Updated on January 23, 2026

Summary: The Unified Pension Scheme (UPS) is a new retirement plan launched by the Indian government in 2024 for central government employees. It combines the best of the old pension scheme and the market-based NPS, offering both fixed pensions and long-term sustainability.

Only government employees who joined after January 2004 can opt in, and new hires from April 2025 can enroll directly. The application is time-sensitive—workers must decide within 30 days of joining.

UPS ensures a more stable income post-retirement and carries no extra charges for switching. To explore all details, please read the full article.

The Unified Pension Scheme (UPS), implemented on April 1, 2025, marks a historic shift in India’s pension landscape. Designed to bridge the gap between the market-linked National Pension System (NPS) and the security of the Old Pension Scheme (OPS), the UPS offers central government employees a “best of both worlds” solution: assured returns with a sustainable contributory framework.

Whether you are a central government employee or a state employee in a region adopting this model, this guide breaks down everything you need to know about your retirement security in 2026.

What is the Unified Pension Scheme (UPS)?

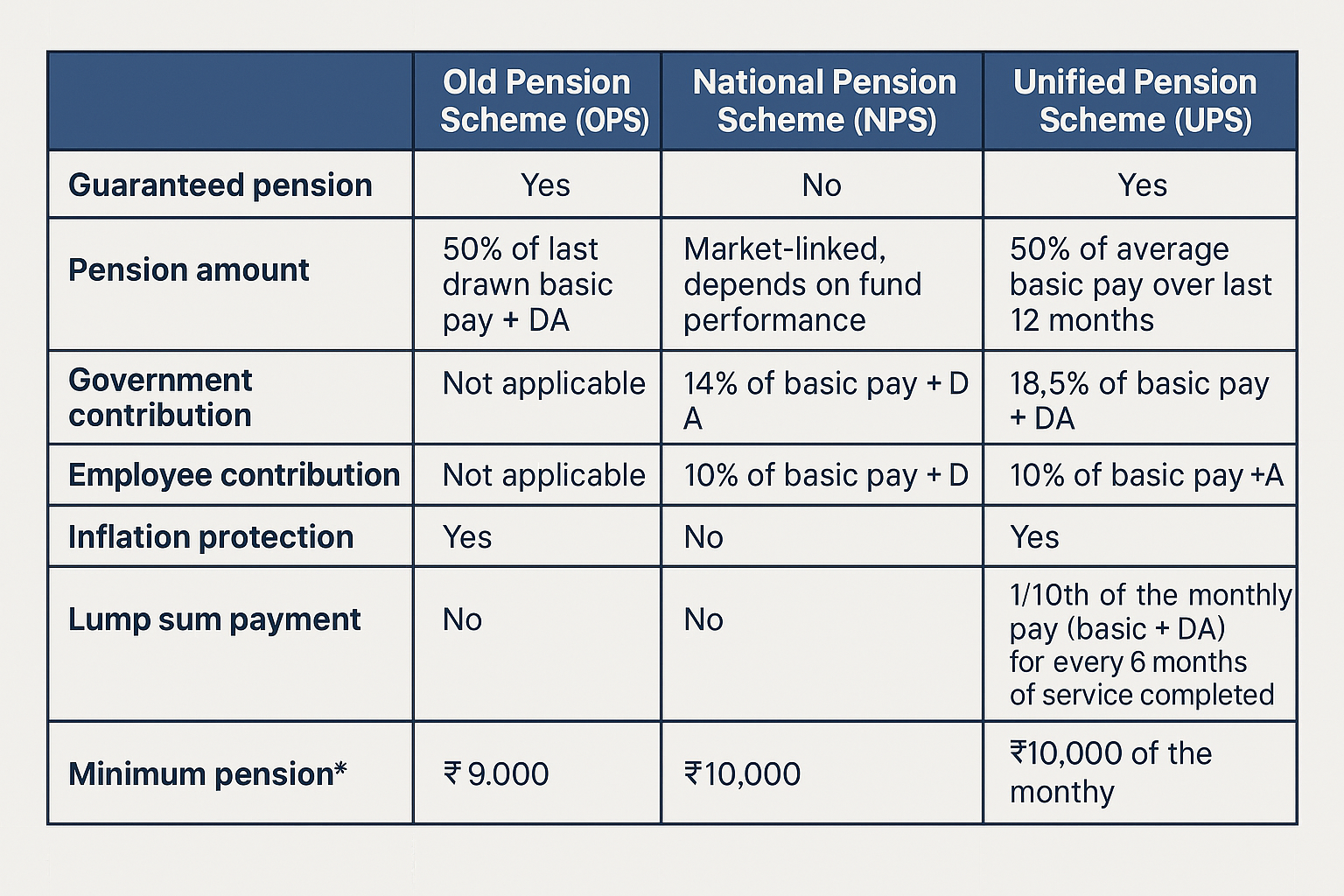

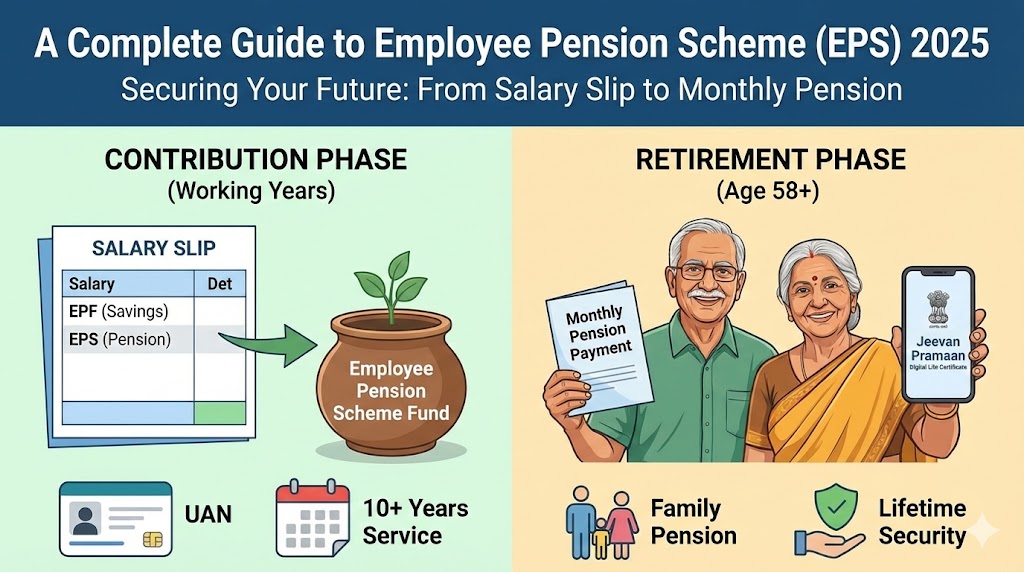

The UPS is a defined benefit scheme that guarantees a fixed monthly payout based on your service tenure and salary. Unlike the NPS, where your pension depends entirely on market fluctuations, the UPS provides a safety net while still being funded through contributions from both the employee and the government.

7 Key Benefits of the Unified Pension Scheme

1. Assured Pension (50% of Basic Pay)

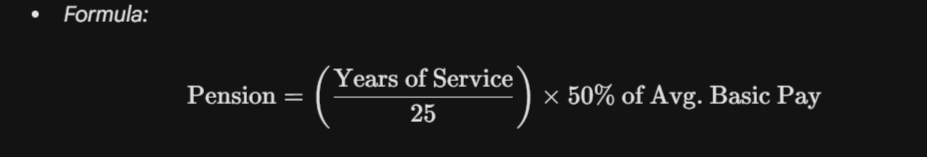

The cornerstone of UPS is the guarantee of a fixed income. Employees who complete 25 years of qualifying service are entitled to a pension equal to 50% of their average basic pay drawn during the last 12 months of service.

- Example: If your average basic pay in your final year is ₹60,000, your monthly pension will be ₹30,000.

2. Guaranteed Minimum Pension

To protect those in lower pay scales or with shorter service durations, UPS guarantees a minimum pension of ₹10,000 per month. This benefit applies to anyone who has completed at least 10 years of service.

3. Inflation Protection (Dearness Relief)

The UPS is not a static pension. Like the Old Pension Scheme, it includes Dearness Relief (DR). This means your pension and family pension will be adjusted periodically based on the All India Consumer Price Index for Industrial Workers (AICPI-IW), ensuring your purchasing power remains intact as prices rise.

4. Assured Family Pension

The scheme provides a robust safety net for your loved ones. In the event of the pensioner’s death, the legally wedded spouse is entitled to an Assured Family Pension equal to 60% of the pension the employee was receiving immediately before their demise.

5. Proportionate Pension for Shorter Service

You don’t need 25 years to qualify for a pension. For service ranging between 10 and 25 years, the pension is calculated proportionally.

6. Lump Sum Payout at Retirement

Upon superannuation, employees receive a one-time lump sum payment that does not reduce their monthly pension. This is calculated as 1/10th of your monthly emoluments (Basic + DA) for every completed six months of service.

7. Higher Government Contribution

Under the UPS, the government’s commitment is significantly higher than under the NPS. While the employee contributes 10% of Basic + DA, the government contributes 18.5% (compared to 14% in NPS). This ensures the “pool corpus” remains healthy enough to pay out guaranteed amounts.

UPS vs. NPS: A Quick Comparison

| Feature | National Pension System (NPS) | Unified Pension Scheme (UPS) |

| Pension Amount | Market-linked (Variable) | Assured (50% of last 12-mo pay) |

| Minimum Pension | No guarantee | ₹10,000 per month |

| Inflation Protection | None | Yes (Dearness Relief) |

| Govt. Contribution | 14% | 18.5% |

| Lump Sum | 60% of corpus (tax-free) | Based on service months |

Eligibility & Enrollment for 2026

- Existing Employees: Central government employees currently under NPS have a one-time option to switch to the UPS.

- New Recruits: Those joining after April 1, 2025, are typically enrolled in UPS by default, though an option to choose NPS may exist during the first 30 days.

- Retired NPS Subscribers: Employees who retired under the NPS between 2004 and March 31, 2025, are also eligible to opt for the UPS and receive arrears, provided they meet the minimum service criteria.

यूनिफाइड पेंशन स्कीम (UPS) का ताज़ा अपडेट

जनवरी 2026 तक की रिपोर्ट के अनुसार, लगभग 1.22 लाख से अधिक केंद्रीय कर्मचारियों ने NPS से UPS में स्विच करने का विकल्प चुना है। सरकार अब राज्यों को भी इसे अपनाने के लिए प्रोत्साहित कर रही है।

Conclusion: Is UPS Right for You?

The Unified Pension Scheme is a game-changer for those who value financial predictability over high-risk market returns. If you are looking for a retirement plan that guarantees a dignified lifestyle regardless of stock market performance, the UPS is likely your best choice.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Unified Pension Scheme (UPS): 7 Key Benefits & Complete Guide for Secure Retirement - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)