Updated on August 31, 2025

Starting your own business as a woman in India can feel like a dream just out of reach, especially when banks ask for guarantees you don’t have or you’re unsure where to begin. But here’s something many don’t know: there are government schemes for women entrepreneurs made exactly for this.

These schemes help you get funding without collateral, offer low-interest loans, and even provide free training and mentorship so you can turn your idea into real income. Whether it’s opening a boutique, running a food stall, or setting up a small factory, these programmes are designed to support you at every step.

Here’s what you can tap into:

- Stand-Up India: Get up to ₹1 crore loan with no collateral for first-time women entrepreneurs.

- Mudra Yojana: Start small with loans from ₹50,000 to ₹20 lakh for any business idea, with minimal paperwork.

- Mahila Udyam Nidhi: SIDBI’s special loan for women to upgrade or revive existing small businesses with flexible repayment.

- Women Entrepreneurship Platform (WEP): A free portal where you can find mentors, funding options, and government support in one place.

These women’s entrepreneur schemes are here to help you take the first step confidently.

Anita Patel still remembers the day she carried three jars of lemon pickle to the weekly haat in her small Gujarat town. Her neighbours loved the taste, but no one carried the faith or the funds to place a bigger order. Anita’s husband earned just enough as a bus conductor to run the house; a bank manager told her, “Madam, bring collateral first.”

Then she heard a radio jingle about the Stand-Up India Scheme that lets every branch of every scheduled commercial bank give one business loan each to a woman or SC/ST borrower. “Zero collateral?” she asked, half-disbelieving. Within two months, Anita had a ₹10 lakh term loan and a ₹5 lakh working-capital limit. Today, Aunty Achaars sits on supermarket shelves across three districts, giving jobs to seven other women.

Anita’s journey is not a fairy tale; it’s what happens when a motivated entrepreneur meets the right government support at the right time.

Below are 15 Indian schemes, all active in 2025, that can help thousands more Anitas light their lamps.

Schemes for Women Entrepreneurs

| # | Scheme | Loan / Grant Range | Best For | Collateral? | Key Highlight |

|---|---|---|---|---|---|

| 1 | Stand-Up India | ₹10 lakh – ₹1 crore | The government guarantee covers up to 75 % of the loan | N/A | Govt guarantee covers up to 75 % of the loan |

| 2 | PM Mudra Yojana | Up to ₹10 lakh (Shishu/Kishore/Tarun) | Micro & home-based units | N/A | First-time manufacturing, trade, and services |

| 3 | Women Entrepreneurship Platform (WEP) | Free support | Any stage | N/A | Zero processing fee; online application |

| 4 | Mahila Coir Yojana | 75 % subsidy on machines | Coir products | N/A | Motorized equipment subsidy |

| 5 | Annapurna Scheme | ₹50 k – ₹1 lakh | Food & catering | N/A | 1-month EMI holiday |

| 6 | Udyogini | Up to ₹3 lakh | Tiny rural ventures | Low | Interest subsidy upto 50 % |

| 7 | Mahila Udyam Nidhi | Up to ₹10 lakh | Upgrading existing units | N/A | 10-year repayment with 5-year holiday |

| 8 | TREAD | 30 % grant + 70 % loan | Group projects via NGOs | ❌ | Interest subsidy up to 50 % |

| 9 | Cent Kalyani | Up to ₹1 crore | Retail & MSME | ❌ | No guarantor, no fee, CGTMSE cover |

| 10 | CGTMSE Cover | Up to ₹2 crore guarantee | Any MSE loan | N/A | Makes any bank feel safe to lend |

| 11 | STEP | Free training + linkage | Skill-based micro biz | N/A | Paid training & market tie-ups |

Most female entrepreneurs, or 70.4%, may be aware of government programs and training available. The table below shows the respondents familiar with the schemes provided by the government for women entrepreneurs.

| Scheme / Factor | Never heard | Heard about this scheme | Vague idea | Good awareness | Excellent knowledge | Total |

|---|

| Mahila Samriddhi Yojana | 11 (20.4 %) | 32 (59.3 %) | 10 (18.5 %) | 1 (1.9 %) | 0 (0 %) | 54 (100 %) |

| Trade-Related Entrepreneurship Assistance & Development | 47 (87.0 %) | 3 (5.6 %) | 4 (7.4 %) | 0 (0 %) | 0 (0 %) | 54 (100 %) |

| Pradhan Mantri Mudra Yojana | 49 (90.7 %) | 4 (7.4 %) | 1 (1.9 %) | 0 (0 %) | 0 (0 %) | 54 (100 %) |

| Stand-Up India / Mahila E-Haat | 23 (42.6 %) | 28 (51.9 %) | 3 (5.6 %) | 0 (0 %) | 0 (0 %) | 54 (100 %) |

| Credit Guarantee Scheme for Micro & Small Enterprises | 48 (88.9 %) | 5 (9.3 %) | 0 (0 %) | 1 (1.9 %) | 0 (0 %) | 54 (100 %) |

| Mahilar Loan by Tamil Nadu Mercantile Bank | 50 (92.6 %) | 3 (5.6 %) | 1 (1.9 %) | 0 (0 %) | 0 (0 %) | 54 (100 %) |

| Annapurna Scheme | 9 (16.7 %) | 44 (81.5 %) | 1 (1.9 %) | 0 (0 %) | 0 (0 %) | 54 (100 %) |

Explore the best government schemes for women entrepreneurs in India. Learn how to get collateral-free loans, business training, and start-up support to grow your venture today.

1. Stand-Up India

Stand-Up India is a scheme launched by the Government of India aimed at promoting entrepreneurship among women and the Scheduled Castes and the Scheduled Tribes. The program seeks to provide financial support and facilitate access to loans for aspiring entrepreneurs to help them establish and expand their businesses.

By fostering a conducive environment for these underrepresented groups, Stand-Up India encourages economic empowerment and contributes to inclusive growth within the country. The initiative creates job opportunities but also promotes innovation and self-reliance in the community.

Who Can Apply?

- Women (or SC/ST) above 18 years

- Green-field projects—first-time ventures

How Much?

- ₹10 lakh – ₹1 crore

- Only 15 % margin money—you bring 15 paisa for every rupee you borrow.

Why It’s Great

- The bank gets a government guarantee, so no house papers are needed.

- Repayment up to 7 years with a handy working-capital overdraft.

How to Start

Walk into any bank’s MSME desk and say: “I want to file a Stand-Up India application on the standupmitra portal.”

2. Pradhan Mantri Mudra Yojana (PMMY)

| Quick Facts | Details |

|---|---|

| Started | 8 April 2015 |

| Purpose | Give small, collateral-free loans to micro businesses that banks usually ignore—street-vendors, tailors, tradespeople, service shops, small factories, etc. |

| Loan Limits | Shishu (₹1 – 50,000) • Kishore (₹50,001 – ₹5 lakh) • Tarun (₹5 lakh – ₹10 lakh) • Tarun Plus (new, 2024) (₹10 lakh – ₹20 lakh) |

| Security Needed | None—no house papers, no guarantor. |

| Where to Apply | Any commercial or rural bank, small-finance bank, cooperative bank, NBFC/MFI, or online through e-Mudra on major bank apps. |

| Who Usually Gets It | First-time entrepreneurs, women, SC / ST / OBC, craftsmen, small traders, home-based food units, repair shops, cab or e-rickshaw owners, etc. |

| Interest Rate | Set by each lender (usually 9 % – 12 % a year); lower for Shishu, negotiated for higher slabs. |

| Repayment | Up to 5 years; flexible instalments linked to cash flow. |

Why Mudra Matters

- Funds the unfunded: lets you grow without pawning gold or land.

- Women-friendly: nearly two-thirds of all Mudra accounts belong to women.

- Job creator: tiny businesses that borrow under Mudra often hire 1–3 more people within a year—family or neighbours.

Basic Eligibility

- Age 18+ and an Indian resident.

- Running—or planning—non-farm, non-corporate activity.

- Need up to ₹20 lakh only (anything bigger is handled under regular MSME loans).

Documents You’ll Need

- Aadhaar & PAN (link both to your bank account).

- Recent photo.

- Proof of address (utility bill or voter ID).

- Simple business plan or quotation for machinery/stock.

- If existing business: last 6-month bank statement.

(Tip: For tiny Shishu loans, most banks accept a one-page form and Aadhaar only.)

How to Apply—Step by Step

- Choose lender: Start with the bank where you already have a savings account.

- Fill Mudra application: Get it at the branch or download from the bank’s site.

- Attach docs & plan: Even a half-page cost/revenue estimate is fine for Shishu.

- Bank checks CIBIL (it won’t kill your chance if you’re new-to-credit).

- Sanction & Disbursal: Money lands straight into your account; you’ll also get a Mudra RuPay debit card to track spends.

Online alternative: Many PSBs now allow e-Mudra up to ₹1 lakh—apply on their mobile app, complete e-KYC, sign digitally, receive funds within 24-48 hours.

Costs & Care

- Processing fee: Nil for Shishu & Kishore; small fee for Tarun.

- Insurance: Banks may bundle accident coverage (optional but cheap).

- Use wisely: The loan should buy assets or stock that earn interest. Misusing funds (e.g., personal gadgets) can strain repayment and hurt future credit.

Common Questions

| Question | Answer in Plain Words |

|---|---|

| Can I top up later? | Correct. The loan is backed by a government guarantee, so banks don’t demand property papers. |

| How fast is approval? | Shishu cases are often cleared in 2–7 days; higher slabs can take 2–3 weeks. |

| Yes. Repay on time, and you can move from Shishu to Kishore, then Tarun. | Yes. Repay on time and you can move from Shishu to Kishore, then Tarun. |

| What if I miss an EMI? | Talk to the bank immediately; they can reschedule. Ignoring notices will spoil your credit score. |

| Is there a subsidy? | The benefit is collateral-free access; interest subsidy applies only in a few state-run add-ons (check your state portal). |

Latest Numbers at a Glance (till March 2025)

Average NPA: ≈ 2 %—lower than many other small-loan programs.

Total loans: ~52 crore

Total amount: ₹32.6 lakh crore

Women’s share: ~68 % of accounts

3. Women Entrepreneurship Platform (WEP)

| Key Fact | Details (in plain words) |

|---|---|

| What it is | A free, government-run website that puts training, mentors, investors and useful schemes for women business owners in one place. Managed by NITI Aayog. |

| Launched | December 2017 (revamped as “WEP Nxt” in 2023). |

| Why it exists | To make starting or growing a business easier for women by cutting paperwork and showing all support options on one dashboard. |

| How many users | 25,000 + women entrepreneurs and 250+ partner organizations (banks, VCS, incubators) as of early 2025. |

| Cost | Completely free—no membership fee, no commission. You only pay the usual charges directly to a lender or service provider if you choose their offer. |

What WEP Gives You

- Quick Scheme Finder – answers “Which loan/subsidy fits me?” in minutes.

- Mentor & Investor Match – book free calls or apply to pitch events.

- Learning Hub – short courses on GST, digital marketing, bookkeeping, and export rules.

- Community – online groups by sector (fashion, food, tech, crafts) so you can swap tips or bulk-buy raw materials.

- Credit-Score Help (SEHER module) – step-by-step videos, in partnership with TransUnion CIBIL, on how to build a solid credit record before you approach a bank. Press Information Bureau

Who Can Join?

- Any woman aged 18 or above with a business idea or an existing micro, small or medium enterprise (yes—even a home kitchen or Instagram store counts).

- No turnover minimum, no PAN/GST at sign-up (though you’ll need them when you seek funding).

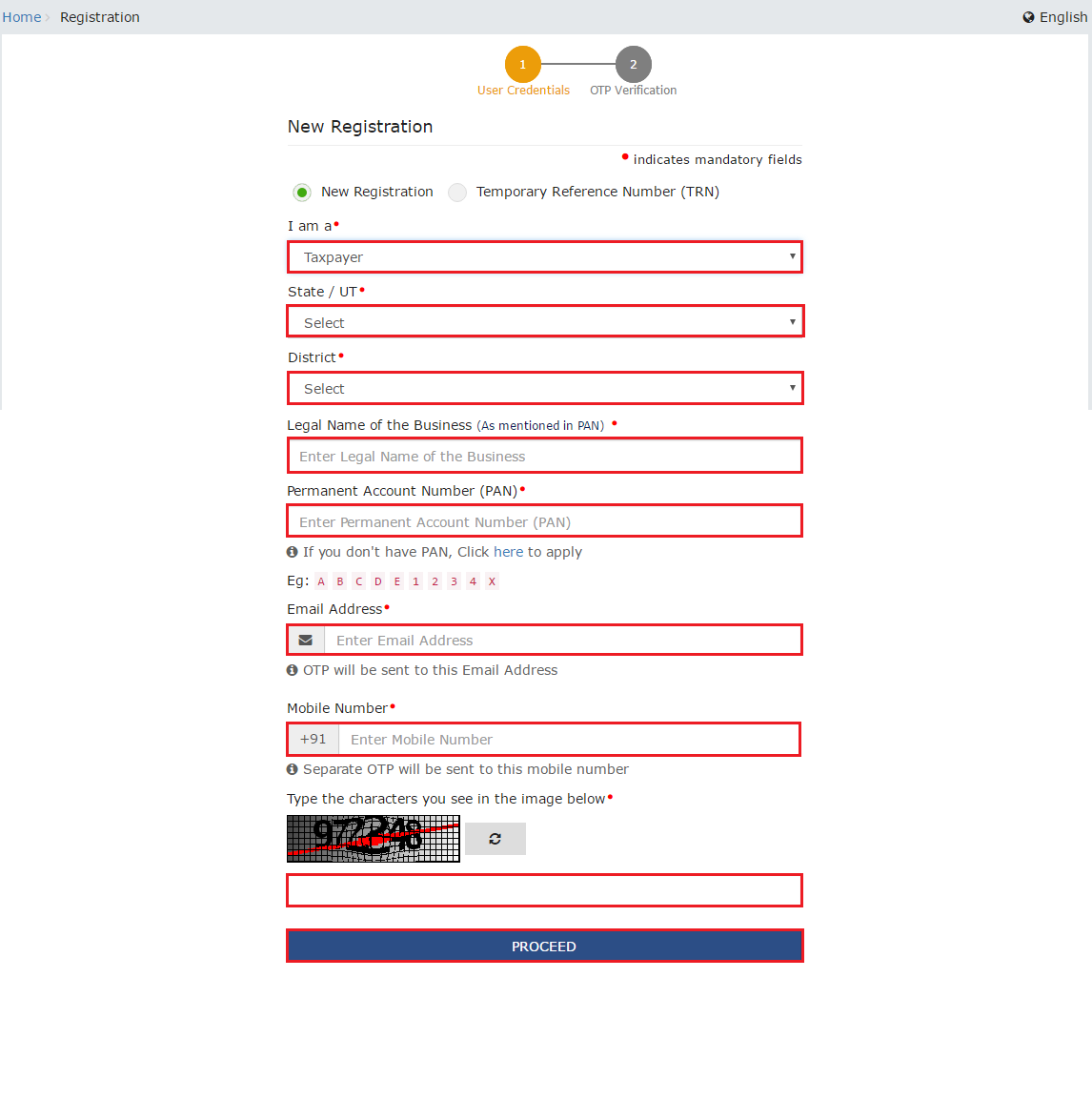

How to Register (Takes < 5 Minutes)

- Visit wep.gov.in → click “Register as Entrepreneur.”

- Enter name, email, and mobile OTP.

- Tick areas where you need help (finance, legal, marketing, etc.).

- Build a short profile (logo, one-line pitch). Done!

You’ll now see a personalized dashboard suggesting courses, grants and mentors that match your stage.

Success Snapshot

Roshni, 32, Jaipur: Joined WEP in 2022, took the 4-hour GST basics course, then matched with a SIDBI mentor. Landed a ₹12 lakh Mudra-Tarun loan and supplies her handmade décor on ONDC today—staff strength: 7.

Stories like Roshni’s appear in the WEP newsletter every month, proving you don’t need big capital to scale—just the right info and contacts.

FAQS in Everyday Language

| Question | Short Answer |

|---|---|

| Is WEP an NGO or a private app? | It’s a Government of India initiative under NITI Aayog. |

| Will they give me money directly? | No cash is paid by WEP itself. It connects you to banks, VCs, or grant programmes. |

| Do I lose ownership if I join? | Absolutely not. You keep 100 % ownership; you only share what you choose with partners. |

| Not tech-savvy—can someone guide me? | Use the “Request a Call-Back” button; a help-desk agent walks you through registration on the phone. |

| Is my data safe? | The site uses government cloud hosting and two-factor login; only verified partners can see limited profile data. |

Why It’s Worth Your Time

Free upgrades—new modules keep coming (export compliance, climate-smart packaging, etc.).

Saves legwork—no more Googling 50 schemes or hunting separate mentor lists.

Boosts credibility—a WEP profile link in your pitch deck signals you’re part of a vetted government network.

4. Mahila Coir Yojana

Mahila Coir Yojana lets rural women turn coconut waste into steady cash with only 25 % machine cost and a free, stipend-linked course. If you live in a coconut-growing belt and want home-based income, call your Coir Board office today and book a seat in the next batch.

| What it is | A Ministry of MSME / Coir Board programme that teaches rural women how to spin coir fibre and then gives them 75 %-subsidized, motor-operated spinning machines so they can earn from home or a small shed. |

| Started | 1994 (running under the umbrella “Coir Vikas Yojana”) |

| Cost to You | Training free |

| Who can join | Women (18 +) living in any coir-producing area—Kerala, TN, Karnataka, Andhra, Odisha, Goa, NE states, A&N Islands, etc. |

| What you get | A Ministry of MSME / Coir Board programme that teaches rural women how to spin coir fibre and then gives them 75 %-subsidized, motor-operated spinning machines so they can earn from home or a small shed. |

Why this scheme matters

- Turns a low-cost farm by-product (coconut husk) into income.

- Machines are easy to run by one person, so you can work from home.

- Women keep control of their work hours while adding ₹ 8,000-₹ 12,000 per month to family income (Coir Board trainee survey, 2024).

Step-by-step: How to enrol

- Contact your nearest Coir Board office or call the helpline listed on coirboard.gov.in.

- Fill a one-page Training Application (Aadhaar, photo, bank passbook).

- Attend the two-month course (usually 5 days × 8 weeks, 10 a.m.–4 p.m.).

- On completion, apply for the subsidized motorized rickshaw—pay only 25 % of the bill; Coir Board pays the rest directly to the supplier.

- Open a savings account (if you don’t have one) so the ₹ 3,000 stipend is sent each month.

Running costs & earnings

| Item | Approx. Monthly Cost | Approx. Monthly Income* |

|---|---|---|

| Electricity for the machine | Coconut husk/fibre | — |

| Electricity for machine | ₹300 | — |

| Gross sales of coir yarn (80 kg) | — | ₹ 1,200 |

| Net profit | — | ₹ 14,000 |

*Assuming current coir yarn price ~₹175/kg and six-hour daily operation.

Frequently asked questions

| Question | Plain-language answer |

|---|---|

| Do I need land? | A 6 × 8 ft covered space with a power socket is enough. |

| Is any exam required? | No, you only need to attend 80 % of the training days. |

| What if my village has no Coir Board centre? | Get 15+ interested women; the Board will send a Mobile Training Unit to your panchayat. |

| No; you only need to attend 80 % of the training days. | Yes, if it’s in the Board’s approved equipment list—ask the trainer. |

| Can I use the subsidy to buy a loom or a mat-making machine? | You can: a) sell yarn to local co-ops, b) weave mats via a PMEGP micro-unit, c) join Coir Board e-commerce tie-ups (ONDC). |

Where to get more help

- Website: https://coirboard.gov.in → ‘Financial Assistance Schemes’ → Mahila Coir Yojana

- Toll-free helpline: 1800-425-1240 (10 a.m.–5 p.m., Mon-Fri)

- Nearest offices: Kochi, Alleppey, Pollachi, Bhubaneswar, Guwahati, Port Blair, Panaji.

5. Annapurna Scheme

Annapurna Scheme is a quick, collateral-light loan that pays for the first utensils, raw stock and delivery gear of a home-catering business. If you can cook and have customers waiting—neighbours, office staff, school canteen—walk to your bank, ask for the Annapurna form, and turn today’s recipes into tomorrow’s income.

| What it is | A bank loan (up to ₹50,000–₹1 lakh) designed especially for women who want to start or grow a small food-catering, tiffin, snack or canteen business. The scheme was first rolled out by public-sector banks (State Bank group, Canara Bank, etc.) and is now available at most PSU banks under their women-entrepreneur desks. |

| Why it exists | Nil to ₹500, depending on the bank. |

| Loan size | Minimum ₹10,000 |

| Who can apply | Women aged 18–60 who: ① already run—or plan to run—a small food business, and ② can show either basic experience (home tiffin, snack stall) or a simple business plan. |

| Security needed | No heavy collateral like house papers; banks usually ask for: a) a guarantor (spouse/relative) and b) a small deposit or machinery invoice as primary security. |

| Repayment | 36 monthly instalments (3 years) after a 1-month moratorium, so you can start selling before EMIs begin. |

| Interest rate | Linked to each bank’s MCLR (roughly 10 %–12 % per year). |

| Processing fee | Nil to ₹500, depending on bank. |

| Extra perk | Nil to ₹500, depending on the bank. |

Expenses the Loan Covers

- Steel vessels, gas stove, mixer-grinder, fridge or freezer

- Raw materials—flour, oil, spices—for the first month

- A second-hand scooter or e-bike for deliveries

- Working capital to pay a helper or buy food-grade packaging

Step-by-Step How to Apply

- Visit your existing bank branch and ask for the “Annapurna Scheme / Women Catering Loan” form.

- Fill in basics (Aadhaar, PAN, photos) + attach:

- Simple business plan: menu, expected daily orders, price per plate

- Supplier quotation for utensils or equipment

- Bring a guarantor (spouse/parent); they sign the guarantee form.

- Bank checks CIBIL score → Approves in 7–15 days → Money credited to your account.

(Tip: If your branch says they don’t know the scheme, ask for the MSME or women-entrepreneur desk; all PSU banks have a circular for it.)

Documents Checklist

- Aadhaar & PAN (borrower and guarantor)

- Two passport photos

- Proof of residence (utility bill)

- Bank passbook (last 6 months)

- Invoice/quotation for utensils or a scooter

- Very short business plan (½-page is fine)

Benefits in Everyday Terms

- Zero big collateral – keep your gold and land safe.

- Grace period – start earning before EMIs kick in.

- Women-first processing – queues and paperwork are shorter at the women’s loan counter.

- Credit history builder – timely EMIs make you eligible for larger Mudra or Stand-Up India loans later.

Common Questions

| Question | Plain Answer |

|---|---|

| Do I need an FSSAI licence first? | Only if you plan to supply to offices/restaurants; you can apply for the licence in parallel after loan sanction. |

| What if I can’t find a guarantor? | Some branches let you pledge the purchased fridge/scooter as primary security—ask the manager. |

| Can SHGs apply? | Yes—if your Self-Help Group wants a group kitchen, apply through the SHG’s bank account; the manager will treat each member as a co-applicant. |

| Is there any subsidy? | Can SHGS apply? |

6. Udyogini Scheme

Udyogini puts up to ₹3 lakh within reach of resourceful women, then chops 30–50 % off through a government subsidy. If you’ve been dreaming of a boutique, dairy unit, or repair shop but don’t own property to pledge, walk into your DIC office, pick up the Udyogini form, and turn that idea into a family income stream.

| What the scheme does | Gives women low-cost bank loans up to ₹3 lakh (and a government subsidy up to 50 %) so they can start or expand a tiny business—tailoring shop, kirana, beauty parlour, dairy, mobile repair, 80-plus other trades. |

| Runs under | To stop women from borrowing at high interest from moneylenders and to push self-employment in villages and small towns. |

| Why it exists | To stop women from borrowing at high interest from money-lenders and to push self-employment in villages and small towns. |

Loan & Subsidy at a Glance

| Borrower Category | Max Loan | Govt Subsidy* | Effective Interest |

|---|---|---|---|

| General | ₹1 lakh | 30 % (or max ₹7,500) | ~10 %–12 % p.a. |

| Rural / Special (BPL, minor disability, etc.) | ₹1.5 lakh | 40 % | ~8 %–10 % p.a. |

| SC / ST, Widows, Disabled | ₹3 lakh | 50 % (or max ₹90,000) | 0 %–6 % (many banks waive interest) |

*Subsidy is credited straight to the bank after you finish a short 3-day Entrepreneurship Development (EDP) training.

Basic Eligibility

- Woman aged 18–55

- Family income ≤ ₹1.5 lakh a year (no cap for SC/ST/widows/disabled)

- First-time entrepreneur or existing micro unit needing extra funds

- Any non-farm trade or service (dairy & poultry are allowed)

Paperwork Needed

- Aadhaar, PAN, two passport photos

- Ration card/address proof

- Income or BPL certificate (not needed for SC/ST/widows/disabled)

- Simple project report—what you’ll buy, how much you’ll earn

- Quotation for machinery/stock (if any)

- Bank statements (last 6 months) — only if you already run a business

(Tip: Your DIC office often helps you draft the project report.)

How to Apply – 5 Easy Steps

- Collect the form at the District Industries Centre (DIC) or download it from your state Development site.

- Fill the form + attach documents → submit back to DIC.

- Attend 3-day EDP training (free, lunch provided).

- DIC forwards your file to a nearby public-sector bank; the bank performs a quick credit check.

- Once the loan is sanctioned, a subsidy (30–50 %) is released to the bank, reducing the amount you repay.

Most banks disburse the money within 15–30 days after training.

Repayment & Top-Ups

- Tenor: 3–5 years with easy monthly instalments.

- Good repayment for 12 months?—You can apply for an extra top-up via Mudra Kishore without fresh security.

Why It’s Worth a Look

- Tiny or no collateral: usually just your new equipment as security.

- Big subsidy: shaves off up to half your principal, lowering EMI.

- Low or zero interest for widows, disabled, SC/ST—rare in other loans.

- Skill boost: The compulsory EDP class teaches pricing, bookkeeping, and online UPI selling.

Common Questions

| Question | Short Answer |

|---|---|

| Do I need a guarantor? | Not for SC/ST/widows/disabled; others might need a family co-applicant. |

| Can I apply online? | Some states (e.g., Karnataka) allow e-Udyogini—check your state women-development portal. |

| What if my credit score is zero? | That’s okay—first-time borrowers are welcome; just avoid existing defaults. |

| Does the scheme work outside Karnataka? | Yes—many states copied the model; ask your DIC if they run “Udyogini,” “Udyogini-like,” or “Women Entrepreneur Subsidy” scheme. |

Check your District Industries Centre (DIC) for exact rules—they differ by state.

7. Mahila Udyam Nidhi (SIDBI)

Mahila Udyam Nidhi gives serious women entrepreneurs up to ₹10 lakh of “patient capital” for 10 years with a 5-year holiday, no heavy collateral required. If you’re eyeing new machinery or breathing life into a struggling small unit, walk into SIDBI, mention the scheme, and put long-term, low-stress funding to work for your business.

| What it is | A soft-loan programme from SIDBI (Small Industries Development Bank of India) that puts up to ₹10 lakh in a woman entrepreneur’s hands at concessional terms. The money acts like “quasi-equity”: you repay slowly, letting you buy machines, renovate a shop, or revive a sick micro-unit without pledging the family home. |

| Launched | 1995; still open in 2025 through SIDBI’s 70+ branch offices and designated public-sector banks. |

| Loan size | ₹2 lakh – ₹10 lakh (normally 25 % of the total project cost, capped at ₹10 lakh). |

| Use cases | Up to 10 years with a generous 5-year moratorium on the principal, so your business can stabilize before big EMIs start. |

| Interest cost | SIDBI’s base rate minus 2% (roughly 7 %–8 % p.a.) is far cheaper than standard MSME loans. |

| Repayment | Up to 10 years with a generous 5-year moratorium on the principal, so your business can stabilise before big EMIs start. |

Why This Matters to You

- Bridges the “own-money” gap: acts like equity, so banks are more willing to give you a larger term loan or working-capital limit on top.

- No hefty collateral: most cases need only the new machinery or fixed assets as security; property mortgage is rare.

- Long holiday period: five years without principal repayment means lower monthly outgo while sales climb.

Are You Eligible?

- Woman aged 18–55 with majority ownership (≥ 51 %) in the enterprise.

- Project cost should be ≤ ₹40 lakh (since scheme funds up to 25 %).

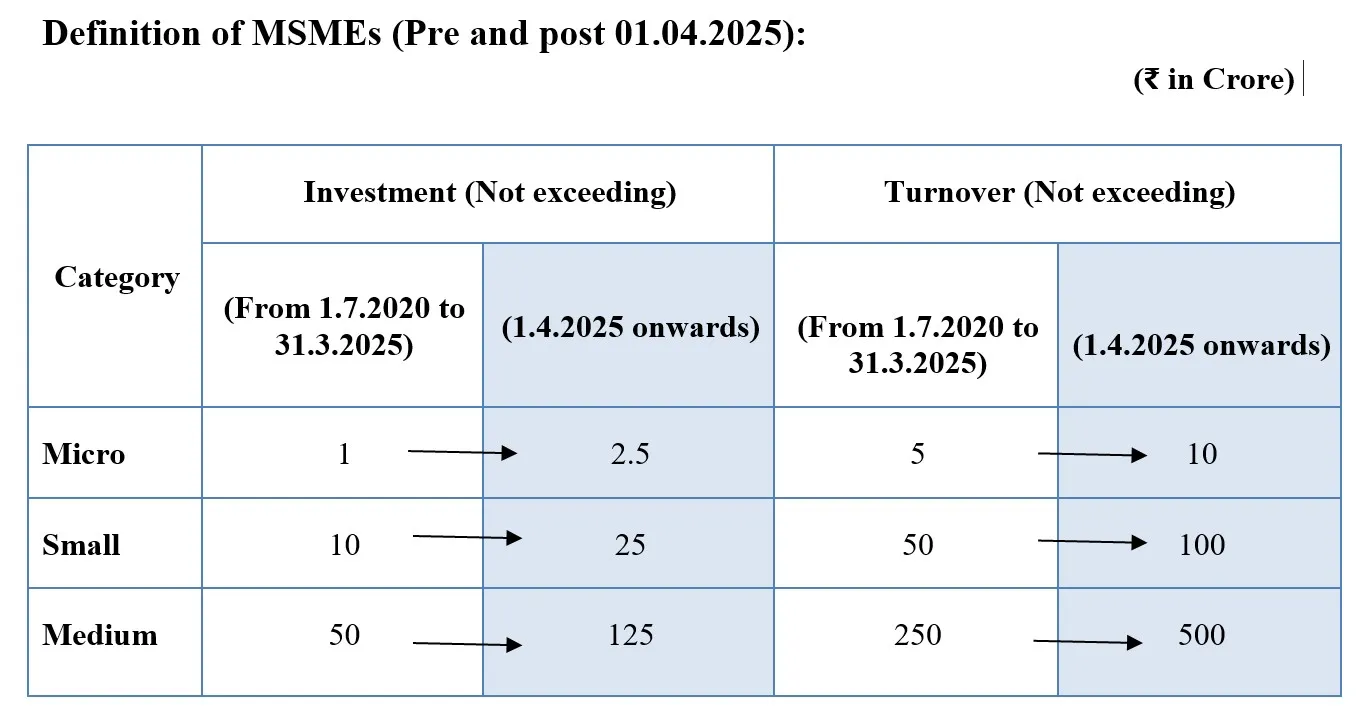

- Activity must fall under the MSME definition (manufacturing, services, or allied activities).

- Good CIBIL record—no wilful defaults.

- If it’s a rehabilitation case, you need a simple techno-economic viability report (SIDBI will guide you).

Paperwork Checklist

- Aadhaar, PAN, recent photos

- Ownership proof of business (Udyam Registration, partnership deed, or Pvt Ltd shareholding)

- Project report (cost breakup, sales projections)

- Quotation for machinery/renovation

- 2–3 years’ balance sheet & GST returns (if already running)

- Bank statements (last 12 months)

SIDBI’s branch usually helps polish the project report so first-timers aren’t overwhelmed.

How to Apply – 4 Simple Steps

- Visit or call your nearest SIDBI branch (sidbi.in → ‘Contact Us’) and ask for the Mahila Udyam Nidhi desk.

- Submit a pre-app form; the officer checks basic eligibility and guides documentation.

- Hand in the full proposal; SIDBI appraises within 30–45 days.

- On sanction, you sign loan docs and draw down funds in one or two tranches.

(Tip: If you live far from a SIDBI branch, many state PSB branches can forward your file to SIDBI.)

5. Typical Cost Example

| Item | Amount (₹) |

|---|---|

| New embroidery machines (4 units) | 12,00,000 |

| Shop renovation & signage | 3,00,000 |

| Working capital margin | 1,00,000 |

| Total project cost | 16,00,000 |

| Mahila Udyam Nidhi soft loan (25 %) | 4,00,000 |

| Bank term loan (regular MSME) | 8,00,000 |

| Promoter’s contribution | 4,00,000 |

Your SIDBI soft-loan reduces the equity you need up front and lowers blended interest.

Frequently Asked Questions

| Question | Plain-English Answer |

|---|---|

| Is this a grant? | Hypothecation of the assets you buy; personal guarantee, no house collateral for most cases under ₹10 lakh. |

| Can I combine it with Mudra or Stand-Up India? | Yes—SIDBI soft-loan + bank Mudra/Stand-Up term-loan is a common combo. |

| What security is required? | Not mandatory, but SIDBI encourages free EDP (Entrepreneurship Dev) workshops. |

| Any training required? | Not mandatory, but SIDBI encourages free EDP (Entrepreneurship Dev.) workshops. |

| Early repayment allowed? | Yes, without penalty after one year. |

Contacts & Help

- SIDBI Toll-Free: 1800-22-SIDBI (74324)

- Email: contact@sidbi.in

- Website: https://www.sidbi.in → ‘MSME Support’ → Mahila Udyam Nidhi

- Udyam Assist Centre: Many districts run help-desks for project-report drafting—ask at your DIC

8. TREAD Scheme

TREAD turns a good group business idea into reality by gifting 30 % of the cost and easing the rest through a bank loan managed by a supportive NGO. If you and your friends have skills—but lack capital and market links—visit your DIC, mention the “TREAD scheme,” and take the first step toward steady group income.

| What it is | Trade Related Entrepreneurship Assistance and Development (TREAD) — a Ministry of MSME programme that channels 30 % free grant money to women through an NGO, while banks provide the remaining 70 % as a loan. The NGO also trains and hand-holds the women for at least a year. |

| Why it exists | Many first-time women entrepreneurs find banks intimidating. TREAD lets a trusted NGO stand in the middle, secure a grant, arrange a bank loan, train the group, and market their products. |

| Good for | Self-Help Groups (SHGs) or clusters of women making food items, handicrafts, garments, coir products, agarbatti, dairy, goat-rearing, repair services, etc. |

| Grant size | Up to ₹5 lakh per beneficiary group (covers 30 % of project cost). |

| Loan size | 70 % of the project cost comes as a regular bank loan, routed through the partner NGO. |

| Other support | Separate grants (up to ₹1 lakh per programme) to reputed institutions for training & counselling of women entrepreneurs. |

- You (the women’s group) prepare a simple project idea.

- NGO submits it to the MSME Ministry + ties up with a bank.

- The government releases 30 % of the cost as a grant to the NGO.

- The bank lends the remaining 70 % to the NGO, which passes it to you in cash or equipment.

- NGO trains you, markets the products, and collects EMIs to repay the bank.

Who Can Apply?

| Requirement | Details |

|---|---|

| Women group size | Minimum 10 women (can be SHG, co-op, or informal cluster). |

| Age | 18 – 60 years. |

| Activity | Non-farm manufacturing or service trade with local demand. |

| Income limit | No rigid cap, but priority if family income < ₹1.5 lakh/yr. |

| Bankability | At least 3 members must have a savings account (helps open a group account). |

Step-by-Step Process

- Find a registered NGO that works with women entrepreneurs.

District Industries Centre (DIC) has the list. - Draft a project: cost sheet, raw material source, selling price, and expected income.

- NGO submits the proposal to the MSME Field Office during quarterly TREAD calls.

- On approval, a 30% grant is released; the bank ties up for the 70 % loan.

- Training (2 – 6 weeks) on production, pricing and digital payments.

- Start operations; the NGO helps you sell to local markets, fairs, or e-commerce.

- Repay the loan in easy monthly instalments via the NGO; the grant portion is never repaid.

Typical Money Example

| Item | Amount (₹) |

|---|---|

| Sewing machines & tables (5 units) | 1,50,000 |

| Fabrics & threads (first 3 months) | 50,000 |

| Marketing stall & banners | 20,000 |

| Project Cost | 2,20,000 |

| Govt Grant (30 %) | 66,000 |

| Bank Loan (70 %) | 1,54,000 |

| Monthly EMI @ 10 % for 3 yrs | 2,20,000 |

Benefits in Everyday Words

- Free grant covers nearly one-third of your cost.

- Lower risk because the loan is in the NGO’s name; you repay through them.

- Skill boost – free training on bookkeeping, GST, and online sales.

- Market link – NGOs often have tie-ups with exhibitions and e-commerce portals.

Frequently Asked Questions

| Question | Simple Answer |

|---|---|

| Do we need collateral? | Is interest subsidized? |

| Can a single woman apply? | TREAD is designed for groups. Solo entrepreneurs can try Mudra, Stand-Up India, or Mahila Udyam Nidhi instead. |

| What if members drop out? | Remaining members must continue EMIs; the NGO can induct new women. |

| Is interest subsidised? | Is interest subsidized? |

Where to Get Started

- District Industries Centre (DIC) – ask for the “TREAD nodal officer.”

- State Khadi & Village Industries Board – many act as TREAD NGOS.

- MSME Development & Facilitation Office – regional locations on https://msme.gov.in.

- Helpline: Call MSME toll-free 1800-123-456; ask to connect to the nearest TREAD coordinator.

Ideal for SHGS producing pickles, toys, and garments at scale.

9. Cent Kalyani (Central Bank of India)

Cent Kalyani is a hassle-free, collateral-free loan of up to ₹1 crore, offered by the Central Bank of India exclusively for women-owned micro and small businesses. If you need new equipment, stock money, or a shop makeover and don’t want to risk family property, collect your Aadhaar, PAN, a simple project plan, and visit the nearest Central Bank branch. Your business dream could be funded in as little as two weeks.

| Key Point | Details in Plain Words |

|---|---|

| What it is | A collateral-free business loan from the government-owned Central Bank of India, made only for women who run (or want to start) a micro- or small-enterprise. |

| Loan amount | ₹50,000 up to ₹1 crore — you choose how much, based on your project cost. |

| Security needed | None. No house papers, no gold. The loan is covered by a government credit guarantee (CGTMSE). |

| Who can apply | Any woman aged 18–55 who owns (or will own) at least 51 % of the business. All sectors allowed: manufacturing, trade, services, e-commerce, food processing, tiny units such as tiffin, salon, boutique, etc. |

| Interest rate | Bank’s 1-year MCLR minus 0.25 % (currently ≈ 8 – 9 % p.a.) — cheaper than a regular business loan. |

| Processing fee | Zero for loans up to ₹10 lakh; small flat charge above that. |

| Repayment | Up to 7 years, including 6–12 months grace (no principal EMI) so your venture can settle before big payments begin. |

What Expenses Does the Loan Cover

- Buying or repairing machines, computers, sewing machines, delivery van

- Shop or workshop renovation

- Working capital (stock, raw material, salaries, electricity deposit)

- Paying off a small, high-interest informal loan you already took out for the business

Simple Eligibility Checklist

- Woman applicant (single or jointly with other women)

- Owns the majority share of the proposed business

- Clear credit record (no default in the last 12 months)

- Business turnover not more than ₹25 crore (fits MSME definition)

- Basic KYC and, if existing, Udyam Registration number (easy & free online)

Note: Students planning a start-up can also apply if they have a viable project report.

Documents You’ll Need

| Mandatory | Nice to Have (speeds approval) |

|---|---|

| Aadhaar & PAN (borrower + co-borrower, if any) | Quotation for machinery or stock |

| Two passport photos | Previous 6-month bank statement |

| Proof of residence (utility bill) | GST returns / ITR (if existing unit) |

| Simple project plan (cost, sales, profit estimate) | Udyam Registration printout |

How to Apply — 4 Quick Steps

- Walk into any Central Bank of India branch and ask for the MSME / Cent Kalyani desk.

- Fill the Cent Kalyani loan form (2–3 pages) and attach the documents listed above.

- Meet the field officer: she/he will visit your shop or proposed site (or do a short video check).

- Bank runs a credit check → approves → money lands in your account, usually within 7–15 working days.

(Tip: already have a savings/current account with CBI? Approval is often faster.)

Why Women Love Cent Kalyani

- No collateral & no guarantor up to ₹10 lakh.

- Speedy—many branches clear Shishu-sized loans (<₹ 50k) in a week.

- Lower interest and zero processing cost save thousands over the loan life.

- Builds a credit history; timely EMIS lets you graduate to bigger finance (Stand-Up India, SIDBI) later.

Frequently Asked Questions

| Question | Short Answer |

|---|---|

| Is there any subsidy? | The low rate and collateral-free guarantee are the benefits; no cash subsidy is paid. |

| Can an SHG apply? | Yes—if the SHG opens a group account at CBI. |

| What if I miss an EMI? | Contact the branch immediately; they can reschedule. Ignoring notices will hurt your credit score. |

| Can I prepay early? | Yes, after 6 months you can repay partly or fully without penalty. |

| Is personal use allowed? | No. The loan must fund business assets or working capital; misuse can trigger recall. |

Where to Get Help

Nearby MSME Development Centre: They’ll help polish your project report for free.

Branch Locator: https://www.centralbankofindia.co.in → Locate Us

Toll-Free: 1800-22-1911 (ask for “Cent Kalyani desk”)

Email: customercare@centralbank.co.in

Quickest option if you already bank with CBI.

10. Credit Guarantee Fund Scheme (CGTMSE)

If your small business needs up to ₹5 crore but you lack collateral, ask your bank about a CGTMSE-backed loan. With government guarantee cover and modest annual fees, it’s the safest route to formal credit for thousands of Indian micro and small entrepreneurs.

| Point | Easy Explanation |

|---|---|

| Goal | Help small businesses get a bank loan without pledging house papers, land or gold. |

| How it works | Your bank lends to you; CGTMSE (a trust set up by the Govt.. of India & SIDBI) promises to repay up to 75-85 % of that loan if you ever default. Because the bank’s risk is covered, it agrees to lend without collateral. |

| Who can use it | • Up to ₹5 lakh: 85 % • ₹5 lakh – ₹50 lakh: 75 % (women/SC-ST/OBC/NE units get 80 %) • Above ₹50 lakh: 75 % of the loan amount, capped at ₹3.75 crore. |

| Loan size covered | Up to ₹5 crore (raised from ₹2 crore in Dec 2023; pilot increase to ₹10 crore for select lenders announced Mar 2025). |

| Guarantee cover | Any public-sector bank, major private banks, small-finance banks or RRBS—ask for a “collateral-free CGTMSE loan.” |

| Guarantee fee | You pay a small yearly fee to CGTMSE through your bank (0.37 % for tiny loans → 1.35 % for ₹2–5 crore slab). This is added to your loan EMI—no lump-sum cash needed. |

| Tenure | Same as the bank loan (max 10 years for term loans; WC renewed yearly). |

| Paperwork | Normal loan file + a one-page CGTMSE application your branch fills for you; no separate visit to CGTMSE. |

| Where to apply | Any public-sector bank, major private banks, small-finance banks or RRBs—ask for a “collateral-free CGTMSE loan.” |

Step-by-Step: How You Get the Loan

- Prepare a project plan – what you’ll buy, sales forecast, and cost sheet.

- Visit your bank’s MSME desk; request collateral-free loan coverage under CGTMSE.

- Bank checks, CIBIL, and business viability.

- If satisfied, the bank sanctions the loan and simultaneously files an online guarantee request with CGTMSE.

- You sign normal loan papers; no separate CGTMSE contract.

- Pay the annual guarantee fee along with EMIs; enjoy collateral-free funds.

Typical timeline: 7-30 working days, depending on file readiness.

Why It’s Popular

- Crore-plus beneficiaries — By FY 2024-25, the scheme had guaranteed loans worth ₹5 lakh crore to over 75 lakh small units.

- Women & first-timers benefit — about one-third of guarantees go to first-time borrowers who owned no collateral.

- Lower interest than NBFCs — because it’s a regular bank loan, rates are usually MCLR + 1–2 %, far below informal credit.

Points to Remember

- CGTMSE doesn’t give money directly; it only backs your bank.

- You must still present a viable business plan and repay on time—the guarantee protects the bank, not you. Defaults hurt your credit score.

- The bank may still ask for a personal guarantee/signature, though no property mortgage is taken.

- Pay the annual guarantee fee on schedule; missing it can void coverage.

Quick FAQ

| Q | A |

|---|---|

| Yes—each new sanction can be fresh-covered if still within the ₹5 crore overall limit. | Yes—each new sanction can be fresh-covered if still within ₹5 crore overall limit. |

| Existing loan with collateral—can I switch? | Not mid-way; you’d need a new sanction. |

| Any subsidy? | The “subsidy” is zero collateral; no cash grant. |

| Where to track? | You can’t log in, but your branch receives an e-guarantee number—ask for it for records. |

11. STEP Programme

The STEP Programme gives women free skills, starter tool-kits and guided pathways to jobs or micro-businesses in ten income-earning sectors. No collateral, no tuition fees—just your time and eagerness to learn. Check your district notice board or state WCD website and grab the next STEP batch to turn your skill into steady earnings.

| What it is | A Central Government (Ministry of Women & Child Development) scheme that gives free skill-training plus job/self-employment help to women aged 16 years and above in traditional and modern trades. |

| Why it exists | Many women have talent but no formal certificate or market link. STEP covers the cost of training, raw-material kits and placement support so they can earn their income. |

| Started | Many women have talent but no formal certificate or market link. STEP covers the cost of training, raw-material kits and placement support so they can earn their income. |

| Cost to you | 1986-87 — Revamped Guidelines in 2017 to focus on quality & jobs. |

| Training length | Minimum 200 hours (about 2–3 months). |

| Certification | Zero. The government pays up to 90 % of the project cost to the training agency; the rest is borne by that agency. |

Which Sectors Are Covered?

- Agriculture & Allied (organic farming, floriculture)

- Horticulture

- Dairy & Animal Husbandry

- Poultry

- Handlooms

- Handicrafts & Embroidery

- Sericulture (silk)

- Apparel/Tailoring & Garments

- Bamboo & Cane products

- Computer & IT-enabled services

(States can propose any women-friendly trade; these ten get fast approval.)

What You Receive

- Free classroom & practical training (machines, material provided).

- Tool-kit or raw-material pack so you can start work on day 1 after the course.

- Soft-skills & digital-payments module (GST basics, UPI, marketing).

- Job placement OR help setting up a micro-enterprise (bank-loan hand-holding, SHG formation, e-commerce listing).

- Post-training support for at least 12 months—trainers must track and guide you until you start earning.

Some projects also pay a small daily stipend for travel/food (varies by state & NGO).

Who Can Join?

| Requirement | Details |

|---|---|

| Gender | Women & girls aged 16 + (no upper age limit). |

| Income | Preference to families earning ≤ ₹1.5 lakh a year or holding BPL card, but not mandatory. |

| Education | Preference to families earning ≤ ₹1.5 lakh a year or holding a BPL card, but not mandatory. |

| Location | No minimum schooling for most trades; IT courses need a Class 8 pass. |

How to Enrol — Three Simple Paths

- State Women & Child Department

Check their website or notice board for “STEP admissions” - District Industries Centre / Skill Development Centre

They list STEP-approved NGO batches and application dates. - Directly with an NGO / SHG federation running a sanctioned STEP project

Look for banners in the panchayat office, anganwadi or local newspaper ads.

Carry Aadhaar, a photo, and (if you have one) ration-card/BPL certificate.

Realistic Earnings after STEP

| Trade | Typical Starting Monthly Income |

|---|---|

| Tailoring/Apparel | ₹ 8,000 – ₹ 12,000 from piece-work or local orders |

| Dairy Micro-unit | ₹ 8,000 – ₹ 12,000 from piece-work or local orders |

| Handloom/Handicraft | ₹ 6,000 – ₹ 9,000 (home-based, plus fair sales) |

| Computer Data-Entry | ₹ 6,000 – ₹ 9,000 (home-based, plus fair sales) |

(Income depends on hours worked and local demand; STEP aims for at least ₹ 6,000/month within one year of course completion.)

Frequently Asked Questions

| Q | Short Answer |

|---|---|

| Do I pay anything? | No tuition fee. Sometimes, a refundable caution deposit (₹200–₹500) for the tool-kit care. |

| STEP itself is grant-based. For loans, you can use Mudra Shishu/Kishore or state women-enterprise loans—trainers guide you. | Is a hostel provided? |

| Can my SHG apply as a group? | Yes—NGOs love existing groups; you can train together under one project. |

| Will the government give us a loan afterwards? | STEP itself is grant-based. For loans you can use Mudra Shishu/Kishore or state women-enterprise loans—trainers guide you. |

| I’m over 45. Can I still join? | Absolutely—there is no upper age bar. |

Who Runs STEP Projects?

- Reputed NGOs/SHG federations with a three-year track record

- State Government agencies (handloom corporations, animal-husbandry boards)

- Universities & technical institutes for IT or biotech training

The Ministry releases funds directly to these agencies in instalments linked to your progress.

Where to Get More Info

- Ministry website: https://wcd.nic.in → Schemes → STEP

- Women Helpline: 181 (ask to connect to the district WCD officer)

- State Skill Mission portal: often lists STEP batches under “Women-only courses”.

Conclusion

These programmes aren’t charity—they’re investments in India’s growth. Every time a woman like you starts up, she hires neighbours, spends locally, and sends her kids to better schools. Pick the scheme that fits, fill that first form, and watch possibilities open.

The future of India’s economy is being shaped by bold, determined women ready to lead, and with powerful government schemes for women entrepreneurs, there’s no reason to hold back. These aren’t just financial programmes; they are game-changers designed to break barriers that have held women back for too long.

From securing collateral-free loans to getting expert mentorship and market access, the tools you need are now within reach. This is your moment to rise, to build, and to succeed on your terms. The support is real, the opportunity is now—step forward and claim your place as India’s next successful woman entrepreneur.

📩 If you notice any incorrect data in this guide or wish to share additional information, please write to us at info@indiansouls.in.

Over 2000+ Government Schemes & Policies Simplified

Indian Souls is your guide to government Schemes, scholarships, pensions, subsidies, job exams, and more. We break complex schemes into easy steps, helping every citizen take full advantage of the opportunities available.

No jargon. No confusion. Just useful info that helps indian citizen.

![Government Schemes for Women Entrepreneurs - Indian Souls 12 Government Schemes for Urban Poor Must Know About [2025 Guide]](https://indiansouls.in/wp-content/uploads/2025/05/image-1.jpg)