Updated on August 15, 2025

Wondering how to claim unclaimed deposits? Discover 5 smart and easy ways to retrieve forgotten or inactive funds from bank accounts in India.

What Are Unclaimed Bank Deposits and Why Do They Matter

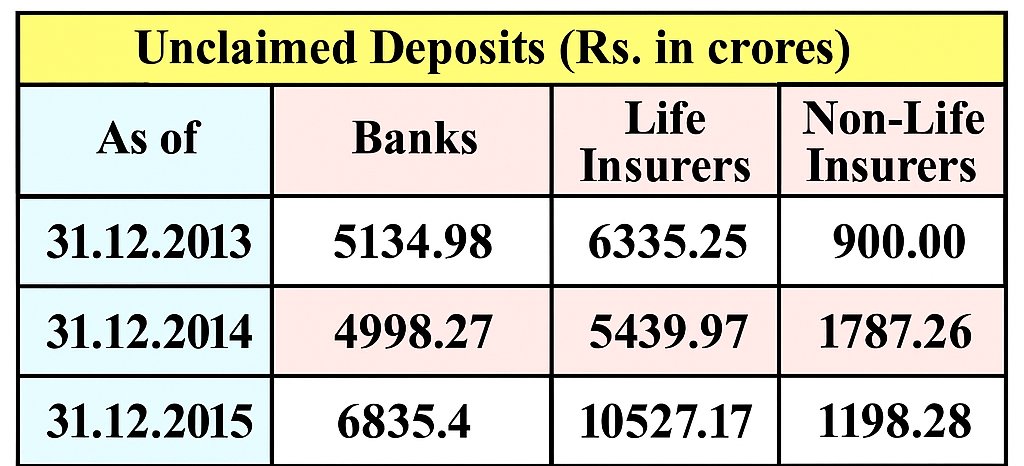

Unclaimed bank deposits are more common than you might think. These are funds lying dormant in savings, current, or fixed deposit accounts where no activity has been recorded for 10 years. The Reserve Bank of India (RBI) classifies such deposits as unclaimed and transfers them to the Depositor Education and Awareness (DEA) Fund.

These deposits often belong to individuals who have moved, forgotten about the account, or passed away without informing family members. Given India’s vast banking network and migratory patterns, it’s no surprise that thousands of crores lie unclaimed, waiting to be recovered.

Why should you care? Because this is your rightful money, and the RBI has now made it easier than ever to track and claim it. Ignoring these accounts means losing out on funds that could be redirected for education, healthcare, investments, or retirement planning.

Who Can Claim Unclaimed Deposits and Eligibility Rules

If you believe you or a deceased family member may have money sitting in an inactive bank account, the good news is—you can claim it legally. Here’s a breakdown of who qualifies:

Eligible Claimants:

- Account Holder (if alive and verified)

- Nominee named in the bank records

- Legal Heirs of the deceased account holder

- Authorized Representatives with proper documentation (e.g., power of attorney, succession certificate)

Scenarios Where Claims Are Possible:

- The account holder is alive but unaware of the dormant account.

- A nominee is seeking funds after the account holder’s death.

- No nominee exists, and the legal heir steps in with succession proof.

Before claiming, you must verify identity and establish a clear link to the account through documentation. Banks scrutinize these claims, so having your paperwork in order is essential.

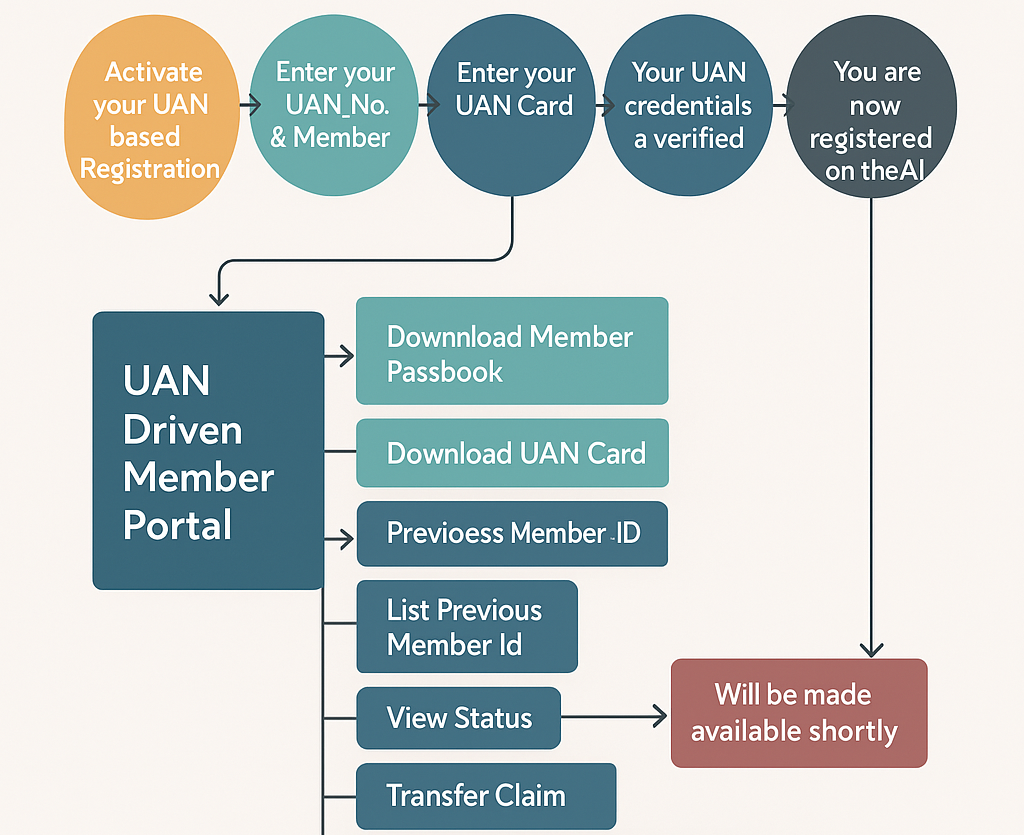

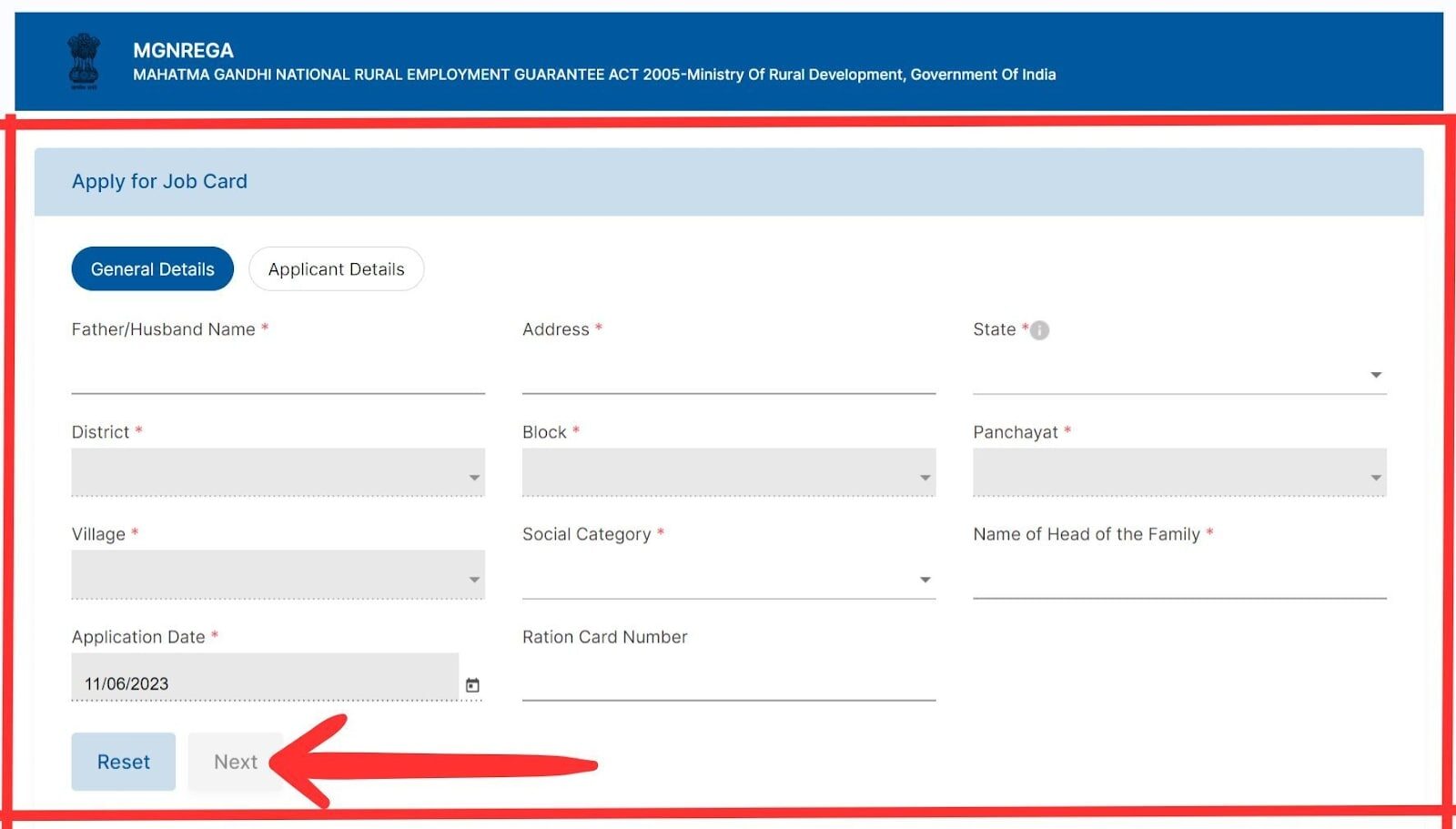

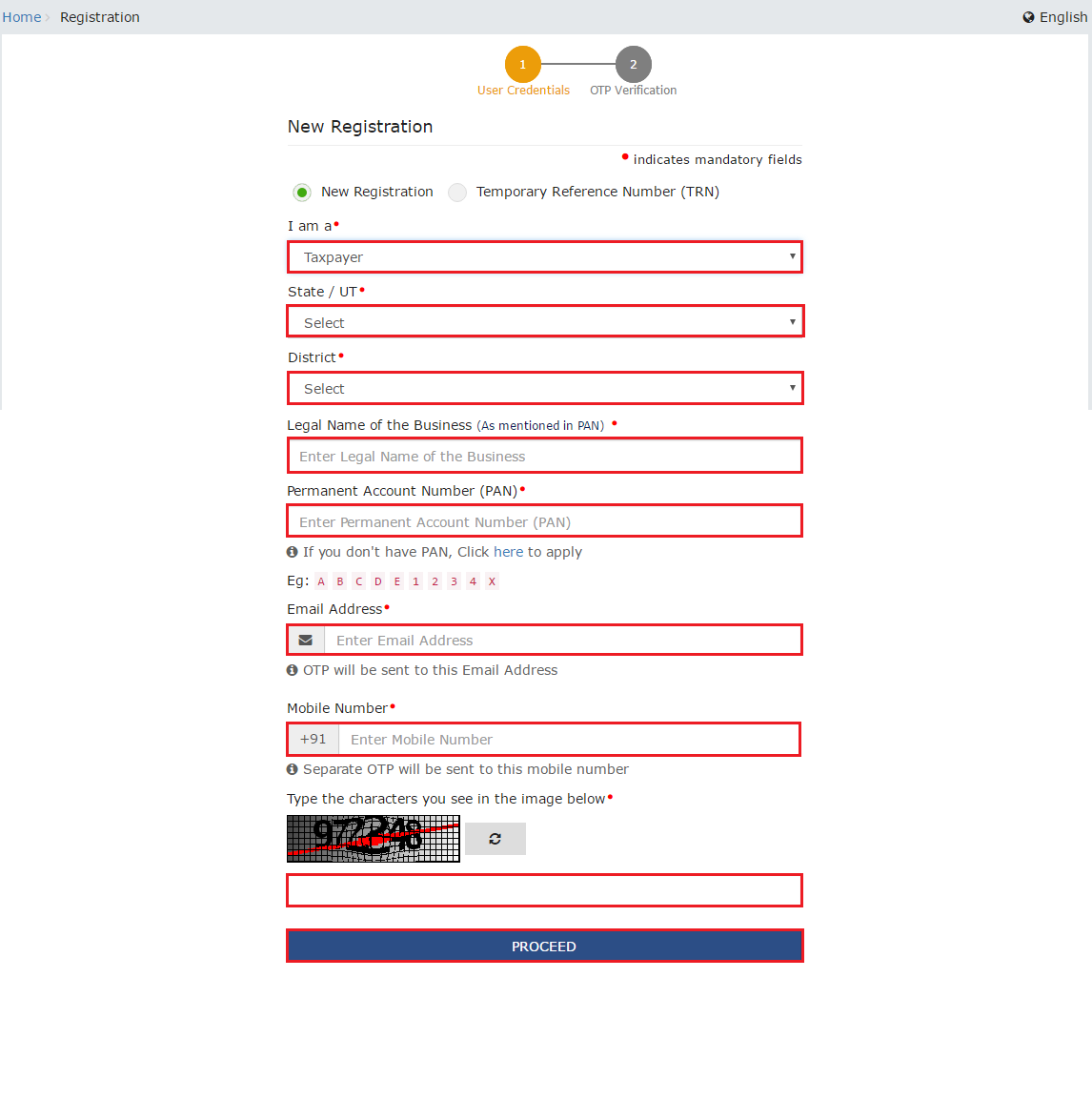

Step-by-Step Guide to Claim Unclaimed Deposits via UDGAM Portal

In August 2023, the RBI launched UDGAM (Unclaimed Deposits – Gateway to Access Information)—a one-stop digital solution to help individuals search and claim unclaimed deposits across multiple banks.

Here’s how to navigate this game-changer:

Step 1: Visit the UDGAM Portal

Go to the official UDGAM platform (search “RBI UDGAM” in your browser). The site is free to use and doesn’t require registration.

Step 2: Accept Terms & Proceed

You’ll see a disclaimer. Read and accept the terms to proceed.

Step 3: Fill in Search Details

Enter the following:

- Account holder’s name

- Select bank(s)

- Provide mobile number, PAN, or Voter ID (optional, improves accuracy)

Step 4: View Search Results

If any unclaimed deposit is linked to the input details, the bank and branch name will appear. Note that exact account details are only disclosed by the bank after further verification.

Step 5: Submit Claim to Bank

Once a match is found, you’ll need to visit the concerned bank or branch and:

- Submit a written claim request

- Provide all required documents (listed in the next section)

- Complete KYC as needed

Some banks offer partial online services for existing customers, but most require physical presence to validate documents.

Alternate Ways to Claim:

- Visit your bank branch directly and request a search.

- Use customer care channels to inquire about dormant accounts.

- Check old passbooks, FD certificates, and SMS/email records for clues.

Documents Required to Claim Unclaimed Deposits

Bank claims are sensitive—handled with caution to avoid fraud. Here’s a list of commonly required documents to successfully claim unclaimed deposits:

For Account Holders:

- Valid photo ID (Aadhaar, PAN, Voter ID)

- Proof of address

- Original bank documents (passbook, cheque, chequebook, FD receipt)

- Claim application form

For Nominees:

- Nominee’s identity proof

- Copy of the deceased’s death certificate

- Proof of nomination (bank records, FD nomination slip)

- Claim form with nominee details

For Legal Heirs (No Nominee Present):

- Legal heir certificate or succession certificate

- Affidavit and indemnity bond (bank-specific formats)

- Deceased’s death certificate

- Proof of relationship (birth certificate, ration card, etc.)

- Valid photo ID of the claimant

Tip: Always contact the bank in advance to ask for their checklist. Documentation requirements may vary by institution.

Common Mistakes to Avoid While Claiming Unclaimed Bank Funds

Claiming unclaimed deposits is fairly straightforward, but small errors can cause delays or outright rejection. Here are common pitfalls and how to sidestep them:

1. Name Mismatches

Spelling inconsistencies or name changes (due to marriage, initials, etc.) between bank records and ID proofs can lead to rejection. Provide a name correction affidavit or a gazette notification if applicable.

2. Missing Documents

Always double-check if your documents match the bank’s checklist. Missing legal proofs, expired IDs, or incorrect claim forms can halt the process.

3. Failure to Track All Banks

Sometimes, families forget the number of banks where a deceased person held accounts. Use the UDGAM portal to search across banks efficiently.

4. No Nominee or Legal Proof

If there’s no nominee, be ready with a succession certificate. Many legal heirs give up when banks demand extra paperwork, but it’s a necessary step.

5. Not Following Up

Once you’ve filed a claim, stay in touch with the bank. Don’t assume silence means rejection. Visit the branch or escalate to the bank’s grievance redressal cell if delays persist.

Avoid these hiccups and your claim process will be far smoother—and faster.

Conclusion

If there’s one financial habit you adopt this year, make it a point to check for and claim unclaimed deposits in your name or on behalf of your family. With the RBI launching the user-friendly UDGAM portal and most banks becoming more proactive, retrieving lost funds is no longer the bureaucratic nightmare it used to be.

From legacy fixed deposits to long-forgotten savings accounts, unclaimed money is often hidden in plain sight. Don’t let your money fade into oblivion—take action, gather your documents, and initiate the claim. Whether you’re an account holder, nominee, or legal heir, the process is entirely within reach.

Money rightfully yours deserves to be claimed—not forgotten.

FAQs

What qualifies as an unclaimed deposit in India?

Any bank account (savings, FD, RD, etc.) that hasn’t seen any activity for 10 years is marked as unclaimed.

Is there a time limit to claim unclaimed bank deposits?

No, there’s no expiry. You can claim unclaimed deposits at any time by providing valid documentation.

Can I search all banks at once for unclaimed deposits?

Yes, use the RBI’s UDGAM portal to search across multiple banks using a single form.

What if the bank branch is closed or merged?

You can still claim from the merged bank. Banks are obligated to honour legacy account claims.

Can NRIs claim unclaimed bank deposits?

Yes, provided they can prove ownership or legal heirship with a valid ID and documentation.

Is legal help required to claim as a legal heir?

Sometimes, especially if a succession certificate is needed. Banks may also require notarized affidavits or indemnity bonds.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Top 5 Smart Ways to Claim Unclaimed Deposits from Any Bank in India - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)