Updated on August 12, 2025

The Student Credit Card Scheme, introduced by the Government of West Bengal, is an innovative program aimed at offering financial assistance to students seeking higher education.

This scheme is designed to help students who have been residents of West Bengal for a minimum of 10 years. It supports individuals starting from Class 10 through those enrolled in undergraduate, postgraduate, professional, or research courses in India or overseas.

Additionally, it includes funding for coaching fees for competitive examinations such as IAS, IPS, and WBCS. Students are eligible for loans of up to ₹10 lakh at a simple interest rate of 4%, without the need for collateral. The funds can be utilized for tuition fees, housing, educational materials, technology, and daily living expenses.

Up to 30% of the loan can be allocated for expenses not directly related to institutional fees, while 20% is designated for living costs. This initiative promotes accessible education financing with manageable repayment options through cooperative and public/private sector banks.

Read More: APAAR ID

Overview of Student Credit Card Scheme

| Feature | Details |

|---|---|

| Maximum Loan Amount | ₹10 lakh |

| Interest Rate | 4% simple interest per annum |

| Repayment Period | Up to 15 years, with a one-year moratorium after course completion or employment |

| Eligibility | Students residing in West Bengal for at least 10 years |

| Applicable Courses | Class 10 onwards, including UG, PG, professional, diploma, and research programs in India and abroad |

| Loan Usage | Tuition fees, accommodation, books, gadgets, living expenses, and coaching fees for competitive exams |

| Collateral Requirement | No collateral required |

| Interest Concession | 1% discount if interest is serviced during the study period |

Read More: ABHA Health ID Card

Here’s a step-by-step guide on how to apply, along with the required documents and key benefits.

Step-by-Step Application Process

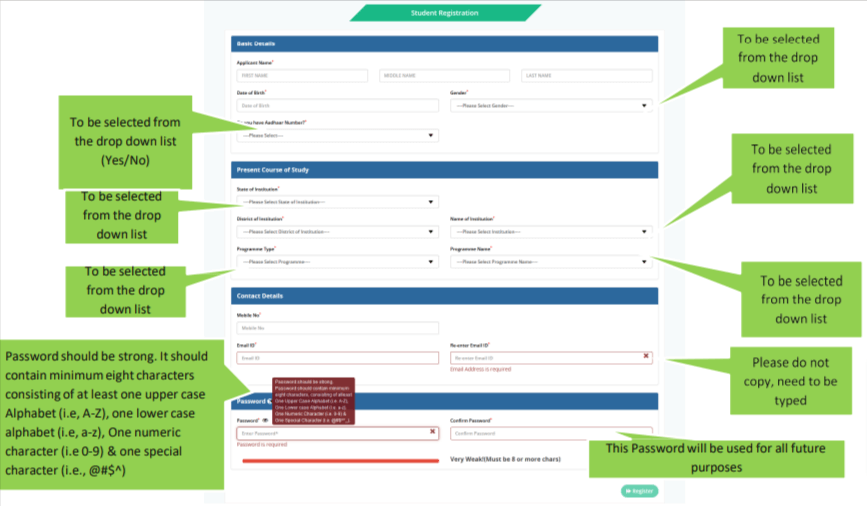

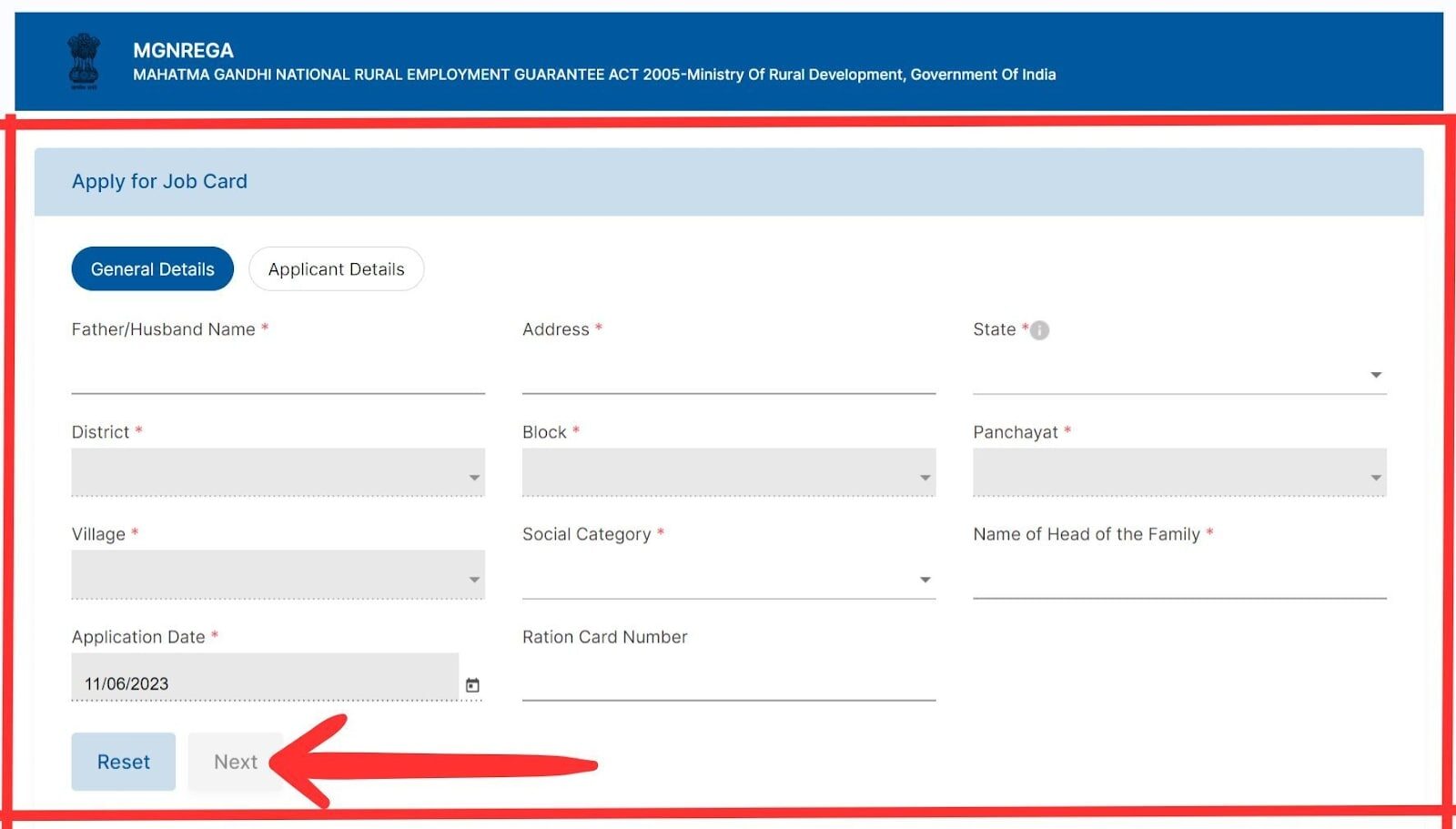

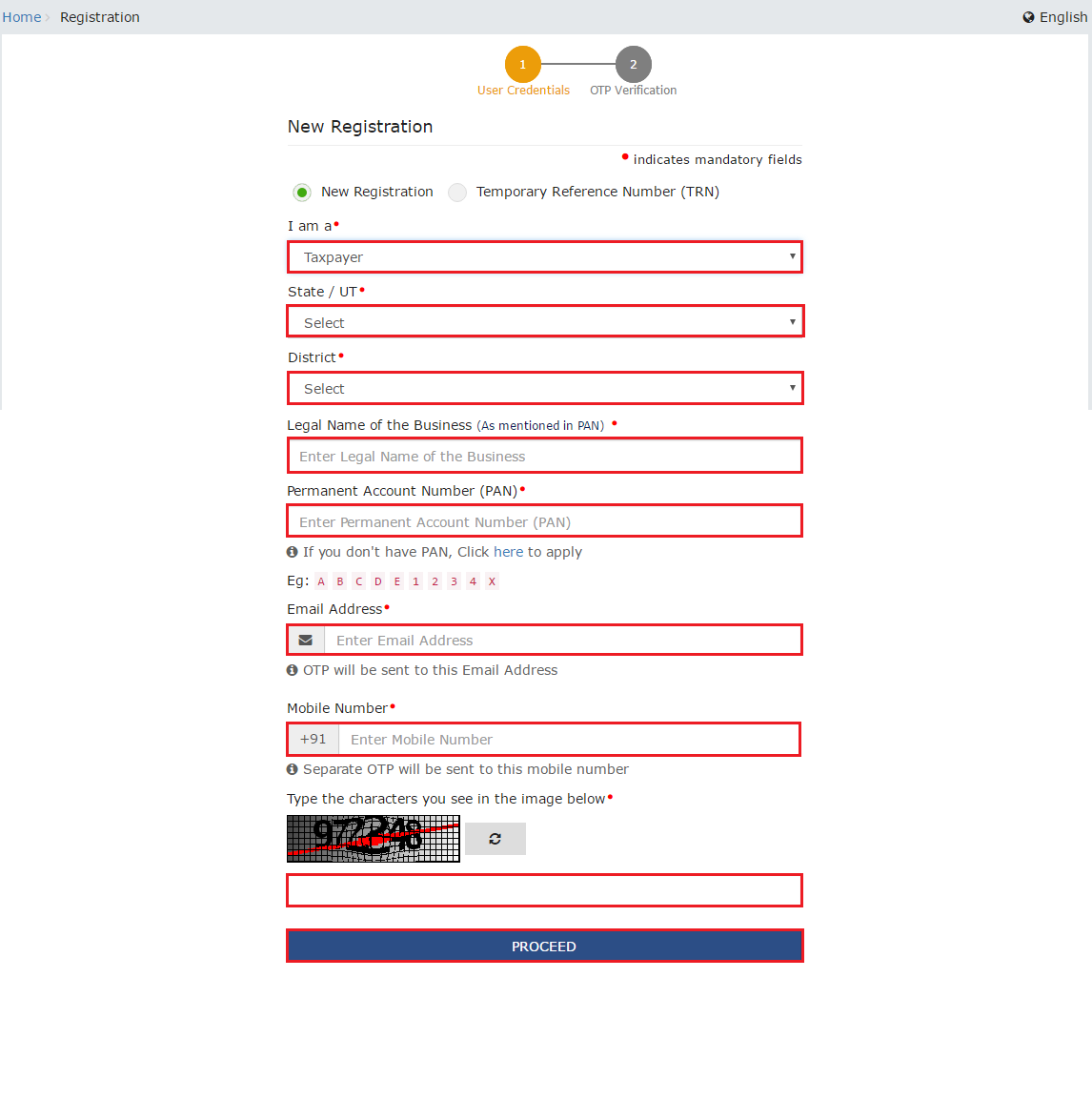

1. Register Online

Follow these steps to begin your application:

- Visit the Official Website: Go to www.wb.gov.in.

- Select the Registration Option: Click on the “Student Credit Card” tab and choose “Registration.”

- Provide Basic Details: Enter the student’s name, mobile number, email, gender, and other necessary details.

Read More: Matriculation Certificate Complete Guide

2. Gather Required Documents

Before registering, ensure you have these documents ready:

- Passport-size Photos: Both student and co-borrower (in .jpeg format).

- Signatures: Digital signatures of the student and co-borrower (in .jpeg format).

- Aadhaar Card: A copy of the student’s Aadhaar card.

- Class 10th Certificate: Required if the Aadhaar card is unavailable.

- Admission Receipt: Proof of enrolment in a recognised educational institution.

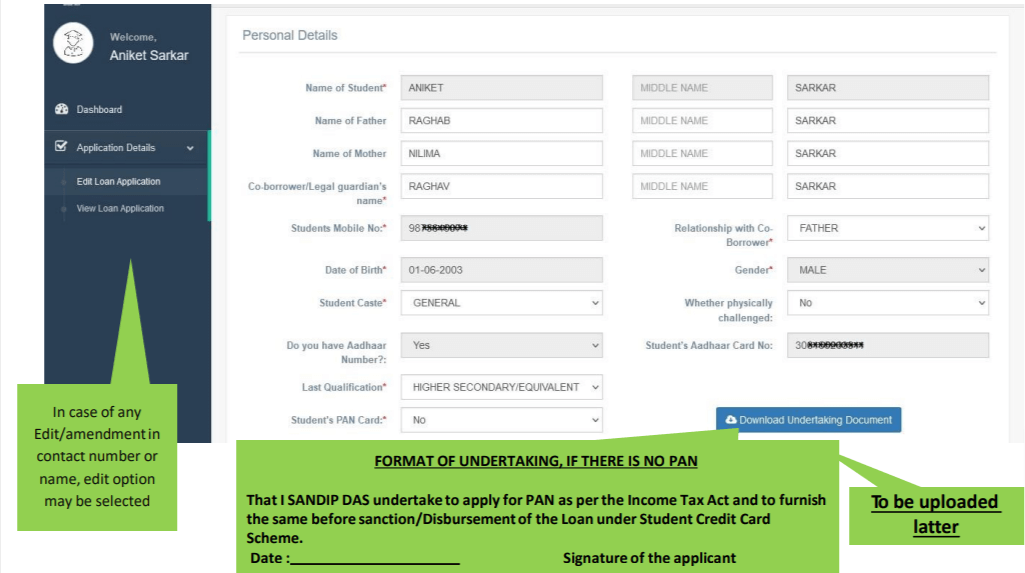

- PAN Card: PAN details of the student and co-borrower (or an undertaking if unavailable).

- Address Proof: Guardian’s address verification document.

3. Complete the Application Form

After registering, log in using the unique ID and password. Fill in details under these sections:

- Personal Information: Student and guardian details.

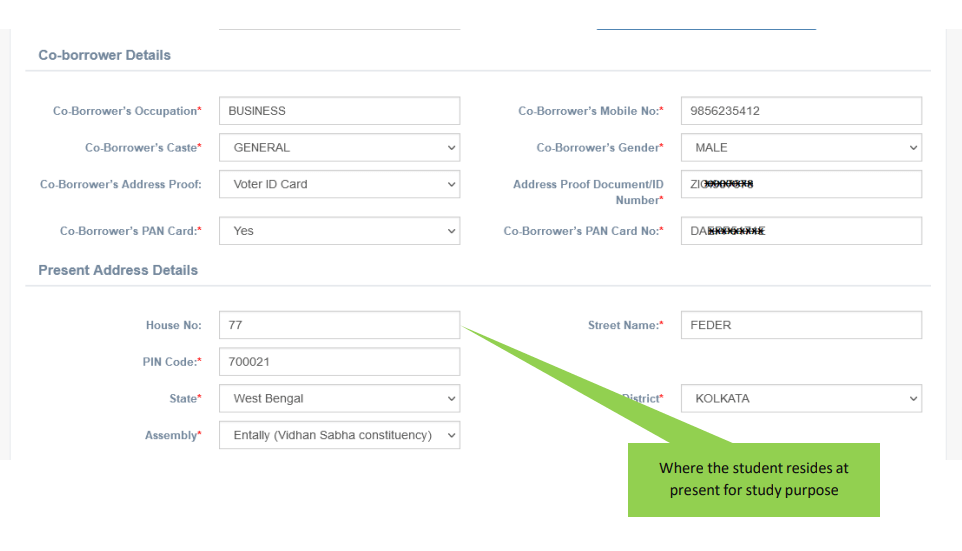

- Co-borrower Information: Details about the co-borrower’s identity and address.

- Course Information: Name of the program and its fee structure.

- Income Details: Financial background and income sources.

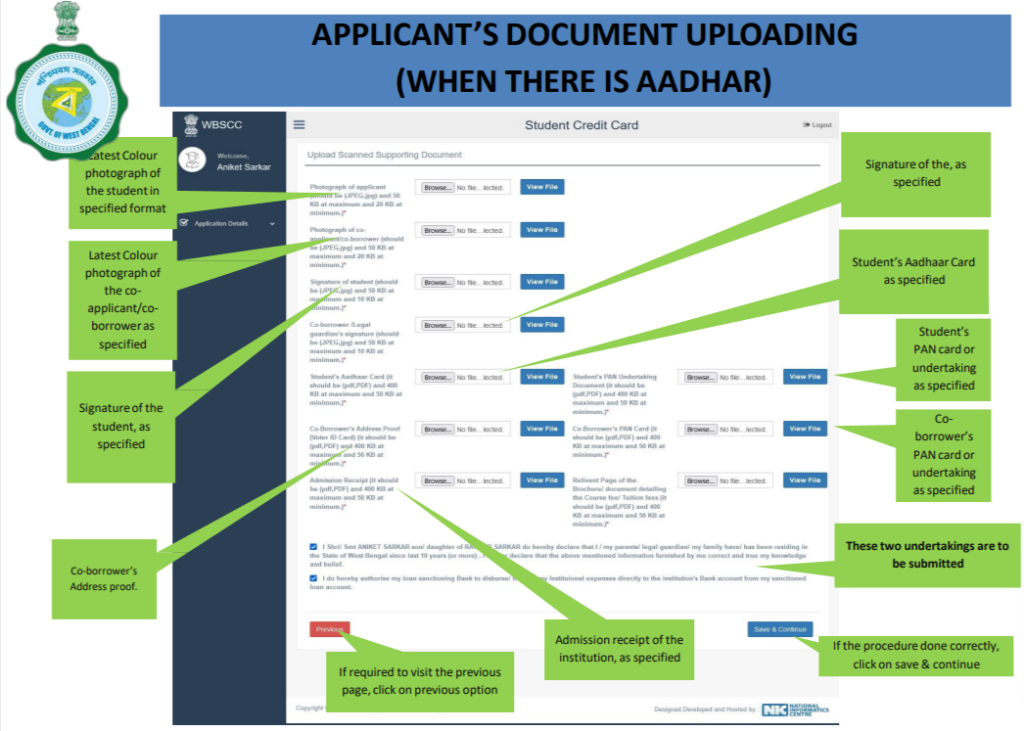

4. Upload Documents

Submit all necessary documents in the specified format, including:

- Photographs and signatures of the student and co-borrower.

- Aadhaar card, PAN card, or an alternative document.

- Admission receipt and other course-related papers.

5. Submit and Make Payment

- Finalise Application: Click “Save and Continue” after filling out the form.

- Process Payment: Choose a payment method (Net Banking or Payment Gateway) to complete the transaction.

6. Verification and Loan Approval

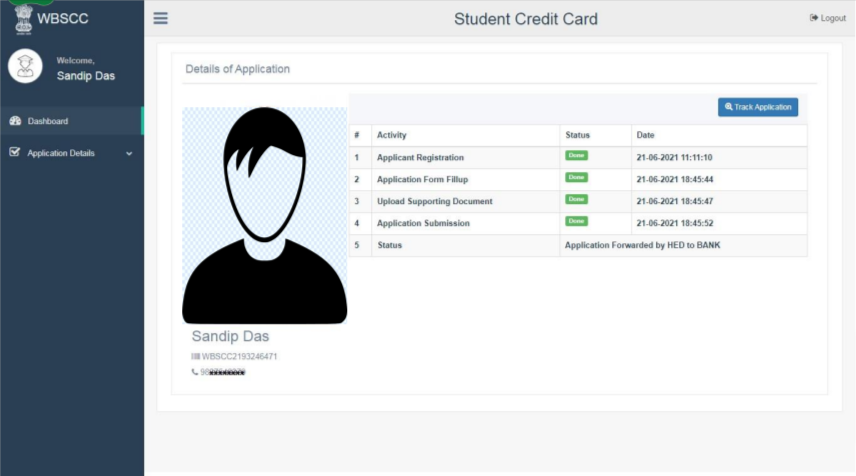

Once submitted, your application will undergo verification by the concerned authorities. Upon approval, the loan will be sanctioned, and you will receive your Student Credit Card.

Read More: Caste Certificate: Application Process, Benefits & Eligibility

Key Features of the Student Credit Card Scheme

- Maximum Loan Amount: Students can avail of loans up to ₹10 lakh.

- Low-Interest Rate: The loan is offered at a nominal interest rate of 4% per annum.

- Flexible Repayment Terms: The repayment period extends up to 15 years, with a one-year moratorium after course completion or employment.

- No Collateral Required: The loan does not require any security or collateral.

- Wide Coverage: Available for students from Class 10 onwards, including undergraduate, postgraduate, and professional courses in India and abroad.

- Comprehensive Expense Coverage: Loan covers tuition fees, accommodation, living expenses, study materials, and coaching fees for competitive exams like IAS, IPS, WBCS, SSC, etc.

Eligibility Criteria

- Residency Requirement: The student or their guardian must have been a resident of West Bengal for at least 10 years.

- Age Limit: The applicant should not be older than 40 years at the time of application.

- Eligible Institutions: Students enrolled in schools, madrasahs, colleges, universities, or professional institutes such as IITs, IIMs, ISI, AIIMS, and NITs.

Read More: Family ID in Uttar Pradesh: Everything You Need to Know

Loan Repayment and Interest Benefits

- Simple Interest Calculation: The loan is sanctioned at the prevailing SBI MCLR + 1% but capped at 4% per annum.

- Interest Concession: A 1% concession is granted if the interest is serviced during the study period.

- Moratorium Period: Repayment starts one year after course completion or employment, whichever is earlier.

Read More: UDID Card Complete Guide | Check Swavlamban Card Status

Monitoring and Grievance Redressal

- State and District Monitoring Committees: Ensuring smooth implementation of the scheme.

- Public Grievance Cell: Students can reach out via the toll-free number 1800 102 8014 or email support-wbscc@bangla.gov.in.

Conclusion

The Student Credit Card Scheme is a transformative initiative that makes higher education accessible to everyone, regardless of their financial background.

By providing easy loans with low interest rates and flexible repayment options, this program allows students to concentrate on their education without financial stress.

Through this initiative, the West Bengal government is creating opportunities for a brighter future for students throughout the state.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Student Credit Card Scheme 2025 : A Complete Guide - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)