Updated on May 22, 2025

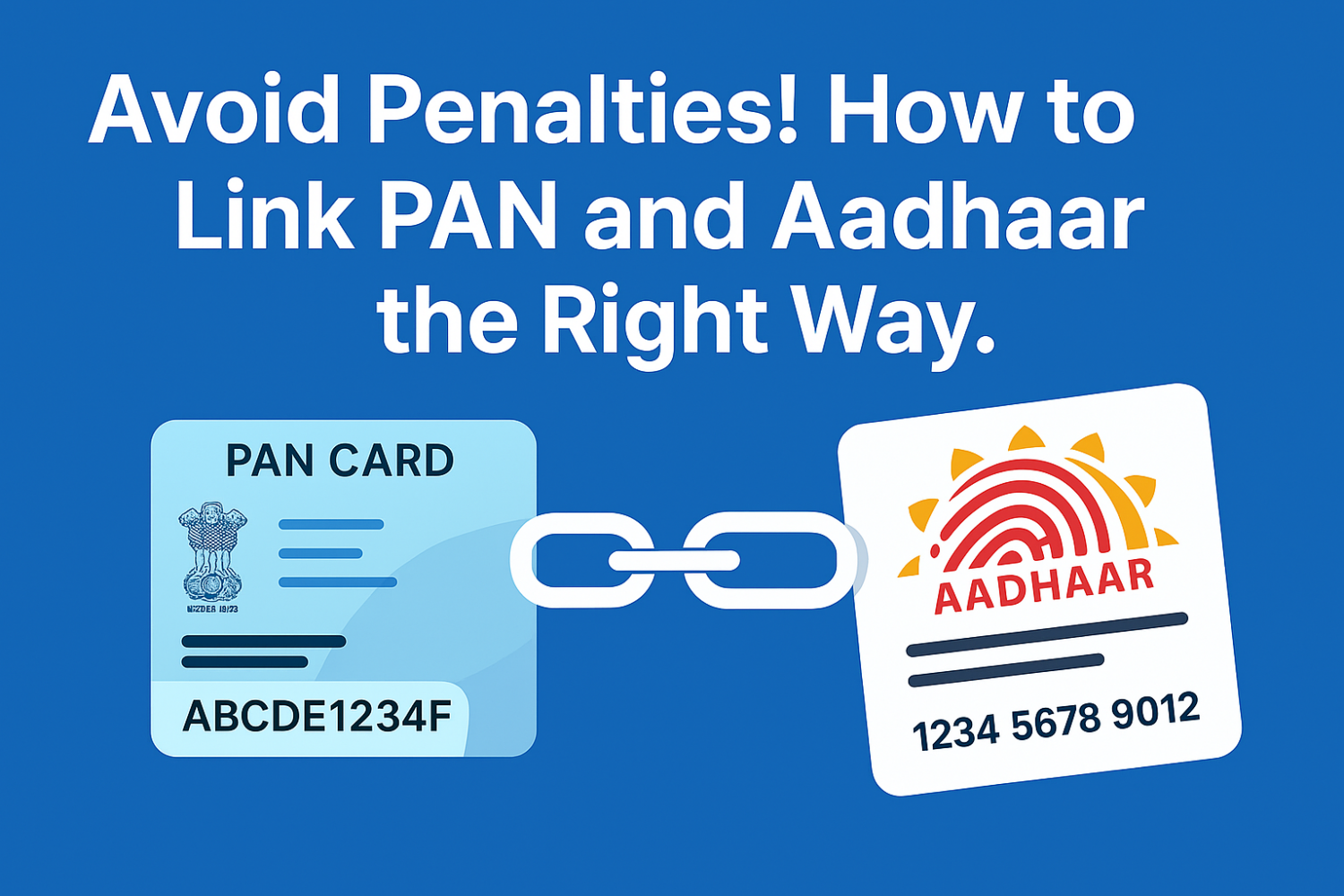

Avoid fines and stay compliant. Learn how to link PAN and Aadhaar before the deadline in 2025 with this complete step-by-step guide.

Why It’s Crucial to Link PAN with Aadhaar Before the Deadline

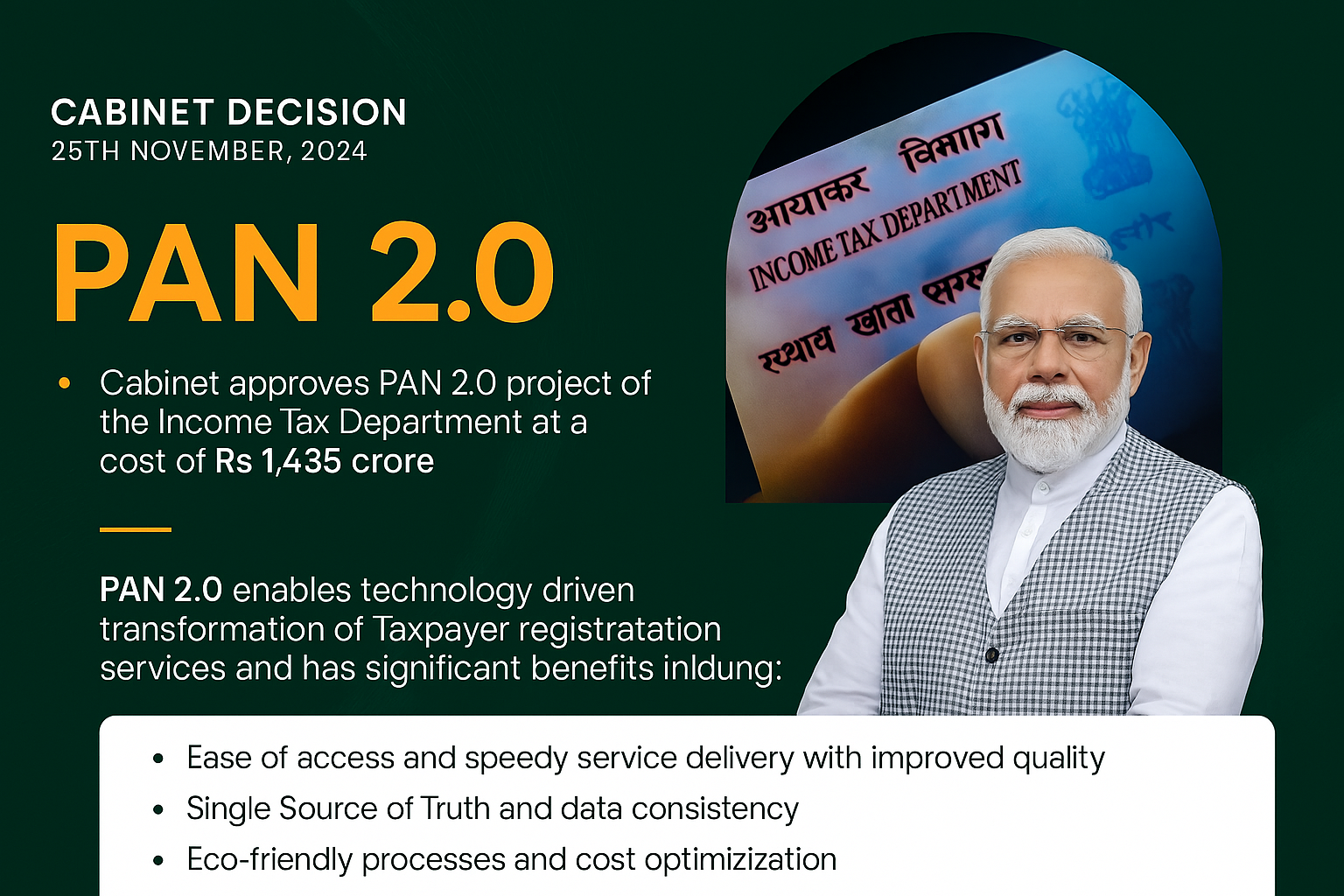

In today’s compliance-driven financial landscape, linking your PAN with Aadhaar isn’t just a government formality—it’s essential. The Income Tax Department of India mandates this linking to streamline tax administration, curb fraudulent PANs, and ensure transparency in financial transactions.

Starting July 1, 2023, failure to link PAN with Aadhaar leads to PAN becoming inoperative. This can stop you from filing tax returns, processing refunds, opening bank accounts, or even conducting transactions above ₹50,000. Not only is it inconvenient, but it could also lead to financial penalties of up to ₹1,000 under Section 234H of the Income Tax Act.

Additionally, linking helps reduce tax evasion and ensures that all financial records across platforms are tied to a single identity. So, if you haven’t linked them yet, now’s the time—especially with the 2025 deadline approaching fast.

Who Needs to Link PAN to Aadhaar and Who is Exempt?

While the rule to link PAN and Aadhaar applies broadly, there are specific exemptions under current government regulations. Understanding whether you’re required to link can save time and avoid unnecessary effort.

Mandatory For:

- All individuals who hold both PAN and Aadhaar.

- Indian citizens who file income tax returns.

- Residents with taxable income.

Exempt From Linking:

- Non-Resident Indians (NRIs) as per the Income Tax Act.

- Individuals aged 80 years or above (Super Senior Citizens).

- Residents of Assam, Jammu & Kashmir, and Meghalaya.

- Individuals who do not hold an Aadhaar and are not required to under current laws.

If you’re not sure about your status, you can always log into the Income Tax e-filing portal to verify whether the link already exists or if action is needed.

Documents & Prerequisites to Link PAN and Aadhaar

Before starting the linking process, it’s wise to keep everything ready for a smooth and quick experience. The linking can be done online through the Income Tax e-filing portal or via SMS. Here’s what you’ll need:

What to Keep Handy:

- Your 10-digit PAN (Permanent Account Number).

- Your 12-digit Aadhaar number.

- Registered mobile number linked to Aadhaar for OTP verification.

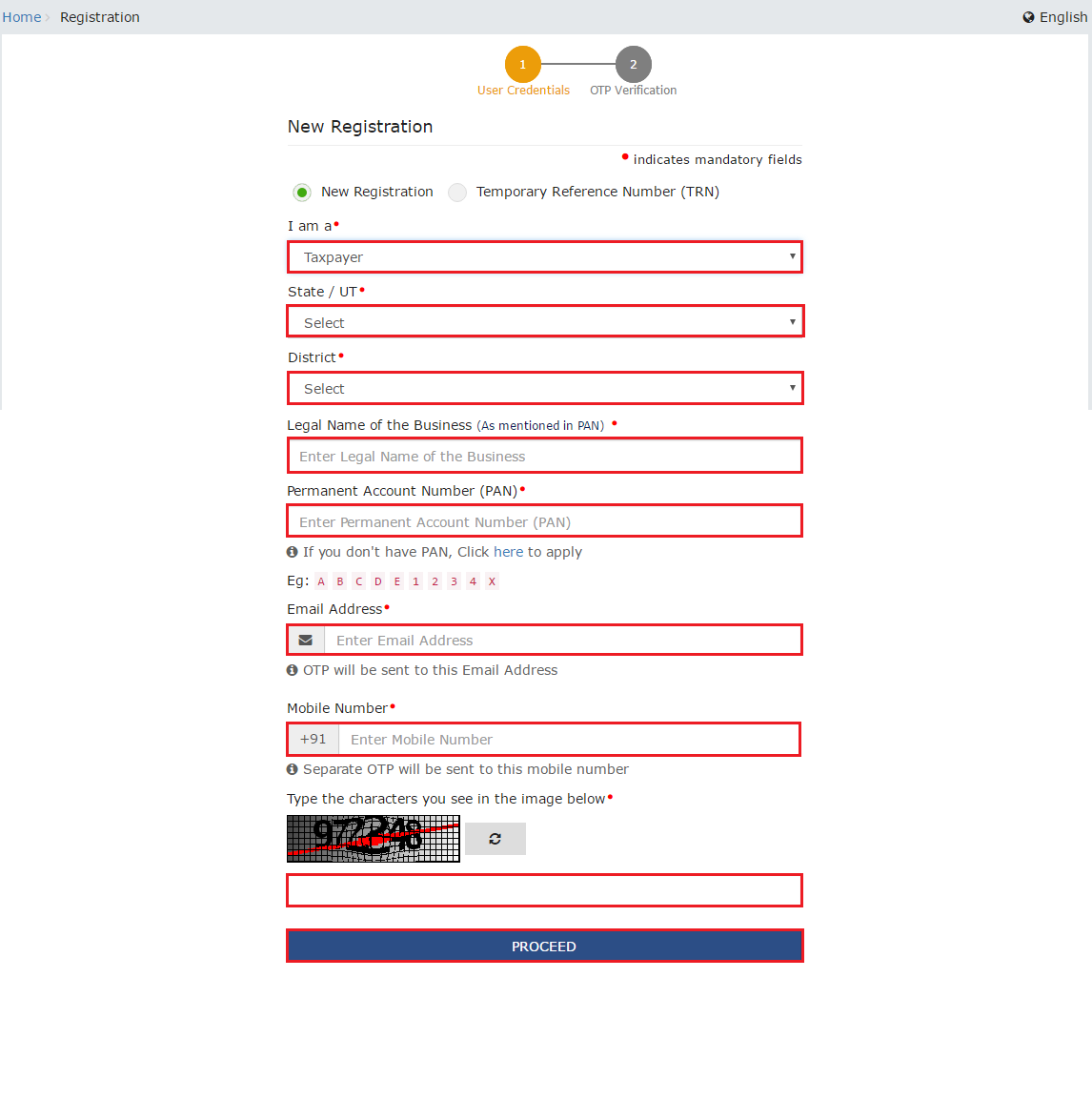

- Access the e-filing portal (create an account if you haven’t already).

- An internet connection and basic browser access.

Optional:

- If using SMS, you’ll need the mobile number linked to both PAN and Aadhaar.

Make sure the details—especially name, date of birth, and gender—match across both records. Any mismatch can delay or prevent the linking process and may require correction via UIDAI or NSDL.

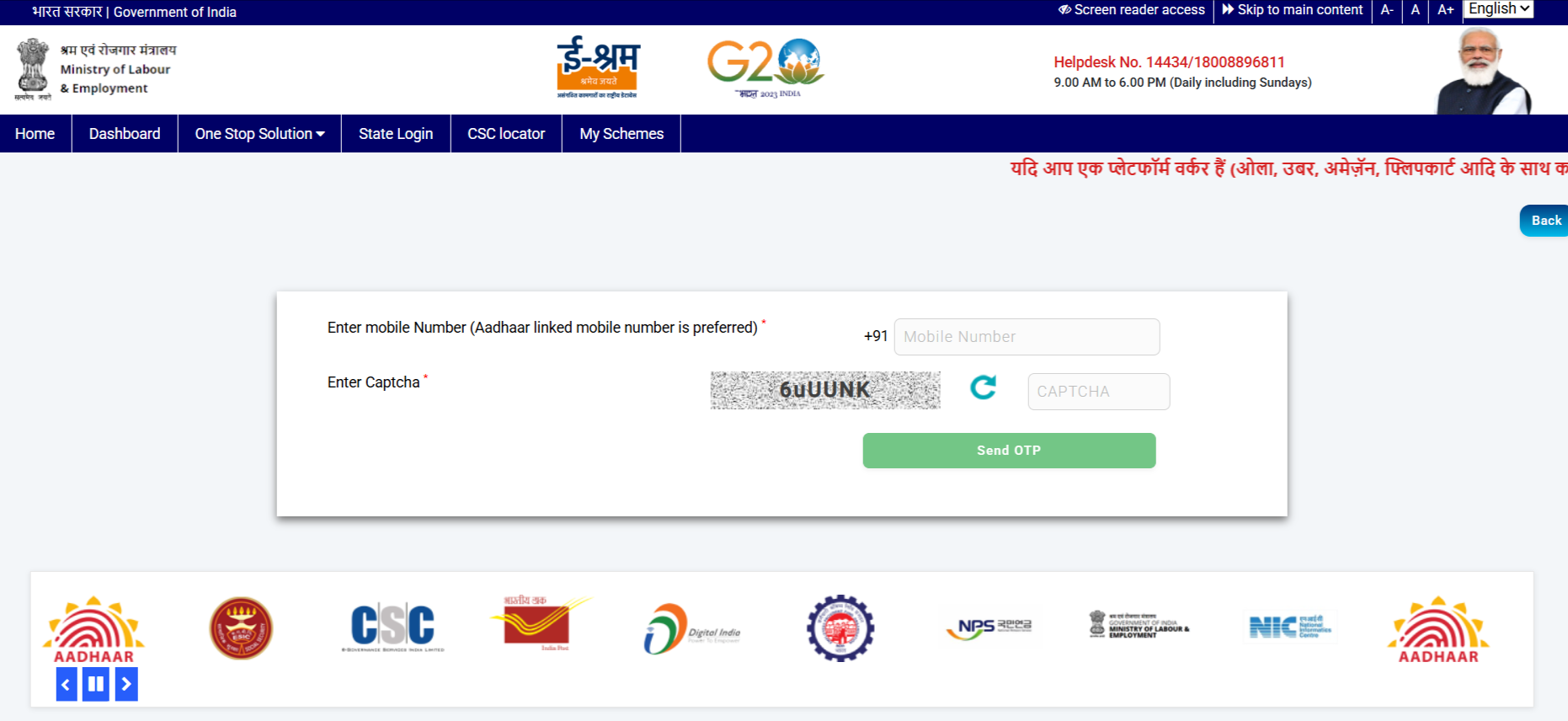

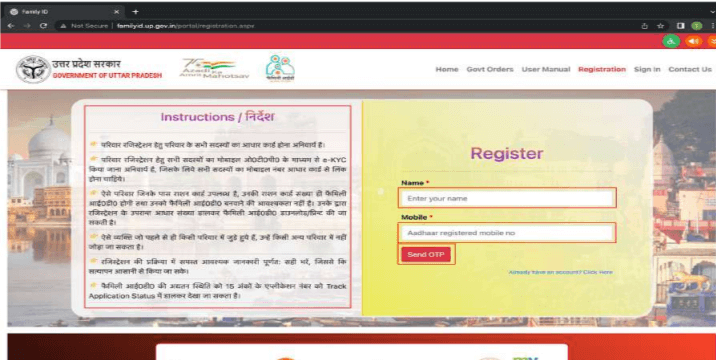

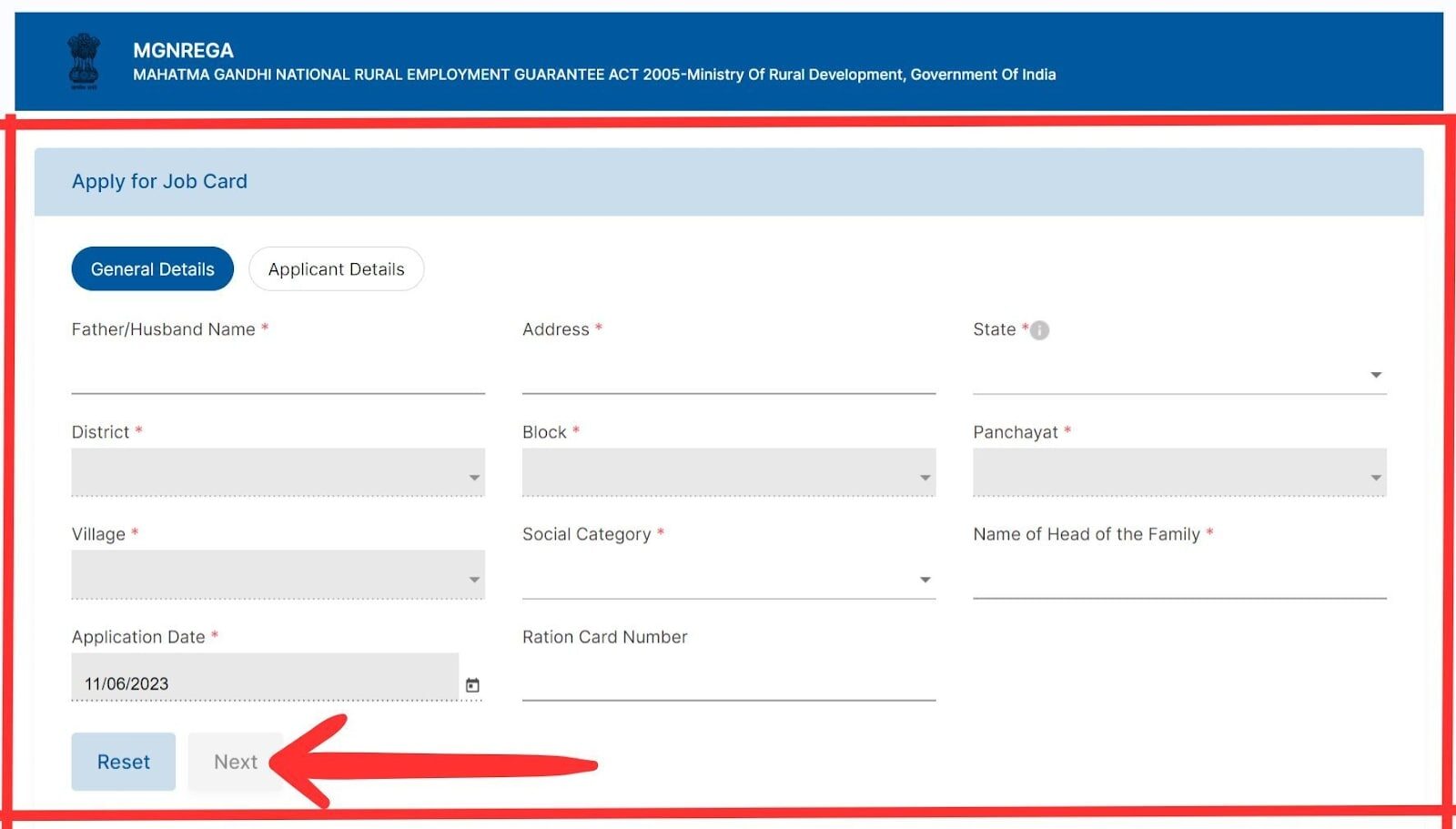

Step-by-Step Process to Link PAN Aadhaar Online

Linking your PAN and Aadhaar is incredibly simple. The government has streamlined the process, and it usually takes less than 10 minutes if you have everything in place.

Via Income Tax Portal (Recommended Method):

- Visit the e-Filing Website: Go to the Income Tax Portal.

- Click on “Link Aadhaar”: Found on the homepage under ‘Quick Links’.

- Enter PAN and Aadhaar Number: Fill in both details correctly.

- Verify Your Identity: If only the year of birth is mentioned in Aadhaar, tick the corresponding checkbox.

- Captcha Verification: Enter the security code displayed.

- Click “Link Aadhaar”: You’ll get an OTP on your Aadhaar-linked mobile number.

- Enter OTP and Submit. That’s it! You’ll receive a confirmation message.

Via SMS:

Send an SMS in this format to 567678 or 56161:

UIDPAN<space><12-digit Aadhaar><space><10-digit PAN>

Example: UIDPAN 123456789012 ABCDE1234F

You’ll receive a confirmation message if the details match and the link is successful.

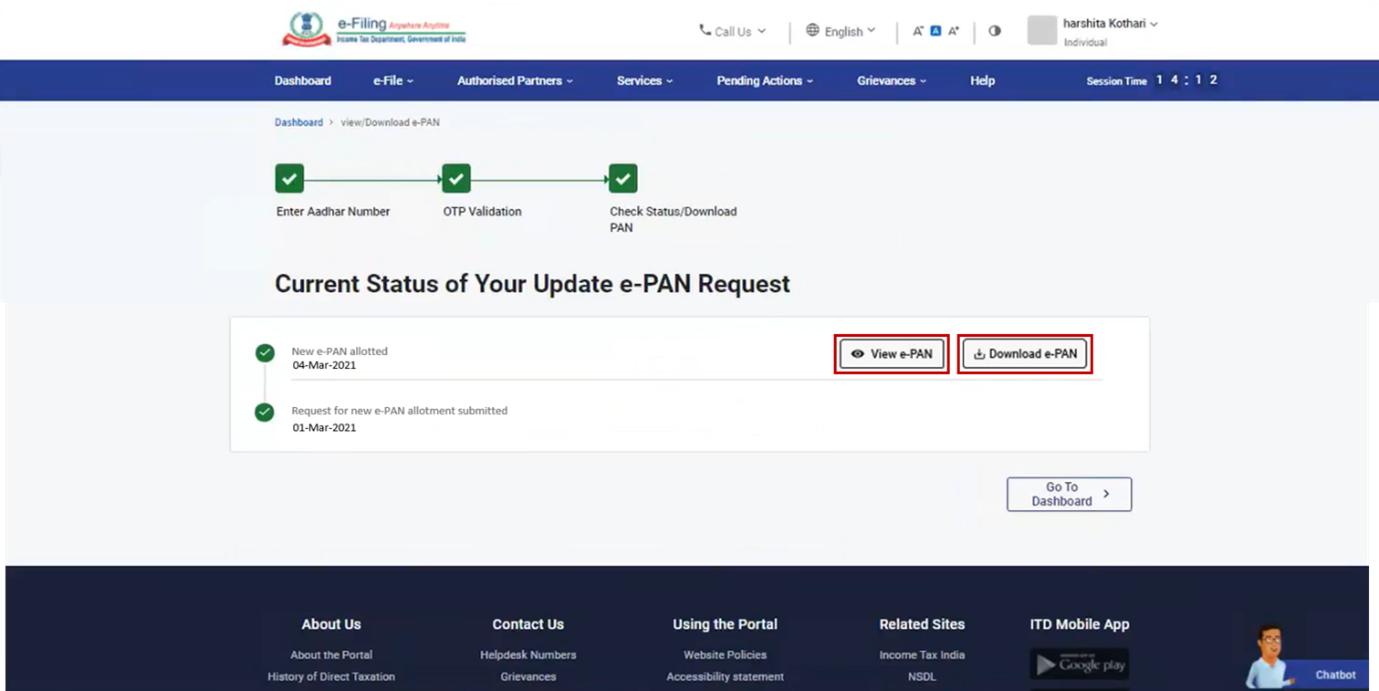

How to Check Status and Confirm PAN-Aadhaar Linking

Once the linking process is complete, it’s good to confirm that everything went through correctly.

Steps to Check PAN-Aadhaar Link Status:

- Visit the Income Tax Portal.

- Click on “Link Aadhaar Status” under the ‘Quick Links’ section.

- Enter your PAN and Aadhaar number.

- Submit to view the current status.

If your PAN and Aadhaar are linked, the system will confirm it. If not, you’ll be prompted to complete the process.

What If It Fails?

Sometimes, linking might fail due to

- Mismatched name or birth date.

- Aadhaar is not active or not linked to your mobile number.

- Technical issues on the portal.

If that happens:

- Cross-check details on both documents.

- Use the UIDAI portal to update Aadhaar info.

- Reattempt linking or use the manual method at a PAN service center.

Conclusion

With the deadline looming, linking your PAN with Aadhaar has become more than just a compliance task—it’s a financial safeguard. The consequences of failing to act on time are real, including penalties and restrictions on essential services like banking, investing, or filing tax returns.

Fortunately, the process is easy, quick, and can be done from your phone or computer in just a few minutes. Whether you choose the e-filing portal or SMS, the key is accuracy—ensure your documents match and your mobile number is up to date.

Take action now to avoid penalties and enjoy uninterrupted access to India’s digital and financial services ecosystem. Don’t wait for the deadline to sneak up—link your PAN and Aadhaar today and stay one step ahead.

FAQs

Is it mandatory to link PAN and Aadhaar?

Yes, unless you’re exempt (like NRIs or senior citizens above 80), it is mandatory by law.

What is the penalty for not linking PAN with Aadhaar?

A fine of up to ₹1,000 can be levied, and your PAN will become inoperative.

Can I link PAN and Aadhaar offline?

Yes, by visiting an NSDL or UTIITSL service center with valid documents.

Can I link PAN with Aadhaar without an internet connection?

Yes, use the SMS facility from your Aadhaar-registered mobile number.

What happens if I link the wrong Aadhaar with PAN?

Your PAN may become inoperative. You’ll need to contact the tax department to rectify the error.

Can I link my Aadhaar if the name or birthdate doesn’t match?

Yes, but you’ll need to correct the discrepancy first, either on the Aadhaar or PAN database, before retrying.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Avoid Penalties! Here’s How to Link PAN and Aadhaar the Right Way. - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)