Updated on May 22, 2025

Learn how to activate dormant bank account quickly in 2025 with this complete RBI-approved step-by-step guide and avoid losing access to your funds.

What is a Dormant Bank Account and Why does It Gets Frozen

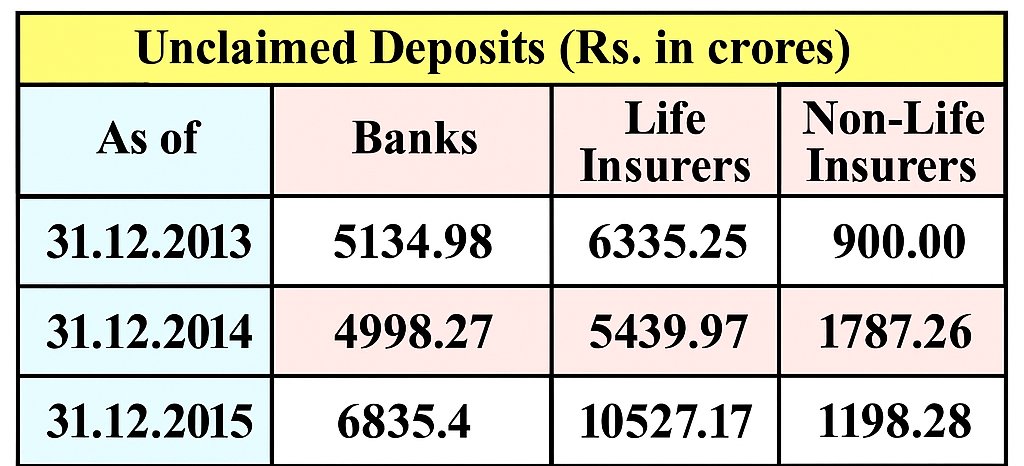

A dormant bank account is one that hasn’t seen any customer-initiated activity for 24 months. According to the Reserve Bank of India (RBI), if neither a withdrawal nor a deposit has occurred—excluding interest credits or service charges—the account is labeled as inactive first and then as dormant if the inactivity continues for two consecutive years.

Why Do Accounts Become Dormant?

Dormancy can happen for various reasons:

- The account holder forgot about it.

- The account is rarely used or used solely for specific deposits.

- The account holder has passed away.

- The customer has moved abroad or changed cities and stopped using the account.

What Happens When an Account Becomes Dormant?

When your account becomes dormant:

- You can’t withdraw or deposit money.

- Online banking, ATM services, and cheques are deactivated.

- Banks stop sending regular account statements.

- You may even miss out on interest benefits or service updates.

That’s why it’s crucial to activate dormant bank accounts before it affects your financial planning.

RBI Guidelines for Reactivating Dormant Accounts in 2025

The RBI’s master circular provides clear instructions to banks for handling and reactivating dormant accounts. These rules are designed to protect account holders while preventing fraud and misuse.

Key Guidelines to Know:

- Banks must notify customers before an account is declared dormant.

- Reactivation should follow a proper KYC (Know Your Customer) procedure.

- Banks are required to allow reactivation at zero cost if initiated by the account holder.

- Deposits to dormant accounts via electronic transfers (NEFT/RTGS/IMPS) do not reactivate them unless supported by a customer request.

New Updates for 2025:

- Reactivation can now be initiated through video KYC with some banks.

- Banks must complete reactivation within two working days upon receipt of valid documents.

- Banks are instructed to integrate UDGAM and dormant account alerts for better customer tracking.

By following these RBI-approved methods, you can regain full access to your funds and services swiftly.

Step-by-Step Process to Activate Dormant Bank Account

Whether your account was dormant for a couple of years or a decade, reactivating it is straightforward if you follow the proper steps.

Step 1: Visit Your Home Branch (or Log into Internet Banking)

While many banks offer digital options, visiting the home branch where the account was opened may still be required in some cases.

- Ask for a dormant account reactivation form.

- Some banks allow reactivation requests via internet banking with re-KYC uploads.

Step 2: Submit Reactivation Request

You’ll need to fill out a written request or online application stating that you want the account reactivated.

Include:

- Account number

- Reason for dormancy

- Updated mobile number and email

Step 3: Complete KYC Verification

Banks will ask you to provide updated KYC documents:

- Proof of identity (Aadhaar, PAN, passport, etc.)

- Proof of address (electricity bill, rent agreement, etc.)

Some banks offer video KYC, which lets you complete the verification over a secure video call.

Step 4: Initiate a Transaction

Once KYC is updated, the bank may ask you to perform a transaction like:

- A deposit

- A withdrawal

- Updating a standing instruction

This helps confirm the account is in use again.

Step 5: Wait for Activation Confirmation

Banks typically reactivate dormant accounts within 24–48 hours after verification is complete. You’ll receive a confirmation via SMS or email.

Pro Tip: Always keep a copy of the reactivation request and any receipts for future reference.

Documents Required to Reactivate Dormant Accounts

To ensure security, banks will require KYC compliance from customers reactivating dormant accounts. Here’s what you’ll need:

For Individuals:

- Identity Proof: Aadhaar card, PAN card, passport, Voter ID, or driving license.

- Address Proof: Utility bill (not older than 2 months), passport, Aadhaar, or bank statement.

- Recent photograph (passport-sized).

- Reactivation application (form or letter, depending on bank policy).

For NRIs:

- Copy of valid passport and visa.

- Overseas address proof (utility bill, rental agreement).

- Self-declaration of NRI status.

- In some cases, a FEMA declaration and KYC attestation by an Indian embassy or notary.

Make sure the details match the bank records or carry a supporting affidavit if there’s a mismatch.

Tips to Avoid Your Account Becoming Dormant Again

Keeping your bank account active is easier than fixing it after dormancy. Here are a few practical ways to ensure your account stays operational:

1. Make Regular Transactions

Even small transactions every 6–12 months can prevent dormancy. Set a calendar reminder to deposit ₹100 or pay a bill through that account.

2. Link to Auto Payments

Link your bank account to:

- Utility bills

- SIPs or mutual funds

- Loan EMIs

This will ensure regular activity and fulfill the usage criteria.

3. Update Your Contact Information

Make sure your mobile number and email ID are always current with the bank. You’ll receive dormancy alerts and KYC reminders in time.

4. Consolidate Your Accounts

If you have multiple unused accounts, consider closing the ones you don’t need. Dormancy doesn’t just affect access—it also leaves room for fraud.

5. Monitor Through Net Banking or Mobile App

Regularly log in to check your balance. Digital login counts as activity with some banks and helps track usage.

Conclusion

A dormant account might seem like a minor issue, but it can cause major disruptions—especially when you need access to your funds the most. Fortunately, the RBI guidelines for 2025 have made the process of reactivating dormant bank accounts faster, safer, and more accessible than ever.

Whether you’re an individual, an NRI, or handling someone else’s account with legal authority, you can reactivate a dormant account by following the steps outlined above. Gather your KYC documents, contact your bank, and initiate a transaction—and within days, you’ll be back in control of your money.

In today’s fast-paced digital economy, don’t let your hard-earned funds sit idle. Activate your dormant bank account now and make sure your finances are always within reach.

FAQs

What is the minimum time for an account to be declared dormant?

An account is marked dormant after 24 months of inactivity.

Will banks charge a fee to reactivate a dormant account?

No. As per RBI rules, there should be no charges for reactivation.

Can I reactivate my dormant account online?

Yes, some banks offer online reactivation if KYC is already up-to-date.

How long does it take to reactivate a dormant account?

Most banks complete reactivation within 1–2 working days after verification.

Can an NRI reactivate a dormant NRE/NRO account?

Yes, through embassy-attested KYC or video KYC, depending on the bank.

Is a dormant account closed by the bank?

No, dormant accounts are not closed—they’re restricted but can be revived anytime.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![How to Activate Dormant Bank Account Fast in 2025 – RBI Approved Methods - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)