Updated on June 14, 2025

Discover the step-by-step process to apply for housing loans under government schemes in India. Learn about eligibility, required documents, and the latest updates for 2025.

Introduction

Owning a home is a significant milestone, and the Indian government has introduced various schemes to make this dream accessible to all. In 2025, several initiatives aim to provide affordable housing through subsidized loans and financial assistance. This guide will walk you through the application process, eligibility criteria, and recent developments in government housing loan schemes.

Understanding Government Housing Loan Schemes

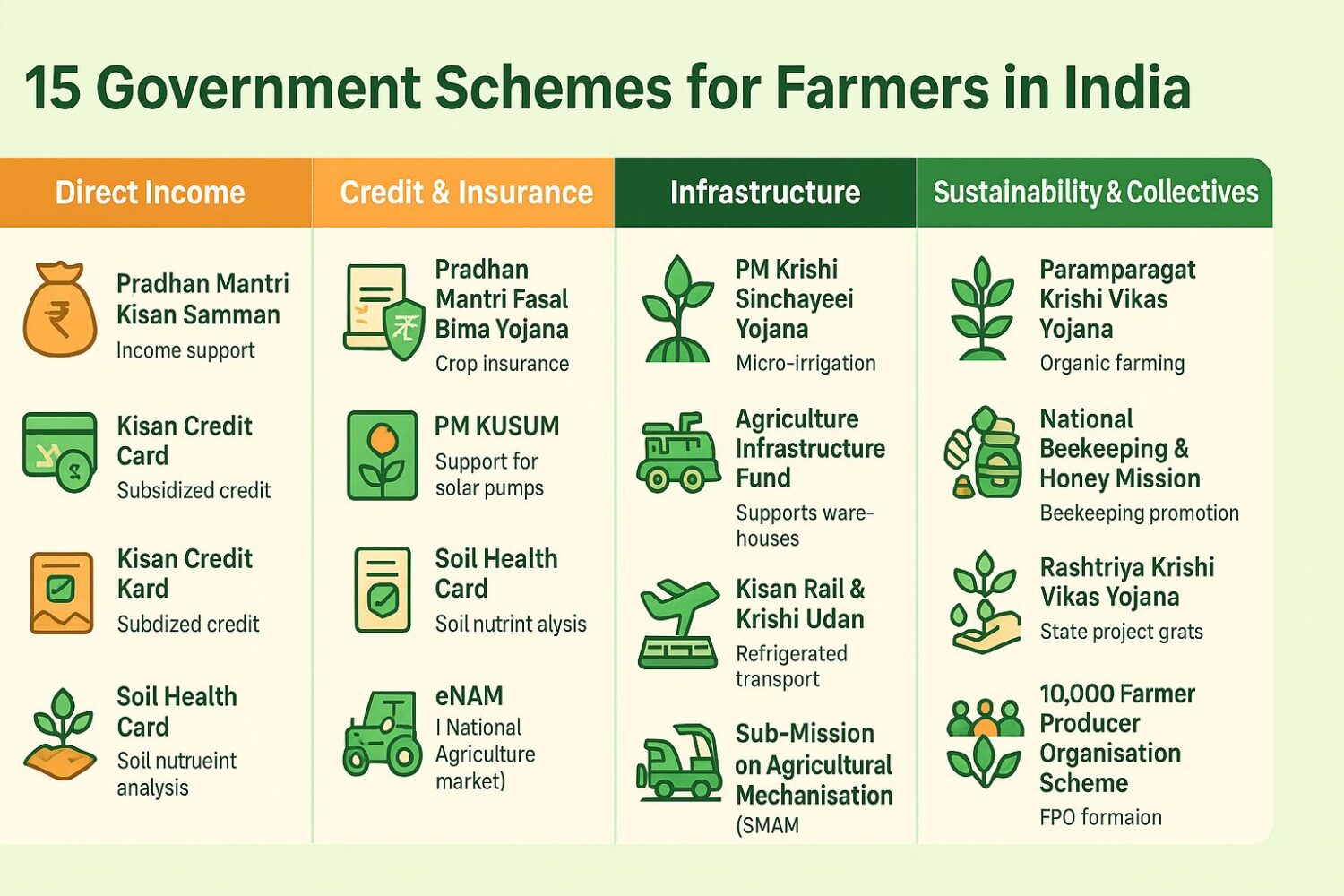

The Indian government offers multiple housing loan schemes to assist different income groups:

- Pradhan Mantri Awas Yojana (PMAY): Targets urban and rural populations, providing interest subsidies on home loans.

- Credit Linked Subsidy Scheme (CLSS): Offers interest subsidies for Economically Weaker Sections (EWS), Low-Income Groups (LIG), and Middle-Income Groups (MIG).

- State-Specific Schemes: Various states have their housing initiatives complementing central schemes.

Key Government Housing Loan Schemes

| Scheme Name | Target Group | Benefit |

|---|---|---|

| PMAY (Urban/Rural) | EWS/LIG/MIG | Interest subsidy of 3-6.5% |

| CLSS (Credit Linked Subsidy Scheme) | Urban poor | Up to ₹2.67 lakh subsidy |

| State Housing Boards | Varies | Special loans and flats |

| PMAY-G | Rural residents | Full housing construction cost support |

Eligibility Criteria

- Indian citizen

- No pucca house in any family member’s name

- Annual income below ₹18 lakhs

- Women or differently-abled co-ownership preferred

- Aadhaar card mandatory

| Income Group | Annual Household Income | Subsidy Available |

|---|---|---|

| EWS | Up to ₹3 lakh | 6.5% interest subsidy |

| LIG | ₹3–6 lakh | 6.5% interest subsidy |

| MIG-I | ₹6–12 lakh | 4% interest subsidy |

| MIG-II | ₹12–18 lakh | 3% interest subsidy |

Note: Applicants must not own a pucca house and should meet other criteria specific to each scheme.

Required Documents

To apply for housing loans under government schemes, prepare the following documents:

- Proof of Identity: Aadhaar card, PAN card, Voter ID, or Passport.

- Proof of Income: Salary slips, income tax returns, or bank statements.

- Property Documents: Sale agreement, property title deed.

- Other Documents: Passport-sized photographs, declaration of not owning a pucca house.

Application Process

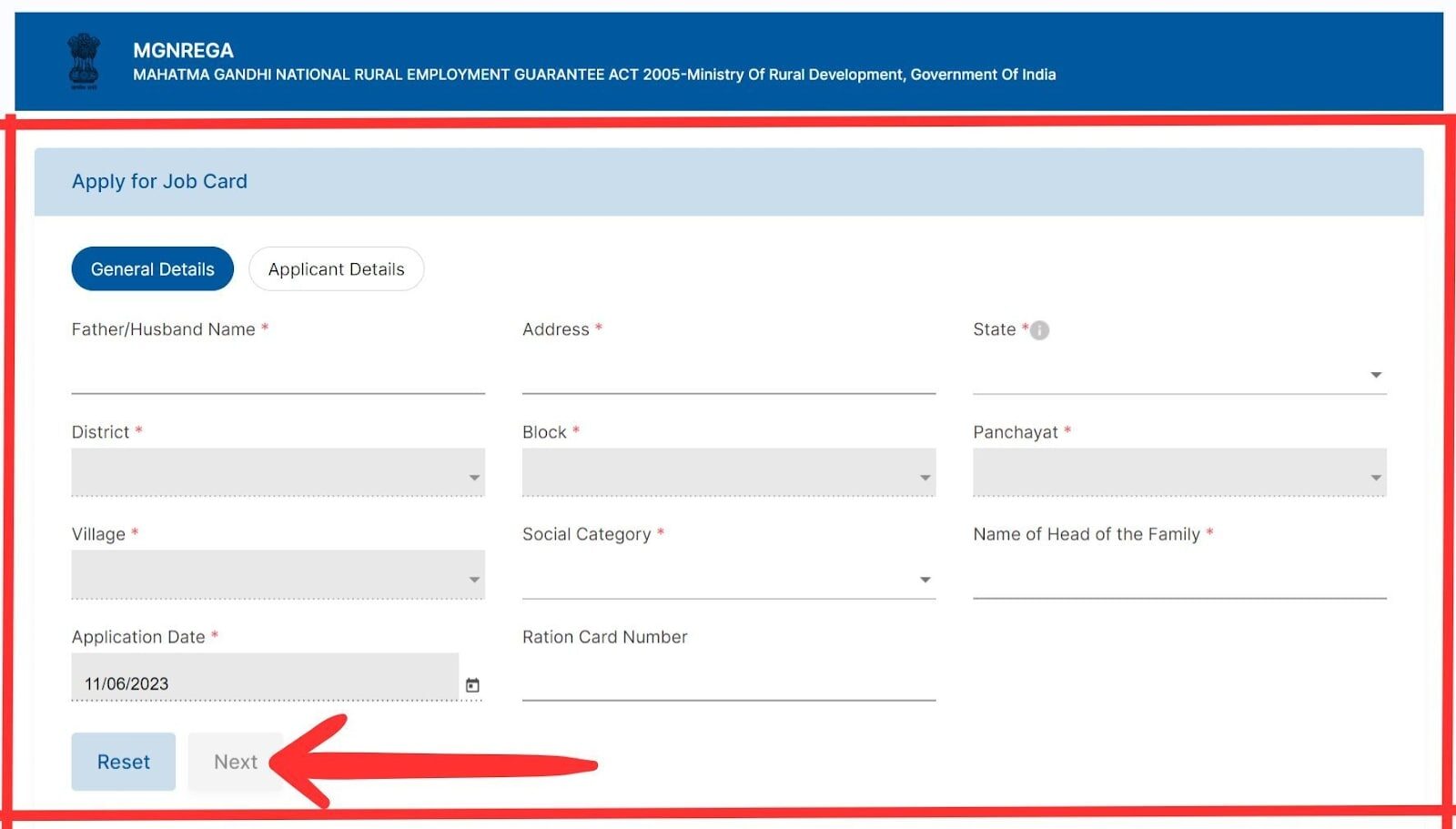

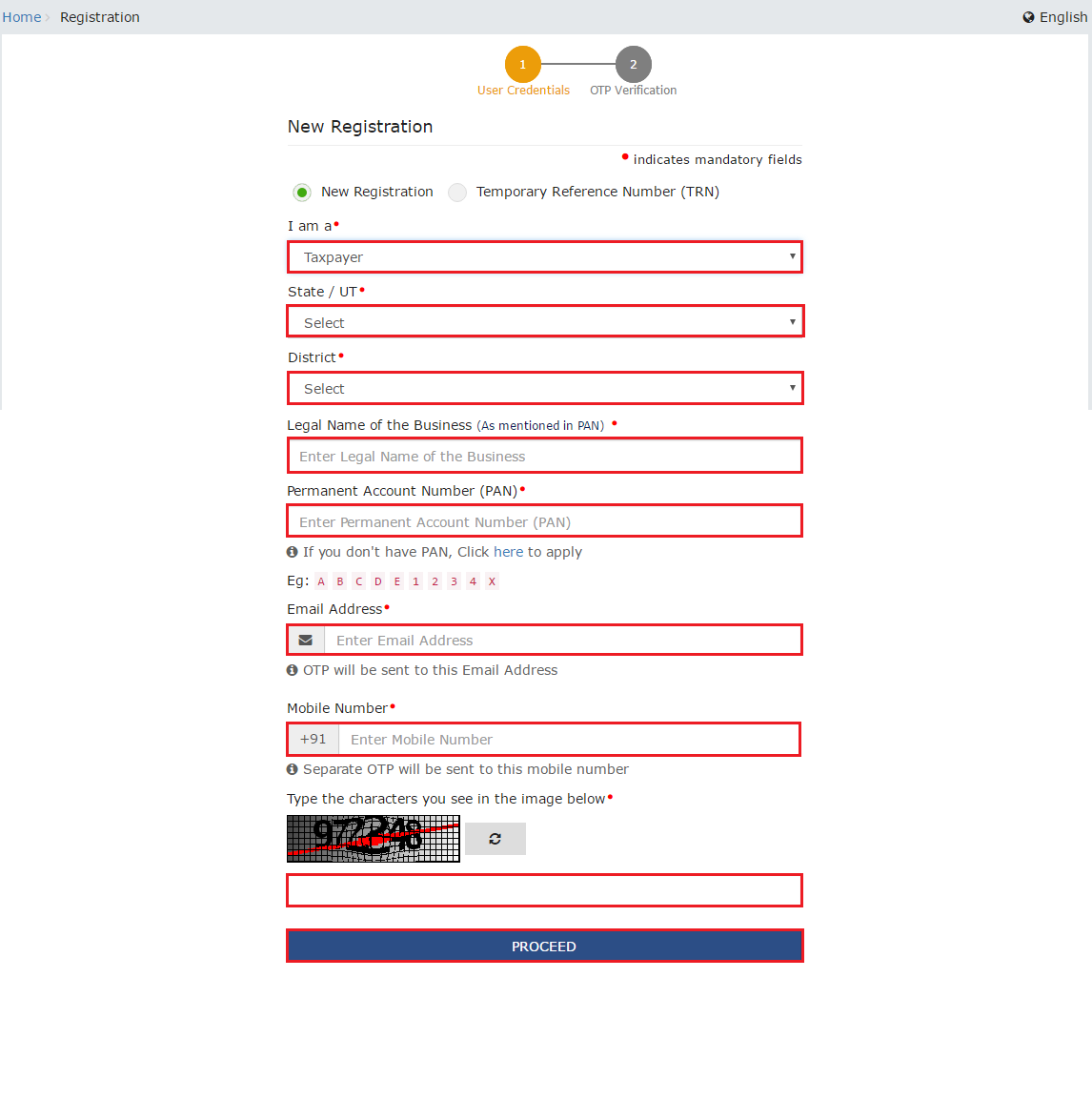

- Online Application:

- Visit the official PMAY website.

- Select the appropriate category (EWS/LIG/MIG).

- Fill in personal and income details.

- Apply and note the application number for future reference.

- Through Banks and Housing Finance Companies:

- Approach a listed lending institution.

- Submit the required documents.

- The institution will process the loan and apply for the subsidy on your behalf.

Recent Developments in 2025

- Reintroduction of CLSS: The government plans to reintroduce the Credit Linked Subsidy Scheme, offering subsidies up to ₹2.67 lakh for eligible beneficiaries.

- Budget Allocations: A ₹15,000 crore fund has been announced to complete 100,000 stalled affordable and middle-income housing projects.

- Tax Benefits: The deduction on home loan interest under Section 24(b) has been increased to ₹3 lakh, providing additional relief to homeowners.

Expert Insights

“The reintroduction of CLSS and increased budget allocations signify the government’s commitment to affordable housing. These steps are expected to boost homeownership among the middle class.”

— Real Estate Analyst, Housing Finance Times

Steps to Check the Status of Housing Application in 2025

After applying for a housing loan or subsidy under government schemes, it’s crucial to monitor the status of your application. Tracking ensures transparency and keeps you informed about the progress. This guide outlines the steps to check your housing application status in 2025.

Tracking Application Status Online

For PMAY (Urban):

- Visit: PMAY Urban Portal

- Navigate to: ‘Citizen Assessment’ > ‘Track Your Assessment Status’

- Enter Details: Application ID or Aadhaar number

- Submit: View the current status of your application

For PMAY (Gramin):

- Visit: PMAY Gramin Portal

- Navigate to: ‘Stakeholders’ > ‘IAY/PMAYG Beneficiary’

- Enter Details: Registration number

- Submit: Check the status of your application

Status Types and What They Mean?

| Status | Description |

|---|---|

| Application Received | Your application has been successfully submitted. |

| Under Processing | Your application is being reviewed. |

| Approved | Your application has been approved. |

| Rejected | Your application did not meet the eligibility criteria. |

| Subsidy Released | The subsidy amount has been disbursed to your account. |

Offline Tracking Methods

- Contact Local Authorities: Visit the nearest Common Service Center (CSC) or municipal office.

- Bank Inquiry: If applied through a bank, inquire about the status at the branch.

- Helpline Numbers: Call the official helpline numbers provided on the respective scheme’s website.

What to Do if Status Is Stuck?

- Contact PMAY Helpline: 1800-11-6446

- Visit your bank branch

- Email support of the respective housing board

- Use the grievance redressal feature on the PMAY website

FAQs

Can I apply online for a PMAY home loan?

Yes, via pmaymis.gov.in or directly through your bank.

Is Aadhaar card mandatory?

Yes, for identity verification and subsidy processing.

How long does approval take?

Usually 15–30 days, depending on documentation and bank response.

Can I get a subsidy if I already own land?

Yes, if you plan to construct a house and meet the other conditions.

How long does it take to receive approval?

Between 15 to 45 days, depending on verification.

What if I lost my application ID?

You can still search using your Aadhaar number and name.

Can I edit my application after submission?

Not directly. You’ll need to visit the nearest CSC or bank branch.

Is the status updated in real-time?

Not always. Expect a delay of 3–5 business days.

Conclusion

Applying for housing loans under government schemes in 2025 has become more streamlined, with increased subsidies and simplified processes. By understanding the eligibility criteria, preparing the necessary documents, and staying informed about recent developments, you can take a significant step toward owning your dream home.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![How to Apply for Housing Loans Under Government Schemes in 2025? - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)