Updated on June 14, 2025

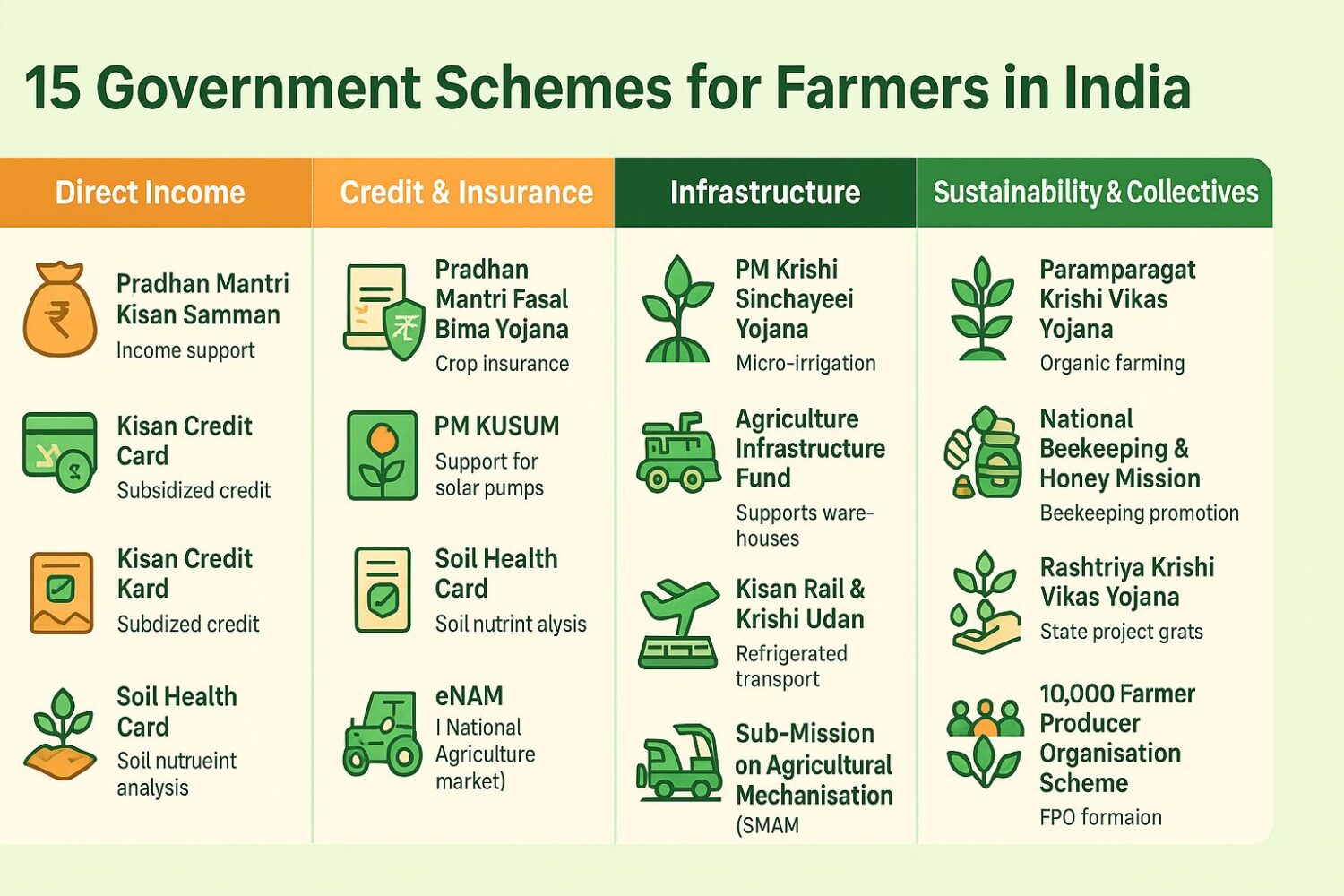

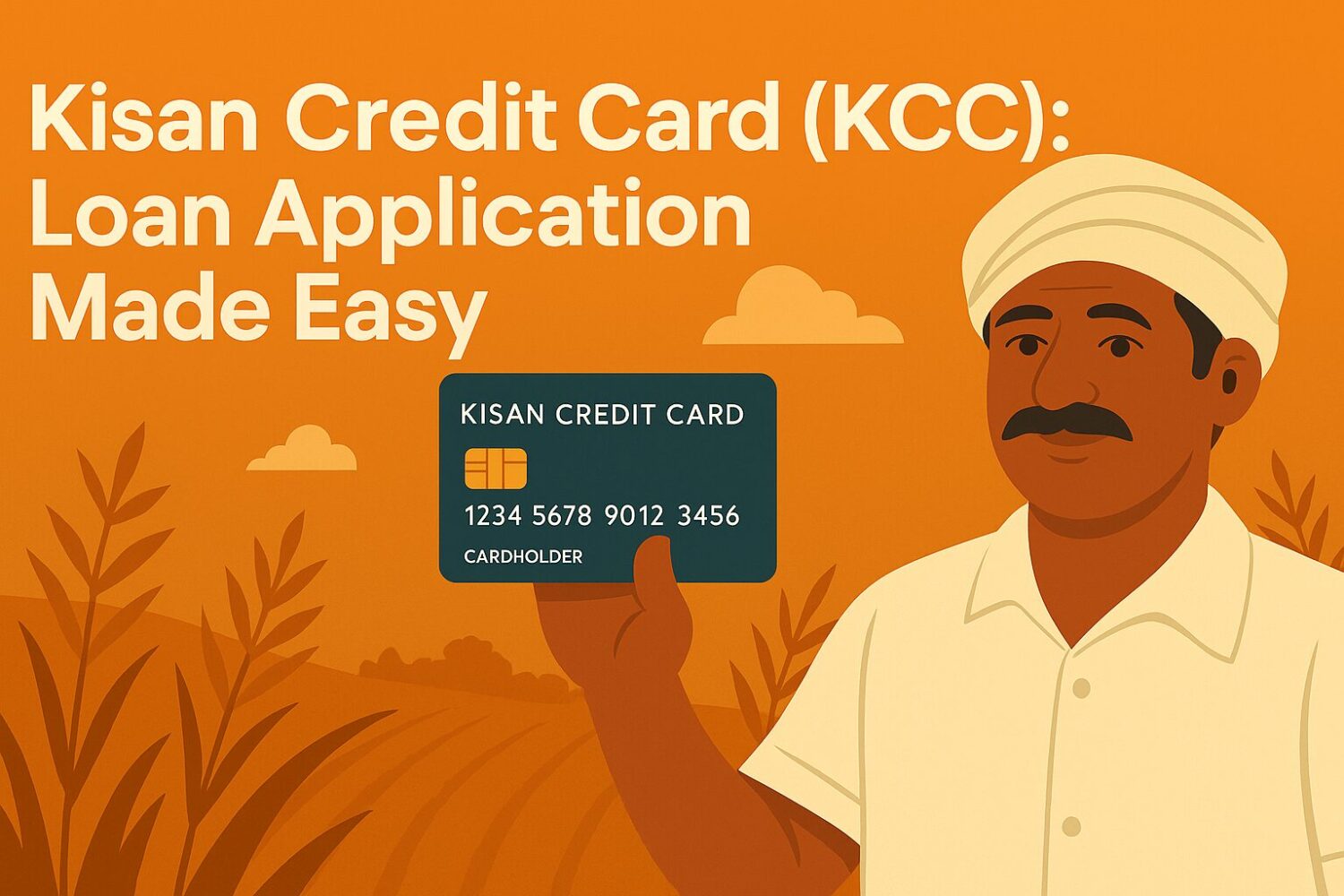

You cannot wait until the cash crop is sold to spend on your farm. Seeds, fertilizers, and labour cost money right now. Many farmers borrow from local lenders, but high interest rates make it hard to repay. The government started the Kisan Credit Card (KCC) to solve this.

Understanding the KCC meaning is crucial – it’s a system that provides fast, low-interest loans for your farm. Use the money when you need it, and repay after your crop sells.

The purpose of the Kisan Credit Card scheme is to provide adequate and timely credit support from the banking system under a single window with flexible procedures and simplified process.

What’s New Under Kisan Credit Card?

- The sprint campaign of Kisan Credit Card (KCC) saturation drive, titled as Kisan Bhagidari Prathmikta Humaari (KBPH), from April 24 to May 1.

- The Ministry of Agriculture & Farmers Welfare of India will conduct ‘Fasal Bima Pathshala’ under ‘Kisan Bhagidari Prathmikta Campaign’ as a Jan Bhagidari movement.

- A Special Drive has been undertaken by the Department to provide all dairy farmers of Milk Cooperatives and Milk Producer Companies with Kisan Credit Cards (KCC).

This Allied credit card serves as the best credit card for farmers, offering working capital for various agricultural operations.

Post-Harvest Expenses Are Real – KCC Helps You Manage Them

After the harvest, many farmers think the hard work is over, but costs keep coming. Storing the crop, transporting it to market, and sometimes even processing it for sale need money. If you don’t have it, you’re forced to sell early or cheap.

KCC doesn’t just help during sowing – it supports you after harvest too.

How KCC Covers Post-Harvest Expenses:

- Storage Costs – Renting space in a warehouse or setting up basic storage at home.

- Transportation Costs – Moving your produce from the farm to the market or storage.

- Processing Costs – Cleaning, grading, or packaging the crop before selling.

This ensures you can hold your crop until the market is right and avoid distress selling. The KCC loan can also be used as a produce marketing loan to help you get the best price for your harvest.

What is KCC (Kisan Credit Card), and how does it help?

The Kisan Credit Card is not just a card – it is a loan system built for farmers. It offers quick access to credit without the delays of regular loans.

You use what you need and pay only for that. Understanding what KCC means is crucial for farmers looking to optimize their financial management.

Here’s what KCC offers you:

- Loans for farming needs at interest as low as 4% per year (subsidized rate).

- Easy withdrawal of cash using the card, including ATM withdrawal.

- Credit for seeds, fertilizers, pesticides, tools, and farm labour.

- Repayment after the harvest season.

Who Offers KCC Loans and Who Can Apply?

Many farmers don’t know where to go for a Kisan Credit Card. It’s simpler than you think.

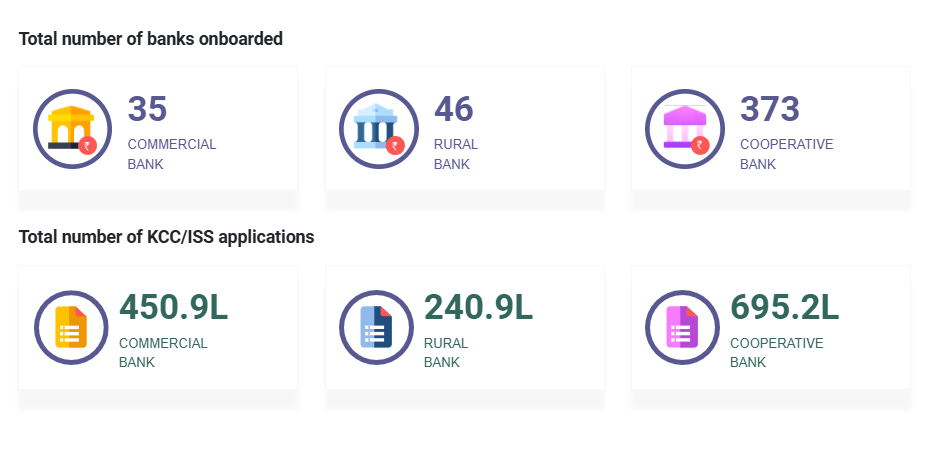

KCC loans are available at:

- Commercial Banks – like SBI, Bank of Baroda, PNB, HDFC, and others. Regional

- Rural Banks – serving rural areas with easy access. Cooperative Banks – supporting local farming communities.

You don’t need to travel far. Your nearest bank likely offers it.

Who can apply Kisan Credit Card online?

- Farmers are involved in the cultivation of crops.

- People in animal husbandry, like dairy farmers.

- Those in allied activities – fisheries, poultry, etc.

KCC is not just for landowners. Tenant farmers, oral lessees, joint cultivators, and share croppers are eligible, too. Even Self Help Groups (SHGs) involved in farming activities can apply.

The goal is simple – provide credit to farmers when they need it, for all types of farming operations and short-term credit requirements.

Many Farmers Can Apply – Are You One of Them?

The scheme is open to more farmers than you may think. Even if you don’t own land, you can still qualify.

You can apply if:

- You are a land-owning farmer, a tenant, an oral lessee, or a sharecropper.

- You are involved in fisheries or animal husbandry.

- You are at least 18 years old and actively engaged in agriculture.

If you farm, there’s a good chance KCC is for you. Owner cultivators and those needing investment credit for farm assets maintenance are also eligible.

What do you need to apply for a Kisan Credit Card?

You don’t need to collect a pile of papers to apply. Just a few key documents are enough. This helps banks process your loan faster.

Keep these ready before visiting the bank:

- Your Aadhaar Card, linked to your bank account (issued by UIDAI).

- Proof of your land ownership or lease documents.

- Your bank account number and IFSC code.

- 2 passport-sized photographs.

These are standard, and banks will let you know if they need anything more. Biometric authentication may be required for KCC registration.

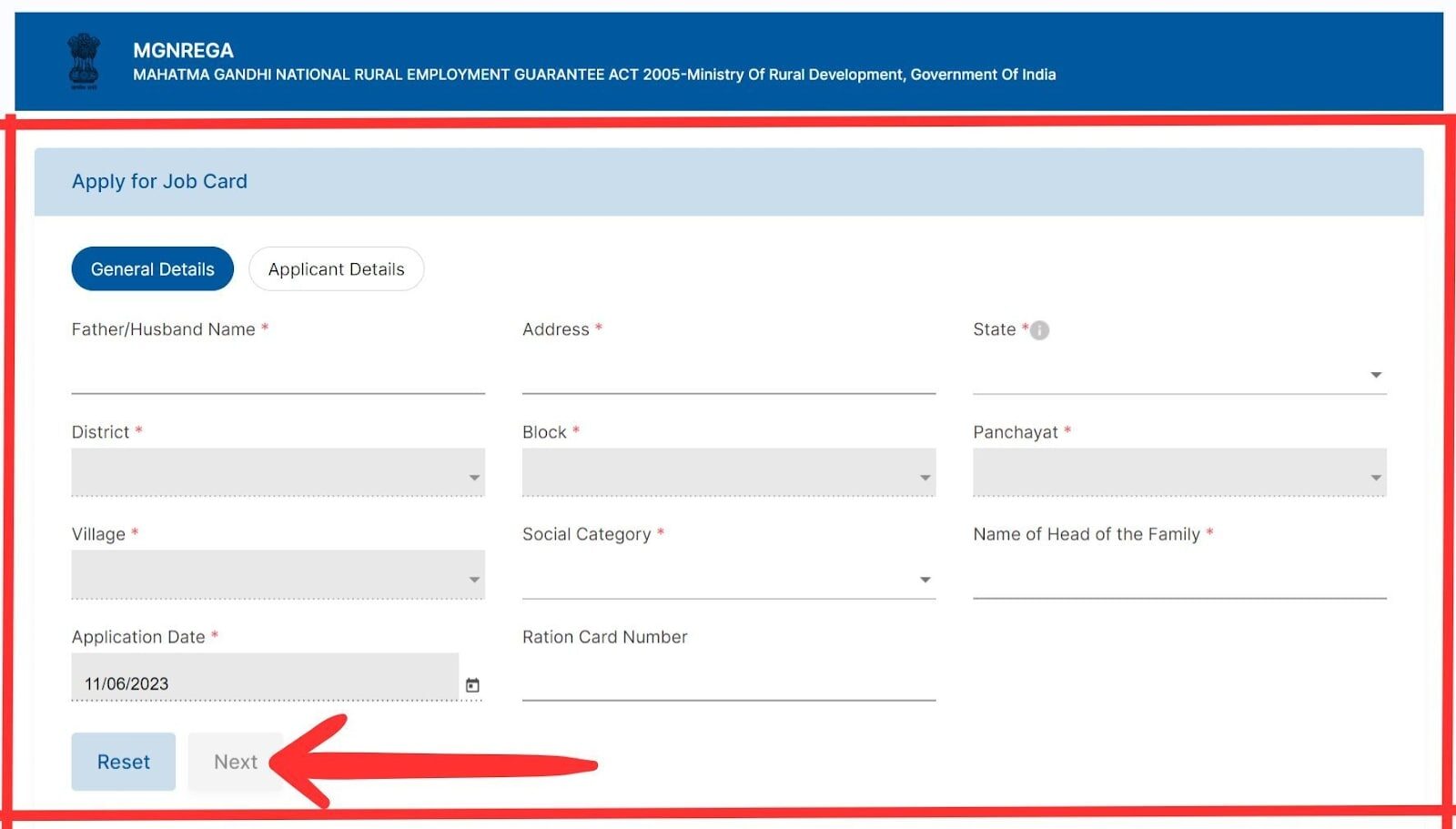

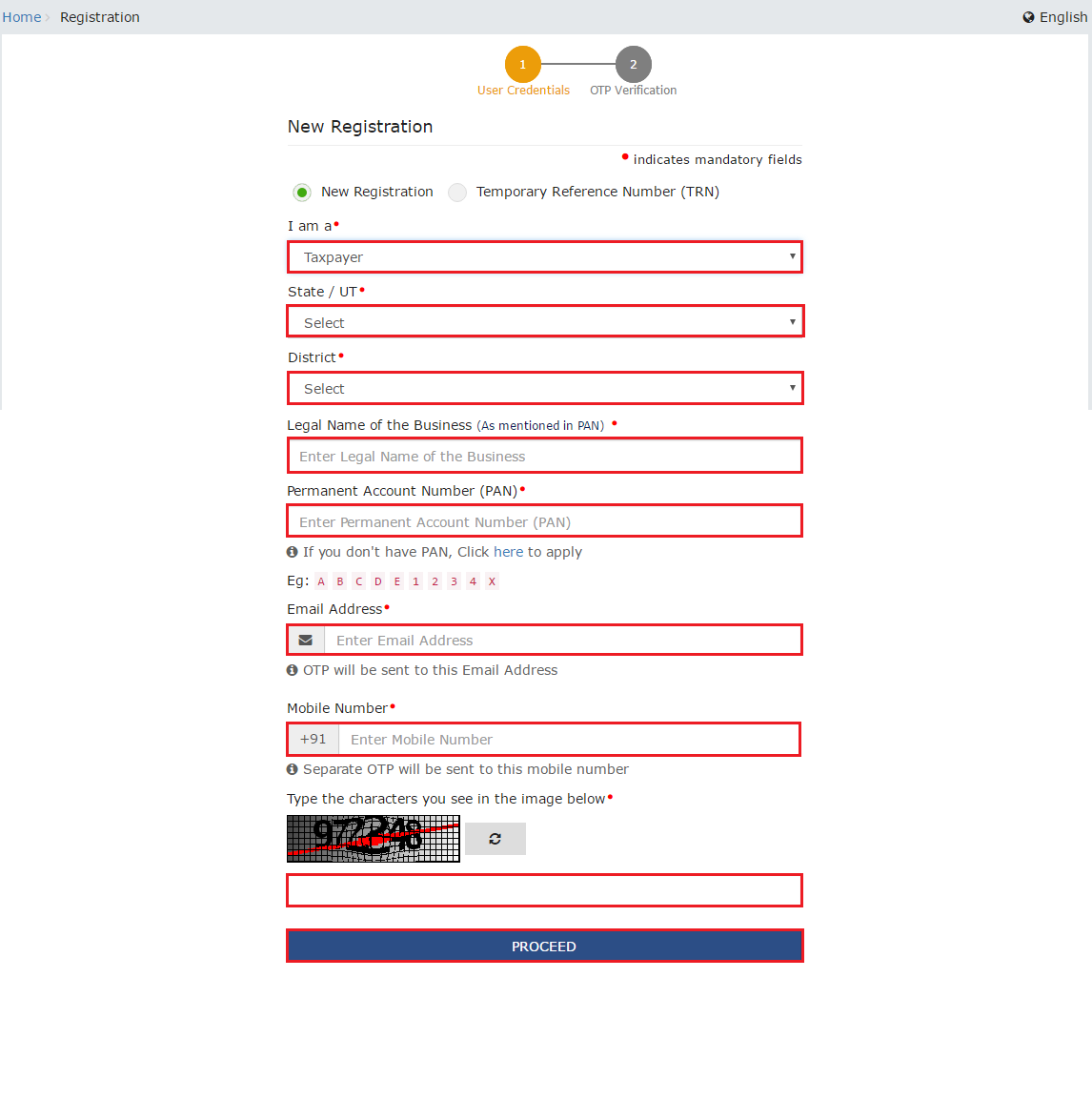

Applying for Kisan Credit Card KCC – Follow These Steps

Many farmers delay applying because they think it’s hard. It’s not. The process is easy, whether you apply at a bank or online. Here’s how to apply for KCC:

Here’s how to apply offline:

- Visit your nearest bank branch – most major banks support KCC.

- Ask for the Kisan Credit Card application form.

- Fill the form with your personal and farm details.

- Submit it along with your documents.

- Bank officials will verify your land and crops.

- If approved, they’ll issue your KCC and tell you your loan limit.

You can also opt for the KCC online application. Many farmers prefer to apply online through their bank’s website or the PM Kisan portal.

You can check your PM Kisan status through the same portal. After approval, you’ll need to set up your KCC account login for easy online management.

What Happens After Approval?

Once you have the card, you don’t need to wait for cash. Your loan amount is linked to the card. You can withdraw money for any farm need.

Here’s what you get:

- A credit limit based on your crop and land size (scale of finance).

- Access to cash withdrawals for farm expenses.

- Insurance cover in case of crop loss.

- Option to repay the loan after harvest without stress.

You pay interest only on the amount you use, not the full limit. The KCC number on your card is essential for all transactions and inquiries.

Your KCC is typically issued on the RUPAY network, ensuring wide acceptance.

Benefits of Making a Kisan Credit Card

Farmers often take loans from moneylenders or local sources because banks are slow or complicated. KCC was made to change that.

Once you get the card, you can focus on your crops, not on finding cash or worrying about high interest.

Here’s why KCC works for farmers like you:

- Low-interest rates if you repay on time, as low as 4% per year (with interest subvention).

- You only pay interest on the amount you use, not the whole limit.

- Flexible repayment – you repay after the crop is sold.

- Loan insurance – if crops fail due to weather, you’re protected.

- One-time approval, long-term use – no need to reapply for every loan.

The prompt repayment incentive encourages timely repayment and helps maintain a good credit score.

Common Mistakes Farmers Make – Don’t Let These Stop You

Some farmers apply but don’t get the card. Often, it’s because of small errors. These can delay or block your approval.

Watch out for these issues:

- Giving incorrect or incomplete documents – make sure your Aadhaar, land papers, and bank details are correct.

- Not linking Aadhaar with your bank account – subsidy benefits come through this.

- Waiting too long to repay – pay on time to keep the 4% interest rate.

- Not knowing the exact limit, understand how much you can borrow.

These are easy to avoid if you take care when applying and follow up. Remember, electronic Kisan Credit Cards are EMV compliant cards, offering enhanced security.

15 FAQS About Kisan Credit Card (KCC)

1. Is KCC only for big farmers?

No, small and marginal farmers, even tenant farmers, can apply. It’s for all types of farmers.

2. How much loan can I get with the Kisan Credit Card?

Loan limits depend on your land size and crop type. Usually, from ₹10,000 to ₹3 lakh.

3. What’s the interest rate for the Kisan Credit Card?

Normally, 7%. If you repay on time, you get a 3% subsidy, making it 4%.

4. How do I repay the loan?

After you harvest and sell your crop, repay the loan. It’s flexible.

5. Can I use the loan for anything?

No, it’s for farm-related needs – seeds, fertilizers, labour, equipment, and consumption requirements.

6. Do I need a guarantor?

Not for small loans. Bigger loans may need one, depending on the bank.

7. How long does it take to get the card?

If your papers are correct, you can get them in 7–10 days.

8. Is the Kisan Credit Card linked to PM Kisan?

Yes, you can apply through the PM Kisan portal if you are registered.

9. Can I withdraw cash from an ATM?

Yes, the card works like a debit card for withdrawing your approved loan amount.

10. What if I don’t repay on time?

You lose the 3% interest subsidy. You may have to pay the full 7% or more.

11. Is there crop insurance with the Kisan Credit Card?

Yes, your crops are insured under this scheme against natural calamities.

12. Can I apply for a Kisan Credit Card online?

Yes, through your bank’s website or the PM Kisan portal. The KCC application process is straightforward.

13. What if my application is rejected?

Ask the bank for the reason. Correct it, and reapply.

14. Can I use KCC for animal farming?

Yes, KCC now covers fisheries and animal husbandry too.

15. Do I need to reapply every year?

No, once issued, you can use it for multiple seasons, as long as you repay.

Remember, the Kisan Credit Card scheme offers flexible procedures for credit card farming, making it easier for farmers to access the funds they need for their agricultural operations.

The hypothecation of crops serves as security for the loan, ensuring that farmers can get the credit they need without additional collateral. After approval, don’t forget to set up your KCC account login for easy online management of your account.

Government Source

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Kisan Credit Card (KCC): Loan Application Made Easy - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)