control their identity data and share verifiable credentials as needed, without central databases. PAN Card 2.0 is not an SSI (it’s government-centralized), but it might incorporate some blockchain elements for security.

Countries like Canada and Spain have pilot programs for blockchain IDs. If PAN 2.0 wanted to go further, it could potentially allow users to cryptographically prove their PAN details to a verifier without exposing all their data (for example, proving you have a valid PAN and are above a certain income level for a financial transaction, without revealing your PAN number or full financial history).

These are future possibilities that the framework could evolve towards.

In conclusion, India’s PAN Card 2.0 is part of a global movement towards digital identities, but it’s unique in its focus on tax and financial systems as the starting point. It combines ideas from successful models (dynamic data like in the EU, security like in Estonia, scale like nowhere else).

How India balances security, privacy, and ease-of-use with PAN 2.0 will offer lessons to many other nations eyeing similar digital transformations.

Conclusion: The Road Ahead for PAN Card 2.0

PAN Card 2.0 represents a bold step into the future of identity management in India. By digitalizing the PAN and enriching it with technology, the government aims to make it the central pillar of a seamless, secure financial ecosystem.

The envisioned outcome is a win-win: individuals and businesses enjoy faster services and easier compliance, while authorities gain better tools to ensure tax compliance and reduce fraud. As we’ve seen, the project touches on everything from cutting-edge tech (AI, blockchain) to everyday convenience (no more photocopies of PAN, perhaps).

However, the journey has just begun. The success of PAN 2.0 will depend on effective implementation and public adoption.

Key milestones to watch for include: the rollout of new PAN cards with QR codes (and how many people upgrade), the readiness of banks and institutions to accept digital PAN for all purposes, and the integration of PAN as a common ID across various services by upcoming deadlines.

Public awareness campaigns will likely be needed so that people know how to use their digital PAN (for example, using the QR code app) and how to update their details online.

Another critical aspect is the interplay with the proposed Data Protection Law, ensuring that the rich data under PAN 2.0 is protected and user consent is respected. Regulators will have to continuously refine KYC norms and security requirements as technology and threats evolve.

It’s a dynamic process: the PAN 2.0 of today might get further enhancements tomorrow (perhaps stronger biometric links, or features to support global use for NRIs, etc.).

In the coming years, if executed well, PAN 2.0 could become as ubiquitous and convenient as the Aadhaar-based authentication is today, forming a twin framework where Aadhaar provides proof of identity (biometric and demographic) and PAN provides proof of financial identity and compliance.

Together, they could power an array of e-governance and fintech innovations, from instant loans to personalized government services.

To sum up, PAN Card 2.0 is more than an updated ID card; it’s a vision for a digitized financial identity system. It promises efficiency, unity, and security, but also challenges us to be vigilant about data privacy and inclusion.

As India stands on the cusp of this change, stakeholders – the government, industry, and citizens – must work in concert to ensure that PAN 2.0 truly becomes a catalyst for positive change in India’s digital journey, much like how UPI revolutionized payments.

If all goes well, PAN 2.0 will not only make life easier for taxpayers and businesses but also solidify India’s reputation as a leader in innovative digital governance

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![PAN Card 2.0 – Changes and Impact on Indian and NRI Citizen - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)