Updated on October 23, 2025

Small businesses drive over 40% of India’s total GDP, and government loan schemes have become their backbone. But getting enough funding remains the biggest problem for entrepreneurs who want to start or grow their businesses.

The Indian government runs several loan programs to tackle this challenge head-on. These programs are a great way to get benefits like low-interest rates, easy repayment options, and simple application steps. To name just one example, the Pradhan Mantri MUDRA Yojana gives loans up to Rs. 10 lakh without collateral. The Credit Guarantee Scheme for Startups backs credit up to ₹5 crore per beneficiary.

On top of that, targeted programs like the Udyogini Scheme help women entrepreneurs with financial support up to Rs. 15 lakh. They don’t need to pay processing fees or provide collateral. Like in the Stand Up India scheme, bank loans between Rs. 10 lakhs and Rs. 1 crore aid SC/ST and women entrepreneurs who start new businesses.

Key Updates Oct 2025

- The Prime Minister’s Employment Generation Programme (PMEGP) has been reinforced in 2025 with reports highlighting that it offers collateral-free loans with up to 35 % subsidy for entrepreneurs setting up new ventures.

- A new compact credit-guarantee scheme is being planned by the Ministry of Micro, Small & Medium Enterprises (MSME) for MSMEs. Under this, banks would get 100 % guarantee cover for extra loans of up to 20% of outstanding credit to MSMEs (including some stressed accounts). The launch is expected in Q4 of 2025.

- The Pradhan Mantri Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme (for street vendors) has been extended until March 2030, with a total outlay of ₹7,332 crore announced. This marks a major policy update relevant for micro-businesses.

- The Mukhyamantri Yuva Udyami Vikas Abhiyan in Uttar Pradesh (UP) announced interest-free and guarantee-free loans (initially up to ₹5 lakh) for young entrepreneurs, plus margin-money support. This is a state-level update but shows broader trends.

- A press release from the Ministry of Skill Development & Entrepreneurship on 25 July 2025 states that as of 30 June 2025, 289 loans amounting to ₹667.85 crore have been guaranteed for startup borrowers.

These 11 Government Business Loan Schemes with instant approval processes could be your path to business success in 2025. This applies whether you’re just starting or growing your existing venture. Let’s examine each option to find the right funding solution that aligns with your business goals.

The search for a suitable government business loan might feel daunting as you try to grow your venture. Here’s a complete overview of major government business loan schemes and their key features available in 2025.

Overview for Government Business Loan Schemes

| Scheme Name | Target Beneficiaries | Loan Amount | Key Features | Application Process |

|---|---|---|---|---|

| MSME Loan in 59 Minutes | GST-registered MSMEs | ₹1 lakh – ₹5 crore | In-principle approval in 59 minutes, minimal paperwork | PSB Loans in 59 Minutes platform |

| Pradhan Mantri MUDRA Yojana | Non-corporate, non-farm micro enterprises | Shishu: Up to ₹50,000 Kishore: ₹50,001-₹5 lakh Tarun: ₹5-10 lakh | Through banks or NBFCS | Banks, UdyamiMitra or JanSamarth portal[51] |

| CGTMSE | New and existing MSMEs | Up to ₹5 crore | Up to 85% credit guarantee, lower fees for women | Through banks or NBFCs |

| Stand Up India | SC/ST and women entrepreneurs | ₹10 lakh – ₹1 crore[33] | Handholding support, greenfield projects | Stand-Up Mitra portal or banks |

| SIDBI Loan Schemes | New and existing MSMEs | ₹10 lakh – ₹50 crore | Multiple schemes: SMILE, SPEED, STAR, TWARIT | SIDBI portal |

| Udyogini Scheme | Women entrepreneurs | Not specified in sources | Women-focused entrepreneurship support | Not specified in sources |

| CLCSS | MSEs in approved sub-sectors | Up to ₹1 crore (15% subsidy, max ₹15 lakh) | Technology upgrade support | MSME portal and banks |

| NSIC Scheme | MSMEs requiring marketing support | Not specified in sources | Marketing and credit support | Not specified in sources |

| PMEGP | Individuals 18+, SHGs, co-ops | Manufacturing: Up to ₹50 lakh Services: Up to ₹20 lakh | 15%-35% subsidy based on location and category | KVIC portal |

| NABARD Loan | Rural businesses | Not specified in sources | Rural business development focus | Not specified in sources |

Government-backed business loan programs are a great way to get financing compared to traditional options. The interest rates are nowhere near the 15.99% to 36% p.a. charged by commercial banks for business loans. These programs also charge processing fees that are much lower than the 2-5% private lenders typically demand.

The benefits of these initiatives extend beyond just financing. You’ll find collateral-free loans with flexible tenure options up to 5 years. This makes them ideal for first-time entrepreneurs or those with limited assets. Some Government Business Loan Schemes provide specialized support through handholding services, marketing assistance, and technological upgrade subsidies.

Your business needs, eligibility criteria, and long-term goals should guide your choice of the most suitable scheme for your entrepreneurial trip.

MSME Loan Scheme in 59 Minutes

The MSME Loan Scheme in 59 Minutes has revolutionized how entrepreneurs can get quick business funding through government support. Small businesses in India now have access to a digital platform that makes the loan approval process much faster than traditional methods.

MSME Loan Scheme overview

Online PSB Loans Ltd, a public limited company with SIDBI and other public sector banks as majority stakeholders, runs this platform that gives in-principle loan approval to MSMEs in just 59 minutes.

The scheme works with more than 18 financial institutions, including major banks like SBI, PNB, Bank of Baroda, and SIDBI, to provide both term loans and working capital loans. Loans are typically disbursed within 7-8 working days after digital approval.

MSME Loan Scheme eligibility

Your business needs these qualifications for this government business loan scheme:

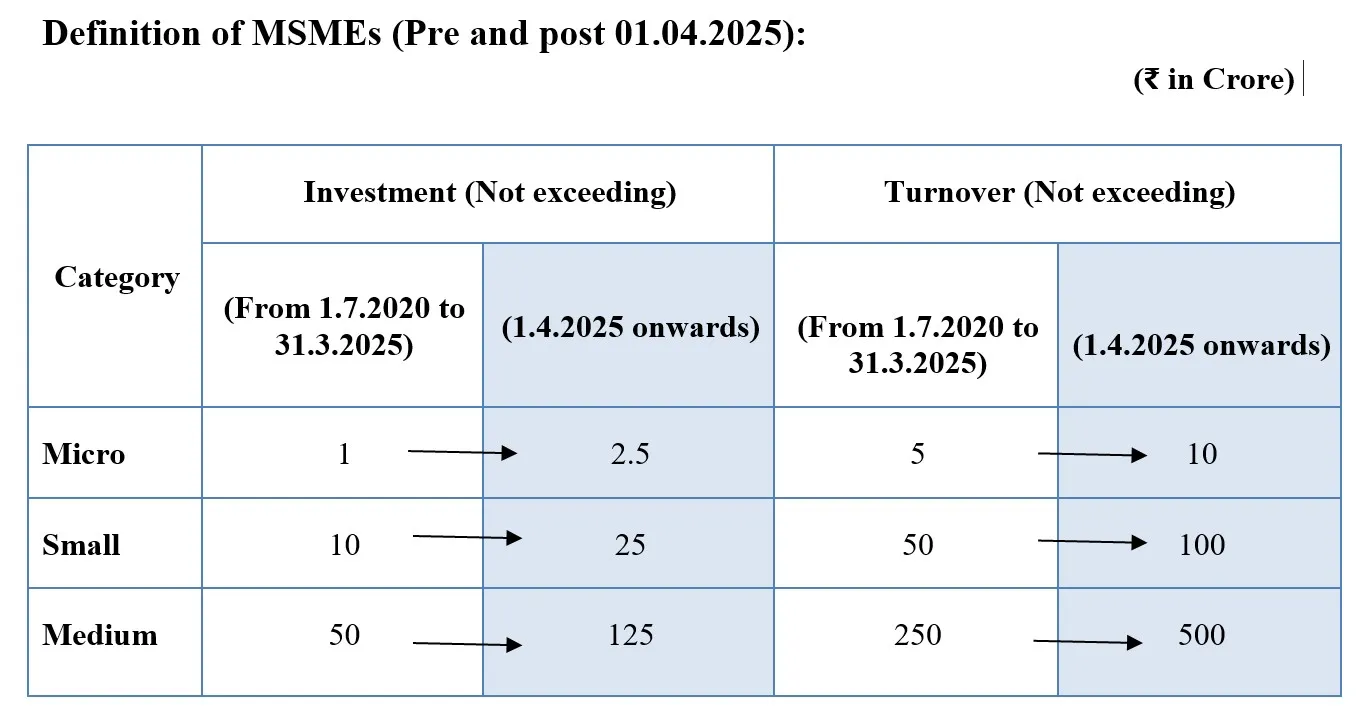

- Classification as a Micro, Small, or Medium Enterprise under the MSMED Act, 2006.

- GST registration (non-GST registered businesses can apply with extra documents).

- IT compliance with a 6-month bank statement history.

- Proof of adequate income, revenue potential, and ability to repay.

The platform works with CGTMSE to check borrower eligibility quickly.

MSME Loan Scheme benefits

This Government Business Loan Scheme comes with several key advantages:

- Immediate capital access: In-principle approval comes within 59 minutes instead of days.

- Simplified documentation: You can apply online with minimal paperwork.

- Interest subvention: GST-registered MSMEs can get a 2% interest subsidy for fresh or incremental loans up to Rs. 1 crore.

- Easier credit access: The optimized system helps MSMEs avoid traditional lending hurdles.

MSME Loan Scheme loan amount & terms

This government business scheme lets you get:

- Loans from Rs. 1 lakh to Rs. 5 crore.

- Interest rates that start at 8.5% p.a.

- Repayment periods between 1 to 15 years.

- Processing fees range from 0.1% to 6% of the sanctioned amount.

- Options for both collateral-based and collateral-free loans based on eligibility.

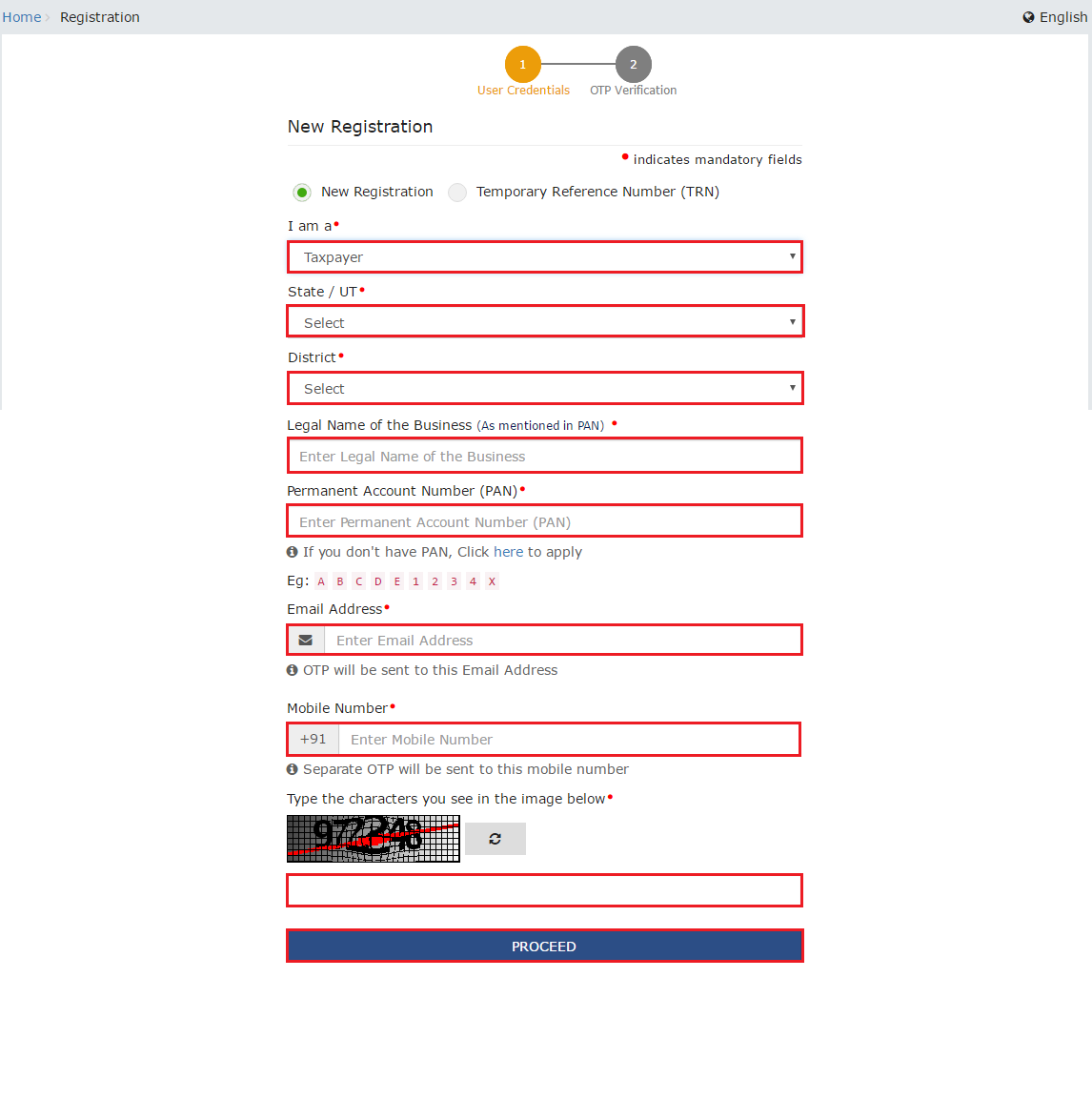

How to apply for the MSME Loan Scheme

Here’s how you can get your funding:

- Go to the official portal (www.psbloansin59minutes.com)

- Choose ‘Business’ as your profile type and continue.

- Set up your profile with PAN details.

- Upload required documents: GST returns, tax returns (XML format), and bank statements (PDF).

- Confirm your email with an OTP.

- Pick your preferred bank and branch from the list.

- Get your in-principle approval letter.

- Visit the selected bank branch with documents to complete the final loan processing.

You’ll need to pay a convenience fee of Rs. 1,000 plus GST after getting digital approval.

Pradhan Mantri MUDRA Yojana (PMMY)

The Pradhan Mantri MUDRA Yojana (PMMY) stands as one of India’s most successful government business loan programs. This 10-year-old flagship initiative has revolutionized financing for small entrepreneurs and micro-enterprises across the country.

PMMY scheme overview

The PMMY launched on April 8, 2015, to provide institutional credit to non-corporate, non-farm micro and small enterprises—essentially “funding the unfunded”. The scheme turned 10 in April 2025 and sanctioned over 52 crore loans worth ₹32.61 lakh crore. The government doubled the maximum loan limit from ₹10 lakh to ₹20 lakh in October 2024 to better support growing businesses.

PMMY eligibility criteria

You can qualify for this government business loan scheme if you:

- Is an individual, proprietary concern, partnership firm, private limited company, or public company.

- Run a non-farm income-generating micro or small enterprise in manufacturing, trading, or services.

- Have no defaults on previous loans and maintain a good credit history.

- Individual borrowers must have the skills/experience needed for the proposed business.

Women entrepreneurs make up 68% of all MUDRA beneficiaries, while SC, ST, and OBC entrepreneurs hold 50% of accounts.

PMMY loan categories (Shishu, Kishor, Tarun)

The scheme has four loan categories based on business stage and funding needs:

| Category | Loan Amount | Target Businesses |

|---|---|---|

| Shishu | Up to ₹50,000 | Nascent-stage businesses |

| Kishor | ₹50,001 to ₹5 lakh | Established micro-enterprises |

| Tarun | ₹5 lakh to ₹10 lakh | Expanding businesses |

| Tarun Plus* | ₹10 lakh to ₹20 lakh | Previously successful Tarun borrowers |

*Introduced in October 2024

PMMY interest rates and repayment

Interest rates begin at 9.30% per annum, but vary based on your lender, loan category, and profile. The repayment structure has these features:

- Term loans: Maximum 84 months (7 years) with a suitable moratorium.

- Working capital loans: 12 months, subject to annual review.

- No collateral requirement for any category.

- Zero processing fees.

- No pre-closure charges.

MUDRA loans come under the Credit Guarantee Fund for Micro Units (CGFMU), which makes them less risky for lenders.

How to apply for PMMY

Here’s how you can get a MUDRA loan:

- Visit any bank, NBFC, MFI, or RRB that offers MUDRA loans.

- Get your documents ready: identity proof, address proof, business plan, and income proof (if applicable).

- Fill out the loan application form.

- Download the MUDRA MITRA mobile app from the Google Play Store or the Apple App Store for digital applications.

- You can also apply through online portals like those listed below.

The scheme also offers a MUDRA Card (RuPay debit card) that gives you working capital through an overdraft facility. You can use it for ATM withdrawals and POS transactions.

Credit Guarantee Fund Scheme (CGTMSE)

Small business owners who struggle with collateral requirements can now get help through the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE). This government-backed program reduces lending risks through loan guarantees.

CGTMSE scheme overview

The Ministry of Micro, Small & Medium Enterprises and SIDBI started CGTMSE in 2000 to help improve credit flow to MSEs by providing guarantees for collateral-free loans. The trust hit a milestone when it approved guarantees worth ₹3 lakh crore during FY 2024-25. This 23-year-old scheme has become crucial in helping enterprises get collateral-free credit in the MSE sector.

CGTMSE eligibility

Your business must meet these requirements to qualify for a government business loan under CGTMSE:

- A new or existing Micro or Small Enterprise as per the MSMED Act

- Work in manufacturing, service, or trading activities

- Not work in agriculture, Self-Help Groups (SHGs), or Joint Liability Groups

- Be set up as a proprietorship, partnership, LLP, or private/registered company

CGTMSE has specific rules – your account should not have been restructured or been in SMA2 status in the last year. Businesses marked as fraud or willful defaulters cannot apply.

CGTMSE benefits for small businesses

This Government Business Loan Scheme gives businesses several key advantages:

- Loans without needing collateral security or third-party guarantees.

- Support for both fund-based and non-fund-based credit facilities.

- Freedom to get credit from multiple institutions up to the maximum limit.

- Banks are more willing to give credit due to lower lending risk.

CGTMSE loan terms and coverage

The expanded scheme from April 2023 covers loans up to ₹5 crore. Different categories get different guarantee coverage:

| Business Category | Coverage for loans up to ₹5 lakh | Coverage for ₹5-50 lakh | Coverage for ₹50 lakh-₹5 crore |

|---|---|---|---|

| Micro Enterprises | 85% | 75% | 75% |

| Women entrepreneurs | 85% | 85% | 85% |

| SC/ST entrepreneurs | 85% | 85% | 85% |

| NE Region businesses | 80% | 80% | 80% |

| Others | 75% | 75% | 75% |

Term loans get guarantee coverage for their full tenure. Working capital facilities get coverage for a 5-year block.

How to apply for CGTMSE

Here’s how you can apply:

- Visit a Member Lending Institution (MLI) like public/private banks, NBFCs, or financial institutions.

- Submit your loan application with the required documents.

- The lender applies for CGTMSE guarantee coverage after approving your loan.

- Pay the guarantee fee and service charges.

- Get your loan after guaranteed approval.

Your guarantee starts when CGTMSE receives the guarantee fee. The MLI handles all recovery work even after settling any claims.

Stand Up India Scheme

The Stand Up India Scheme started in April 2016 and has become the lifeblood of entrepreneurship for people from marginalized backgrounds. The program grew remarkably as sanctioned amounts rose from Rs. 14,431.14 crore in 2018 to Rs. 61,020.41 crore by March 2025.

Stand Up India overview

The Stand Up India Scheme enables entrepreneurship among Scheduled Castes (SC), Scheduled Tribes (ST), and women entrepreneurs. The original scheme’s success led to its extension until 2025. More than 1.25 lakh bank branches across the country help boost economic growth at the grassroots level.

Stand Up India eligibility

You need to meet these requirements to get this government business loan:

- SC/ST individuals or women entrepreneurs must be 18 years or older

- Start a Greenfield project (first venture in manufacturing, services, trading, or agriculture-related activities)

- Non-individual enterprises must have SC/ST or women entrepreneurs holding at least 51% shares and controlling stake

- No existing defaults with any bank or financial institution

Stand Up India benefits for SC/ST and women

The scheme’s reach expanded substantially from November 2018 to November 2024:

- SC accounts went up from 9,399 to 46,248, with loans increasing from Rs. 1,826.21 crore to Rs. 9,747.11 crore

- ST accounts grew from 2,841 to 15,22,8 with sanctioned amounts rising from Rs. 574.65 crore to Rs. 3,244.07 crore

- Women entrepreneurs’ accounts rose from 55,644 to 1,90,844, with sanctioned amounts climbing from Rs. 12,452.37 crore to Rs. 43,984.10 crore

Loan terms under Stand Up India

The scheme provides composite loans (including term loans and working capital) between Rs. 10 lakh and Rs. 1 crore. These terms apply:

- Project cost coverage up to 85%

- Interest rates limited to base rate (MCLR) + 3% + tenor premium

- 7-year repayment period with 18-month maximum moratorium

- Security through primary security, collateral, or the Credit Guarantee Fund Scheme guarantee

How to apply for Stand Up India

Follow these steps to apply for this government business loan:

- Visit the Stand Up India portal (www.standupmitra.in)

- Register and answer the initial questions

- You’ll be grouped as a Trainee or a Ready Borrower based on your responses

- Fill in your business and personal details

- Submit required documents (identity proof, address proof, business plan)

- Work with the assigned bank to process your loan

SIDBI Direct Loan Scheme

The Small Industries Development Bank of India (SIDBI) is a vital financial pillar that helps micro, small, and medium enterprises get government-backed funding options in 2025.

SIDBI loan scheme overview

SIDBI, a 37-year-old institution created under a special Act of Parliament in 1988, serves as the primary financial institution to promote, develop, and finance the MSME sector. The bank provides direct finance options, including working capital assistance, term loans, foreign currency loans, and support against receivables.

SIDBI loan eligibility

Your business must meet these simple requirements to qualify for SIDBI’s financing programs:

- Registration as a Micro, Small, or Medium Enterprise per the MSMED Act

- Business operations of 3-5 years, based on the specific scheme

- Proven stable sales and cash profits in the last 2-3 years

- Good financial standing without any defaults to lenders

SIDBI loan features and benefits

Several distinctive advantages make SIDBI different from regular lenders:

- Business policies customized to your specific needs

- Credit packages adjusted to suit businesses of all sizes

- Lower interest rates through strategic collaborations with international institutions

- Dedicated relationship managers who guide you through the loan process

- Clear processes without hidden charges

SIDBI loan amount and tenure

SIDBI offers various funding options through its different schemes:

| Scheme | Maximum Loan Amount | Tenure | Interest Rate |

|---|---|---|---|

| SPEED | Up to ₹1 crore for new customers; ₹2 crore for existing ones | 2-5 years (3-6 months moratorium) | 8.80%-10.50% p.a. |

| SPEED PLUS | Up to ₹2 crore for new customers; ₹3 crore for existing ones | 2-5 years (3-6 months moratorium) | 8.80%-10.50% p.a. [272] |

| SMILE | Minimum ₹10 lakh for equipment; ₹25 lakh for others | Up to 10 years (3-year moratorium) | Varies by scheme |

How to apply for a SIDBI loan

Here’s how you can apply for a SIDBI loan:

- Access the SIDBI website (www.sidbi.in) or the Udyamimitra portal

- Choose your preferred loan scheme under “Direct Loans.”

- Submit your documents, including KYC, financial statements, and business profile

- Complete the application verification

- Get your loan after approval and sanctioning

Udyogini Scheme

The Udyogini Scheme helps women entrepreneurs start micro-enterprises, especially in rural and underdeveloped areas.

Udyogini scheme overview

The Government of Karnataka launched the Udyogini Scheme in 1997-1998 and updated it in 2004-2005. The scheme wants to make women self-reliant through entrepreneurship. “Udyogini” means woman entrepreneur, which perfectly captures its purpose. The Women Development Corporation runs this scheme that gives subsidized loans for trade and service businesses. The scheme supports 88 different types of small-scale industries.

Udyogini eligibility for women entrepreneurs

Women need to meet these criteria to get this government business loan:

- Women between 18 to 55 years

- The family should earn less than Rs. 1.5 lakh yearly

- Widowed, disabled, or destitute women have no income limit

- Must live in Karnataka permanently

- Should have a good credit score with no loan defaults

The Government Business Loan Scheme gives priority to women below poverty levels, widows, and physically challenged women. Women from World Bank-assisted Swashakthi or Stree Shakthi groups get an extra 10% reservation.

Udyogini loan benefits

The Government Business Loan Scheme goes beyond just financial help. Women get low-interest funding and training in business planning, pricing, costing, and checking project feasibility. They attend a 3-6 day Entrepreneurship Development Program before getting their loan. This program helps strengthen women’s economic status in society.

Udyogini loan amount and interest

| Parameter | Details |

|---|---|

| Maximum loan amount | Up to Rs. 3 lakhs |

| Interest rates | 0% for special categories; 10-12% for others |

| Subsidy | Udyogini Scheme from Karnataka State Women’s Development Corporation (KSWDC) Interest Rate |

| Collateral | Not required |

| Processing fee | Nil |

How to apply for the Udyogini scheme

You can apply for this government business loan scheme online or offline.

The online process starts at the participating bank’s website. You fill out the form and get it verified by the Child Development Project Officer (CDPO). A selection committee reviews your application before the bank checks and approves it.

You can pick up offline forms from the Deputy Director/CDPO office or download them online. Take all your documents to the nearest bank for verification and processing.

Credit-Linked Capital Subsidy Scheme (CLCSS)

Small businesses in India face a tough challenge with technology adoption. The Credit-Linked Capital Subsidy Scheme (CLCSS) helps solve this problem by offering financial support to modernize equipment and production methods.

CLCSS scheme overview

The Ministry of Small Scale Industries (SSI) created CLCSS to make technology upgrades easier for micro and small enterprises. This program helps businesses buy modern machinery and improve their production methods to boost their output and market position. SSI units, including tiny, khadi, village, and coir industrial units, can benefit from this scheme. The government also launched a Special Credit Linked Capital Subsidy Scheme (SCLCSS) under the National SC-ST Hub scheme to support SC/ST entrepreneurs.

CLCSS eligibility

Your business needs these qualifications to get this government business loan subsidy:

- A registered micro or small enterprise

- Businesses should be in one of the 51 approved areas, like pharmaceuticals, food processing, toys, biotech industries, wooden furniture, and electronic equipment

- Your company structure should be a sole proprietorship, partnership, cooperative society, or private/public limited company

The selection process gives preference to women entrepreneurs.

CLCSS benefits for tech upgrades

Businesses can gain these advantages when upgrading their technology:

- Lower production costs with modern equipment

- Better pricing power against rising competition

- Better product quality and workplace environment

- Better energy conservation and pollution control

CLCSS subsidy details

The updated scheme gives businesses a 15% upfront capital subsidy on institutional finance for eligible plant and machinery. You can get loans up to Rs. 100 lakh, with subsidy limits of Rs. 15 lakh. SC/ST entrepreneurs get better benefits through SCLCSS with a 25% subsidy up to Rs. 25 lakh.

How to apply for CLCSS

Here’s how you can apply:

- Submit your application through approved Primary Lending Institutions (PLIs) like scheduled commercial banks, cooperative banks, RRBs, or SFCs

- Go to the MSME website (https://my.msme.gov.in/mymsme/) and apply

- Fill out the online form with your equipment/machinery details

- A nodal agency reviews your verified application

- After approval, the funds go to your PLI account

The scheme has helped 2,841 SC/ST beneficiaries with total subsidies of Rs. 3,21,87,66,152 since it started.

National Small Industries Corporation (NSIC)

The National Small Industries Corporation (NSIC) has spent nearly 70 years building bridges between micro and small enterprises and their essential business resources and government support mechanisms.

NSIC scheme overview

This 68-year-old Mini Ratna public sector enterprise operates under the Ministry of Micro, Small and Medium Enterprises. NSIC serves as the nodal office for several MSME schemes, including Performance & Credit Rating, Single Point Registration, and MSME Databank. The organization aims to boost small businesses through detailed support services that range from marketing assistance to financial facilitation.

NSIC eligibility

Your enterprise needs these qualifications to access NSIC’s government business schemes:

- A valid Udyam Registration as a Micro or Small Enterprise

- Registration as a firm, company, partnership, Limited Liability Partnership, or proprietorship under the Indian Companies Act

- Full compliance with relevant industry regulations

NSIC marketing and credit support

NSIC’s integrated financial and promotional assistance offers two key benefits:

- Marketing Support: The dedicated schemes provide marketing assistance, which helps MSEs join government procurement programs without tender fees or Earnest Money Deposits

- Credit Facilitation: The organization partners with banks for both fund-based and non-fund-based limits and provides free handholding support to MSMEs

NSIC loan terms

NSIC’s financial support comes with specific conditions:

- You need to provide security through a Bank Guarantee

- A formal agreement with standard and specific terms must exist between you and NSIC

- Programs have different interest rates and repayment schedules

How to apply for the NSIC scheme

You can get started with these simple steps:

- Go to NSIC’s official website (www.nsicspronline.com)

- Fill out the registration form and submit the required documents

- Submit the registration fees as specified

- Get your NSIC registration certificate after verification

Prime Minister’s Employment Generation Program (PMEGP)

The Prime Minister’s Employment Generation Program (PMEGP) is a flagship credit-linked subsidy program that enables aspiring entrepreneurs to set up new micro-enterprises in rural and urban India with financial support.

PMEGP scheme overview

PMEGP united two previous schemes—Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Program (REGP) in 2008. Khadi and Village Industries Commission (KVIC) manages this government business loan program at the national level. KVICs, DICs, and KVIBs handle state-level implementation. The scheme creates lasting job opportunities and supports traditional crafts and village industries.

PMEGP eligibility

The government business scheme requirements include:

- Age: Minimum 18 years

- Educational qualifications: 8th pass for projects above ₹10 lakh in manufacturing; 10th pass for service sector projects

- Self-Help Groups, charitable trusts, and registered co-operative societies

- Only new projects qualify; existing units cannot apply

- Income ceiling: No limit for the general category; ₹3 lakh family income for special categories

- Prior experience: Not mandatory for loans under ₹5 lakh

PMEGP benefits for new businesses

This government loan provides substantial subsidies (margin money) to make startup costs affordable. Beneficiaries also receive:

- Free EDP training to build project management skills

- Priority status for traditional artisans and village industries

- Additional funding options for successful first-time entrepreneurs

- Marketing opportunities through trade fairs and exhibitions

PMEGP loan and subsidy details

| Category | Urban Areas | Rural Areas |

|---|---|---|

| General | 15% | 25% |

| Special* | 25% | 35% |

*Special categories include SC/ST/OBC/minorities/women/ex-servicemen/PH/NER applicants

Project costs can reach up to ₹50 lakh for manufacturing and ₹20 lakh for the service sector. Banks provide credit for the remaining amount after the subsidy.

How to apply for PMEGP

The application process follows these steps:

- Register on the PMEGP e-portal (www.kviconline.gov.in)

- Complete the online application form

- Upload required documents (ID proof, caste certificate if applicable, project report)

- Task Force Committee reviews the application

- Selected candidates attend mandatory EDP training

- Banks sanction and disburse the loan after the training is completed

NABARD Loan Scheme

The National Bank for Agriculture and Rural Development (NABARD) began its mission to finance India’s rural backbone in 1982. Today, it manages one-fifth of the country’s total rural infrastructure financing.

NABARD scheme overview

NABARD operates through three core departments: finance, development, and supervision. We focused on agricultural and rural development. The institution supports both long-term refinance (18 months to 5+ years) and short-term credit for seasonal agricultural operations. NABARD’s role extends beyond direct financing as it channels various government subsidy schemes.

NABARD eligibility for rural businesses

The eligible entities include:

- State Cooperative Agriculture & Rural Development Banks

- Regional Rural Banks and Commercial Banks

- District Central Cooperative Banks

- Non-Banking Financial Companies

- Small Finance Banks

The final borrowers can be individuals, proprietorships, partnerships, companies, state corporations, cooperative societies, SHGs, JLGs, or FPOs.

NABARD loan benefits

Rural entrepreneurs get many advantages from NABARD financing. The institution creates district-level credit plans that match local needs and provides specialized subsidy schemes for dairy farming, poultry, and organic farming. NABARD’s developmental support is a great way to get training for rural artisans and promote handicrafts.

NABARD loan amount and interest

Interest rates change based on the scheme and borrower type:

| Credit Type | Interest Rate |

|---|---|

| Short-term refinance | Starting from 4.5% |

| Long-term refinance (5+ years) | 8.20-8.30% |

| Direct lending | Bank rate minus 1.50% |

Loan periods can reach up to 15 years, and refinance covers 90-95% of eligible bank loans.

How to apply for an NABARD loan

NABARD rarely provides direct loans to farmers or entrepreneurs. You can access its financing through these steps:

- Approach eligible financial institutions like banks and NBFCs

- Submit required documentation, including project reports

- Meet the eligibility criteria for the specific scheme

- Complete verification procedures at the chosen bank

NABARD ended up assessing applications based on technical feasibility, financial viability, and organizational arrangements for credit supervision.

Comparison Table

| Scheme Name | Eligible Recipients | Maximum Loan Amount | Interest Rate | Main Benefits | Security Required |

|---|---|---|---|---|---|

| MSME Loan in 59 Minutes | GST-registered MSMEs | ₹1 lakh – ₹5 crore | From 8.5% p.a. | Quick approval within 59 minutes; 2% interest subsidy | Both secured and unsecured options |

| PMMY (MUDRA) | Non-corporate, non-farm enterprises | Up to ₹20 lakh | From 9.30% p.a. | Three tiers (Shishu/Kishor/Tarun); No processing fees | None |

| CGTMSE | New and existing MSEs | Up to ₹5 crore | Not mentioned | Credit guarantee up to 85%; Reduced fees for women | None |

| Stand Up India | SC/ST and women entrepreneurs | ₹10 lakh – ₹1 crore | Base rate + 3% | Project cost coverage at 85%; 18-month grace period | Through Credit Guarantee Fund |

| SIDBI Direct Loan | Through the Credit Guarantee Fund | ₹10 lakh – ₹50 crore | 8.80%-10.50% p.a. | Various schemes (SPEED, SMILE, etc.); Flexible policies | Not mentioned |

| Udyogini Scheme | Women entrepreneurs | Up to ₹3 lakh | 0-12% | Subsidy between 30-50%; Training support at no cost | None |

| CLCSS | MSEs in 51 approved sectors | Up to ₹1 crore | Not mentioned | Capital subsidy of 15% upfront; Maximum ₹15 lakh | Not mentioned |

| NSIC Scheme | Registered MSEs | Not mentioned | Varies by program | Marketing assistance; Credit support | Bank Guarantee needed |

| PMEGP | Adults above 18 years | ₹50 lakh (manufacturing), ₹20 lakh (service) | Not mentioned | Subsidy of 15-35% based on category and area | Not mentioned |

| NABARD Loan | Rural businesses and entrepreneurs | Not mentioned | 4.5-8.30% | Refinance up to 15 years; Development assistance | Not mentioned |

Conclusion

Government business loan schemes in India offer substantial opportunities to entrepreneurs seeking financial support in 2025. Each program tackles specific funding needs with its advantages. MUDRA’s tiered structure supports micro-enterprises, while CGTMSE’s guarantee coverage eliminates the need for collateral.

Without doubt, targeted initiatives like Stand Up India for SC/ST individuals and the Udyogini Scheme help marginalized groups substantially. The Udyogini Scheme exclusively supports women entrepreneurs.

The right government scheme selection needs more than just looking at loan amounts. You should get into processing times, interest rates, repayment flexibility, and specialized benefits that line up with your business sector.

Businesses that need quick capital access might find the MSME Loan in 59 Minutes scheme useful. CLCSS is a great way to get support if you’re focusing on technological upgrades.

A clear understanding of eligibility requirements is crucial before you apply. Most programs just need simple documentation like identity proof, business registration, and financial statements.

Many schemes go beyond funding. They provide training programs, marketing assistance, and subsidized interest rates to reduce your borrowing costs substantially.

These government initiatives do more than just provide funding – they’re powerful tools to propel development. Their detailed support systems help turn entrepreneurial visions into sustainable enterprises and strengthen India’s economic foundation.

Note that the successful use of these schemes depends on thorough preparation, clear business planning, and smart use of the funds you receive.

FAQs

Q1. What new government loan scheme is being introduced in 2025?

A new scheme will be launched to provide term loans up to Rs. 2 crore for 5 lakh women, Scheduled Castes, and Scheduled Tribes first-time entrepreneurs over the next 5 years. This scheme will incorporate lessons from the successful Stand Up India program.

Q2. Which government business loan scheme is considered the most beneficial?

The Pradhan Mantri MUDRA Yojana (PMMY) is widely regarded as one of the most beneficial schemes. It offers tiered loans (Shishu, Kishor, Tarun) catering to different business needs, providing inclusive credit access for non-farm enterprises in manufacturing, trading, and services with loan requirements up to ₹20 lakh.

Q3. Is there a government scheme that offers loans of up to 2 crore?

Yes, the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE) provides collateral-free loans up to Rs. 5 crore to new and existing small and medium enterprises (SMEs). This scheme aims to facilitate easier access to credit for MSMEs.

Q4. What is the primary government loan scheme for small businesses?

The Pradhan Mantri MUDRA Yojana (PMMY) is the primary government loan scheme for small businesses. It provides loans up to Rs. 20 lakh to micro and small enterprises involved in manufacturing, processing, trading, or service activities through various banks and lending institutions.

Q5. How do instant approval business loans work in these government schemes?

Many Government Business Loan Schemes now offer quick loan approvals to support businesses efficiently. For instance, the MSME Loan in 59 Minutes scheme provides in-principle approval within 59 minutes for loans ranging from ₹1 lakh to ₹5 crore. This is achieved through digital platforms that integrate various data sources for faster verification and processing.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![11 Government Business Loan Scheme That Get Instant Approval in 2025 - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)