Updated on May 23, 2025

In today’s fast-paced world, emergencies or sudden financial needs can arise anytime, requiring quick access to funds. Traditional loans often involve lengthy paperwork and approval times, which can be frustrating during urgent situations. That’s where instant cash loans using Aadhaar Card and PAN Card come to the rescue. With minimal documentation and quick approvals, these loans have become an increasingly popular solution for borrowers in India.

This guide will walk you through everything you need to know about instant cash loans based on Aadhaar and PAN, including their features, eligibility, benefits, and steps to apply.

Instant cash loans are short-term personal loans designed to provide quick access to funds without the lengthy paperwork and formalities of traditional loans. Using just your Aadhaar Card and PAN Card, you can apply for these loans online and get the money credited to your bank account within minutes or hours.

Why Aadhaar Card and PAN Card Are Essential

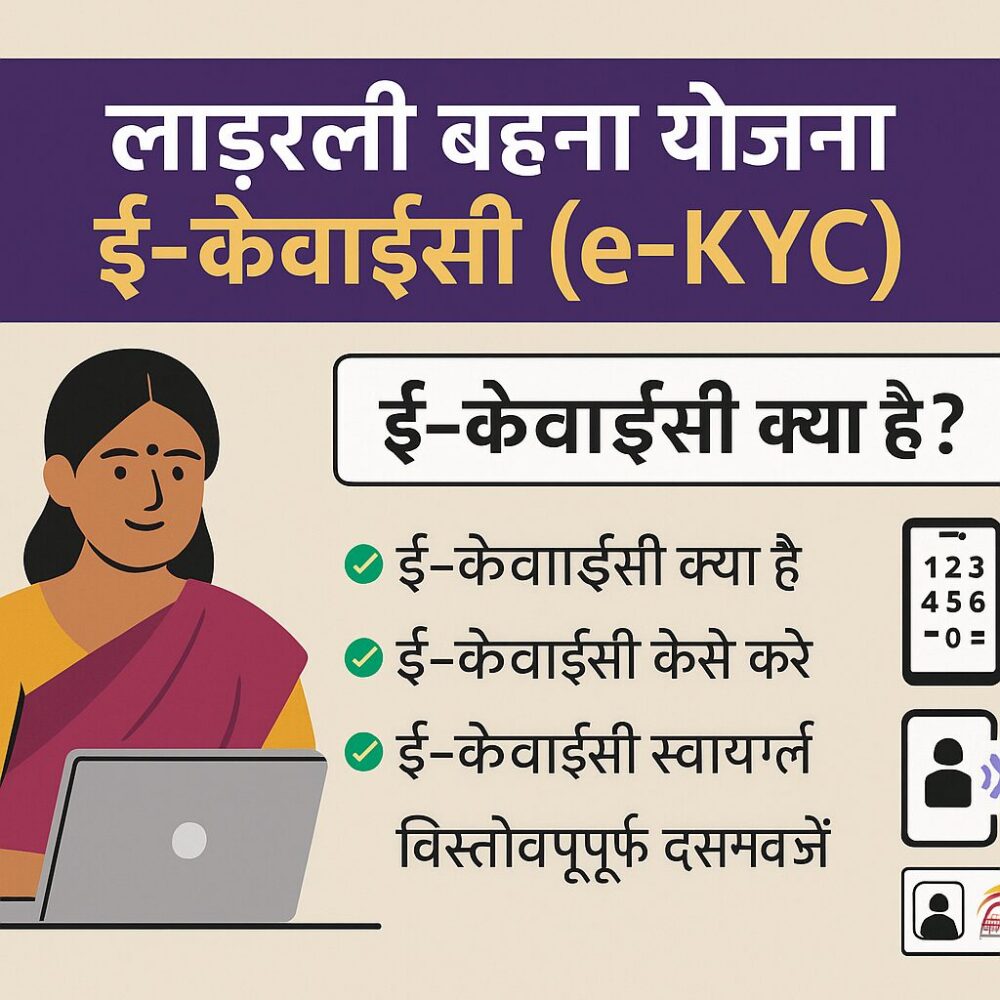

- Aadhaar Card: Serves as proof of identity and address. It also helps with e-KYC (Know Your Customer) verification, speeding up the process.

- PAN Card: Used to verify financial credibility and income tax records.

Key Features of Instant Cash Loans

| Feature | Description |

|---|---|

| Fast Disbursal | Funds are credited to your account within minutes or hours after approval. |

| Minimal Documentation | Only Aadhaar Card and PAN Card are required for most lenders. |

| Unsecured Loan | No collateral or guarantor is required. |

| 100% Online Process | Application, approval, and disbursal are done online—no need to visit any office. |

| Flexible Loan Amounts | Borrow as little as ₹5,000 or as much as ₹5,00,000 based on eligibility. |

| Customizable Tenure | Repayment periods range from a few months to several years, depending on the lender. |

| Accessible to Self-Employed | Individuals with regular income from self-employment or freelancing are also eligible. |

What Are Instant Cash Loans Using Aadhaar Card and PAN Card?

An instant cash loan is a type of personal loan that can be availed of quickly without extensive paperwork. With just two key documents—Aadhaar Card and PAN Card—you can apply for these loans entirely online, often receiving funds within minutes or hours. These loans are unsecured, meaning no collateral is required, making them ideal for emergency needs like medical expenses, bill payments, or travel bookings.

Eligibility Criteria for Loan Using Aadhaar and PAN

The eligibility requirements for instant cash loans are simple and inclusive. Typically, lenders require the following:

- Age: 21–57 years (varies by lender).

- Income Source: Regular income through employment or self-employment.

- Minimum Monthly Income: ₹10,000–₹25,000 (depending on the lender).

- Indian Citizenship: You must be a resident of India.

- Aadhaar and PAN: Aadhaar for identity/address proof and PAN for financial verification.

Documents Required for Loan Application

Only two key documents are needed for most lenders:

- Aadhaar Card: For identity and address proof.

- PAN Card: For financial and tax-related verification.

Additional documents, if required, might include:

- Bank statements (for the last 3–6 months).

- Salary slips (for salaried individuals).

How to Apply for an Instant Cash Loan Using Aadhaar and PAN

Here’s a step-by-step guide to applying for an instant loan:

Step 1: Choose a Trusted Loan Provider

Start by selecting a reputable lender or loan app, such as MoneyView, Navi, or KreditBee. Check reviews and compare interest rates before proceeding.

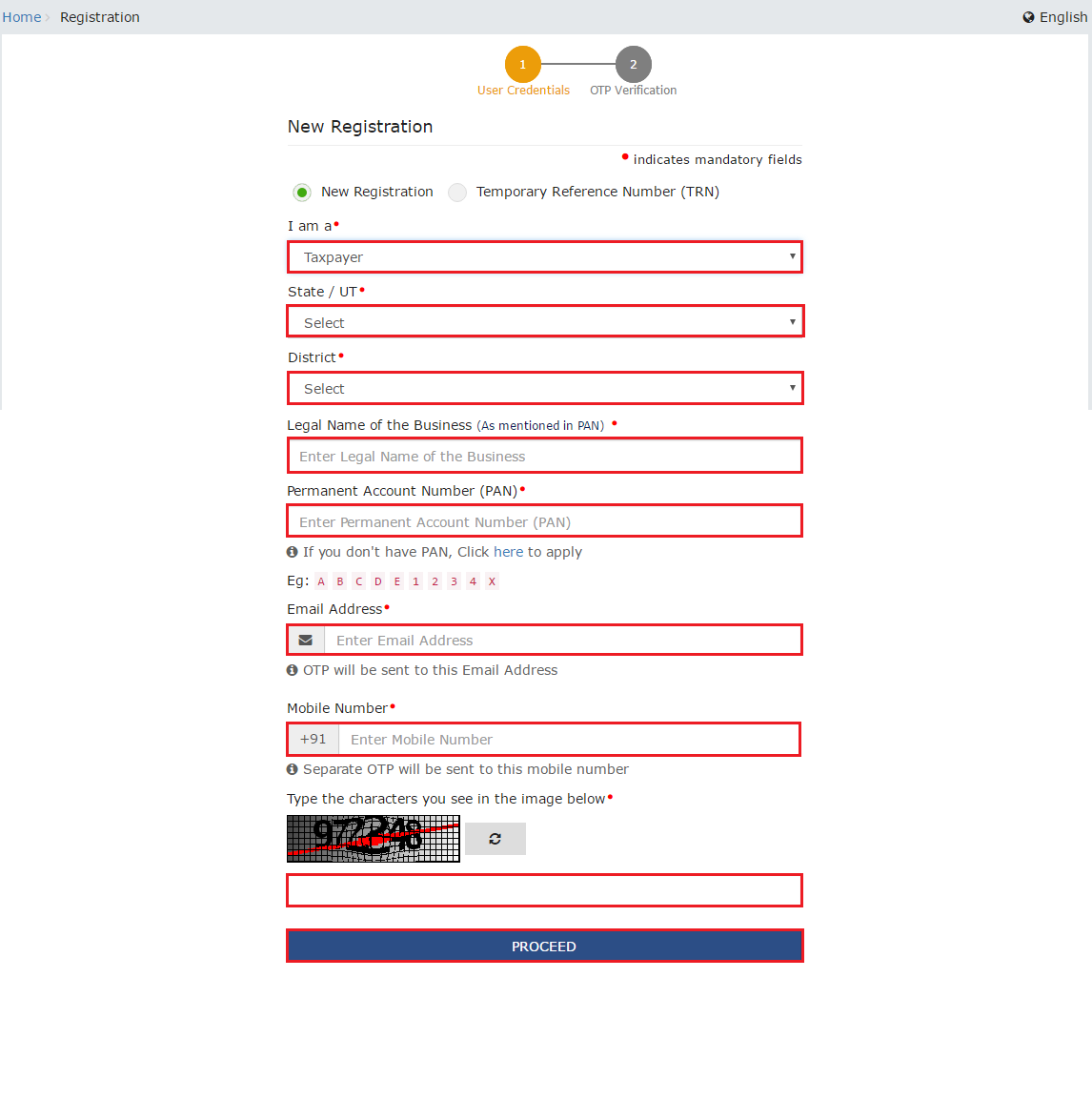

Step 2: Register and Fill Out the Application

- Download the app or visit the lender’s website.

- Create an account by providing your phone number and email ID.

- Fill out the loan application form with basic details like name, date of birth, and income.

Step 3: Upload Aadhaar Card and PAN

- Submit your Aadhaar Card and PAN Card for identity and financial verification.

- Aadhaar is used to validate your identity and address, while PAN ensures financial compliance.

Step 4: Loan Offer and Approval

- The system evaluates your eligibility based on the details provided.

- If approved, you’ll receive a loan offer, including the loan amount, interest rate, and tenure.

Step 5: Accept the Loan Terms

- Review the loan terms carefully.

- Accept the offer, and digitally sign the agreement (via Aadhaar-linked e-signature or OTP verification).

Step 6: Get the Funds

Once you accept the offer, the approved loan amount is disbursed directly to your bank account—usually within minutes or a few hours.

Benefits of Instant Cash Loans Using Aadhaar and PAN

- Convenience: Apply anytime, anywhere with a simple online process.

- Fast Processing: Minimal documentation speeds up the approval process.

- Accessibility: Available to salaried and self-employed individuals with basic eligibility.

- No Asset Risk: Since these are unsecured loans, you don’t risk losing personal assets.

- Transparent Terms: Most lenders provide clear details about interest rates, fees, and repayment terms upfront.

Read More: Aahar Jharkhand : Guide to Apply Online

Things to Consider Before Applying for an Aadhaar Card Loan

While instant cash loans are convenient, it’s important to keep the following in mind:

- Interest Rates: These loans may carry higher interest rates than traditional personal loans. Compare rates across lenders to find the best deal.

- Repayment Tenure: Opt for a tenure that aligns with your repayment capacity.

- Loan Amount: Borrow only what you need to avoid unnecessary debt.

- Hidden Charges: Check for processing fees, prepayment penalties, or late payment charges.

- Credit Score Impact: Timely repayment boosts your credit score, while delays may harm it.

Top Platforms for Instant Cash Loans in India

Here are some trusted platforms where you can apply for instant loans using Aadhaar and PAN:

| Lender/App* | Loan Amount Range | Interest Rate | Repayment Tenure | Features |

|---|---|---|---|---|

| MoneyView | ₹10,000–₹5,00,000 | Starting at 1.33%/month | 3–60 months | Quick disbursal, minimal documentation. |

| Navi | ₹10,000–₹20,00,000 | Starting at 9.9%/year | 3–72 months | 100% paperless process, instant approval. |

| KreditBee | ₹1,000–₹3,00,000 | 15–24%/year | 2–15 months | Designed for salaried professionals. |

| EarlySalary | ₹8,000–₹5,00,000 | Starting at 1.5%/month | 3–12 months | Instant loans for working professionals. |

| PaySense | ₹5,000–₹5,00,000 | Starting at 16%/year | 3–60 months | EMI calculator and flexible tenures. |

Read More: Overseas Citizen of India (OCI): What You Need to Know

Use Cases for Aadhaar Card Instant Cash Loans

Instant cash loans are perfect for a variety of financial needs, including:

| Scenario | How Instant Aadhaar Card Loans Help |

|---|---|

| Medical Emergencies | Quick disbursal ensures funds are available when time is critical. |

| Travel Plans | Book tickets or hotels without waiting for payday. |

| Bill Payments | Cover urgent utility or credit card bills to avoid penalties. |

| Home Repairs | Fund small renovations or repairs without dipping into savings. |

| Debt Consolidation | Combine multiple small debts into one manageable loan with fixed EMIs. |

FAQs About Aadhaar Loans

1. Can I apply for an instant cash loan without a credit score?

Yes, some lenders approve loans for individuals with no credit history, although interest rates may be higher.

2. Is Aadhaar mandatory for these loans?

Yes, Aadhaar is required for identity verification and e-KYC processes.

3. How fast is the loan disbursal?

Once approved, funds are typically credited to your account within minutes to a few hours.

4. Are there any hidden charges?

Most lenders disclose all fees upfront. However, it’s always good to carefully read the loan agreement.

5. Can self-employed individuals apply?

Yes, self-employed individuals with regular income are eligible for instant cash loans.

Conclusion

An instant cash loan using Aadhaar Card and PAN Card is a lifesaver during emergencies, offering a quick and hassle-free way to access funds. With minimal documentation and an entirely online process, these loans are designed to meet your short-term financial needs. However, it’s essential to borrow responsibly, understand the terms, and choose a trusted lender.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Aadhaar Card & PAN Card Loan: Instant Cash Loans Upto 2 Lakh - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)