Last Updated on March 19, 2025 by Sudhir Singh

The Union Budget for 2025-26 introduces significant investments in infrastructure, renewable energy, healthcare, education, and technology, supported by government initiatives.

These efforts aim to accelerate economic growth, enhance public services, and create new business opportunities. This budget outlines a forward-looking vision designed to strengthen India’s economic resilience, foster innovation, and improve social welfare.

By reducing tax burdens, supporting micro, small, and medium enterprises (MSMEs), enhancing infrastructure, and promoting digital and financial inclusion, the government is cultivating an ecosystem for sustainable growth.

Investments in agriculture, education, technology, and healthcare will empower vital sectors while ensuring inclusive development.

With a balanced approach that combines fiscal responsibility with economic expansion, this budget lays the groundwork for a robust and self-reliant India.

As businesses and individuals adapt to these reforms, the emphasis should be on seizing new opportunities for growth, investment, and prosperity.

Key Announcements in Union Budget 2025-26: Impact & Analysis

Boosting Middle-Class Consumption & Savings

The government has exempted income tax for individuals earning up to ₹1 lakh per month (₹12.75 lakh annually under the new tax regime). This move aims to boost household savings, increase disposable income, and drive consumption, ultimately fueling economic growth.

Strengthening India’s Economic Growth Pillars

The budget identifies four key drivers of development—Agriculture, MSMEs, Investments, and Exports—and provides financial and policy support to accelerate industrial expansion and job creation.

Agriculture & Rural Development

- PM Dhan-Dhaanya Yojana will cover 100 districts with low agricultural productivity, benefiting 1.7 crore farmers through better infrastructure and modern farming techniques.

- Mission for Aatmanirbharta in Pulses focuses on boosting domestic production of tur, urad, and masoor dal to reduce dependence on imports.

- Farmers can now avail loans of up to ₹5 lakh under the Modified Interest Subvention Scheme via Kisan Credit Cards (KCC), ensuring better access to credit at lower interest rates.

Fiscal Responsibility & MSME Support

- The fiscal deficit for FY25 is set at 4.8%, with a plan to lower it to 4.4% in FY26 to maintain economic stability.

- MSMEs will get enhanced credit guarantees, increasing the coverage from ₹5 crore to ₹10 crore to encourage small business growth.

- A National Manufacturing Mission will support small, medium, and large industries, furthering the “Make in India” initiative to promote local production.

Education & Technology Innovations

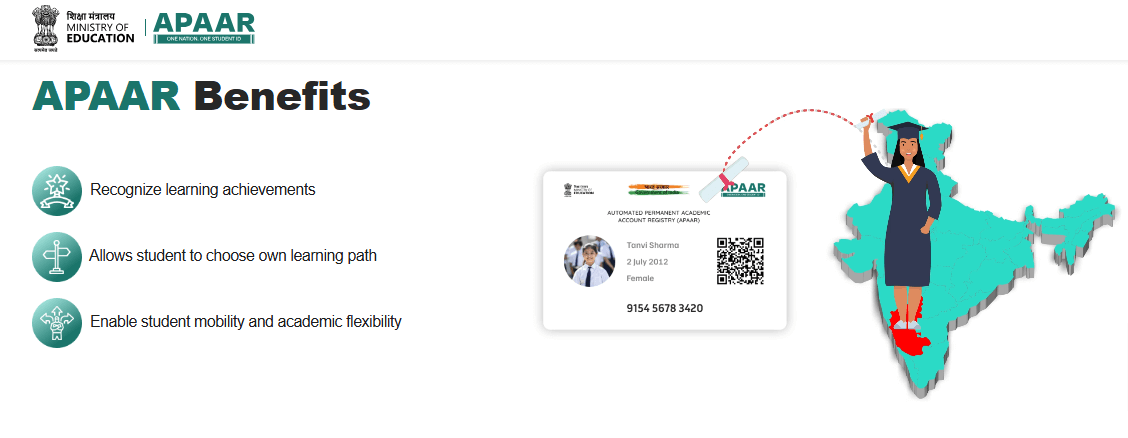

- 50,000 Atal Tinkering Labs will be established in government schools over the next five years to encourage STEM education.

- A Centre of Excellence in AI for Education will be set up with a ₹500 crore budget to drive technology-based learning.

Financial Inclusion & Digital Economy

- The PM SVANidhi scheme will offer higher bank loans, while small vendors can access UPI-linked credit cards with a ₹30,000 limit.

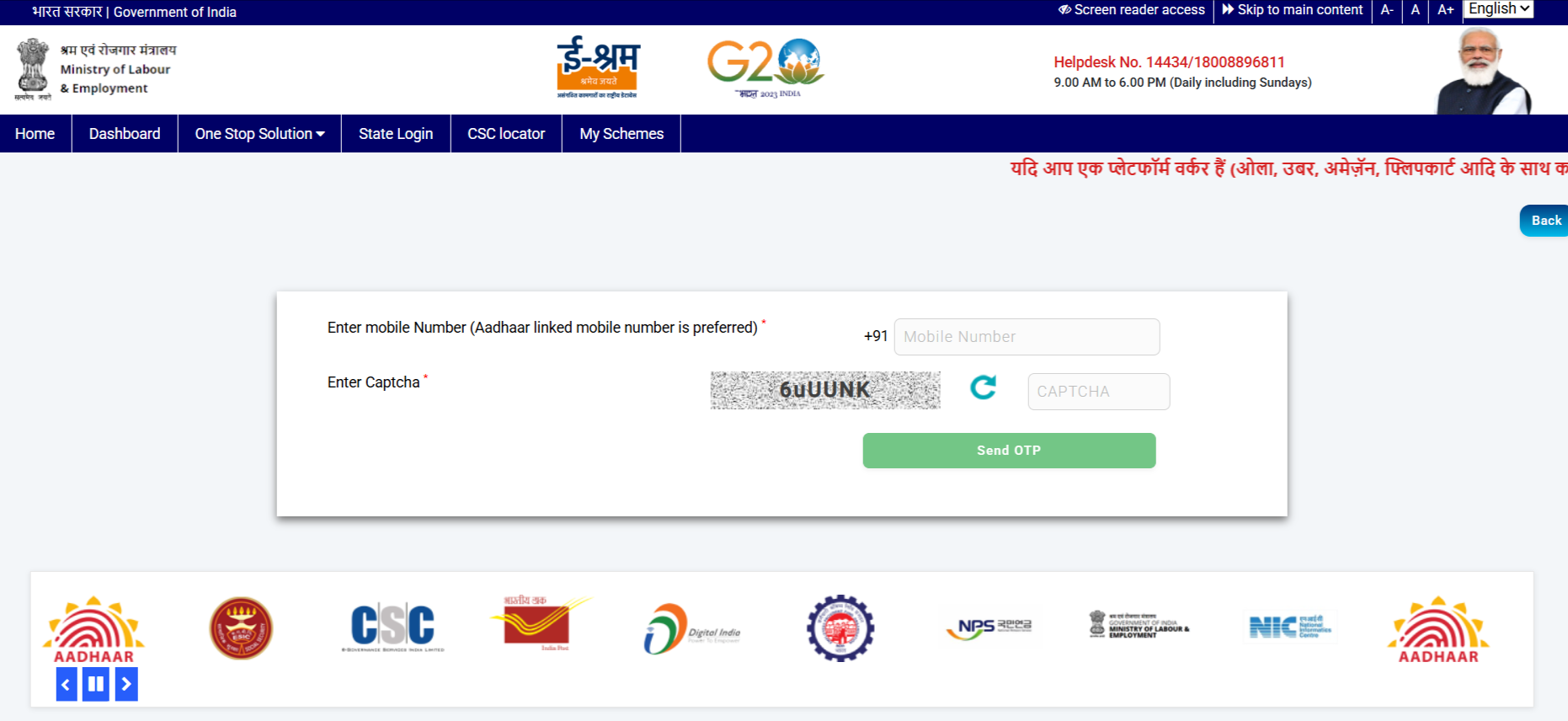

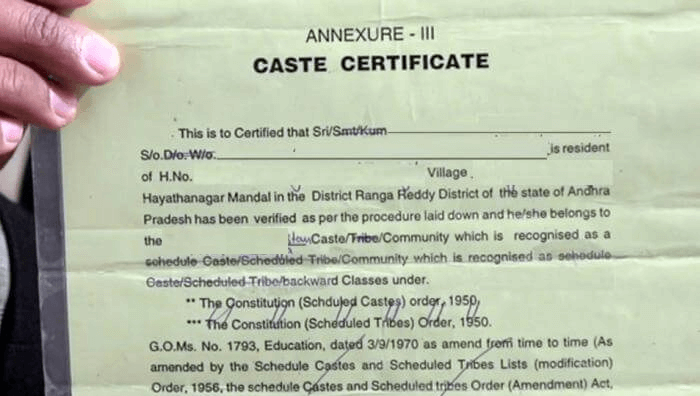

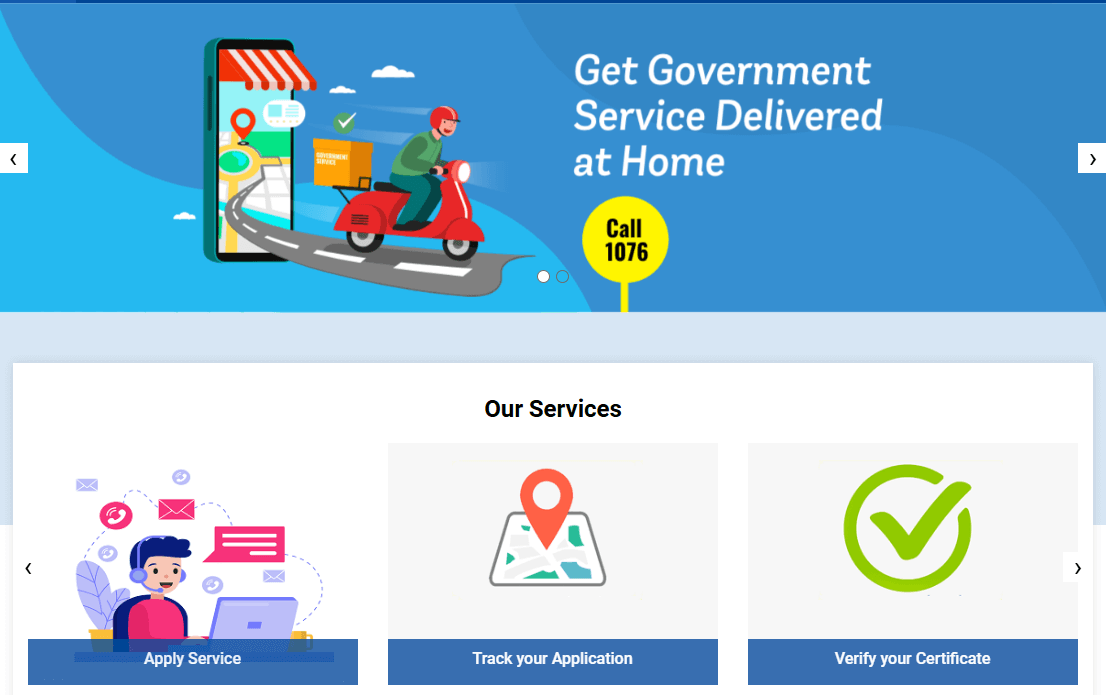

- Gig workers will receive identity cards, be registered on the e-Shram portal, and get healthcare coverage under PM Jan Arogya Yojana.

Urban Development & Infrastructure

- A ₹1 Lakh Crore Urban Challenge Fund will help cities become economic growth hubs while ensuring sustainable urban expansion.

- The Modified UDAN Scheme will improve regional air connectivity with 120 new destinations.

- A ₹15,000 crore SWAMIH Fund will be allocated for completing 1 lakh stalled housing projects, benefiting the real estate sector.

Research, Innovation & Industry Growth

- ₹20,000 crore allocated for private sector-driven R&D and innovation initiatives.

- A Nuclear Energy Mission with a ₹20,000 crore budget will focus on small modular reactor development and research.

- FDI limits in the insurance sector have been raised from 74% to 100%, making it more attractive for foreign investors.

Simplifying Business & Taxation

- The Jan Vishwas Bill 2.0 will decriminalize over 100 provisions across different laws, making compliance easier.

- The time limit for filing updated income tax returns has been extended from 2 years to 4 years, giving taxpayers more flexibility.

- Delay in TCS payment will no longer be a criminal offense, reducing penalties for businesses.

- TDS on rent has increased from ₹2.4 lakh to ₹6 lakh, benefiting landlords and rental markets.

Healthcare & Customs Duty Reforms

- Basic Customs Duty (BCD) has been exempted on 36 life-saving drugs, including those for cancer, rare diseases, and chronic illnesses.

- The duty on Intelligent Flat Panel Displays (IFPD) has been raised to 20%, while the duty on open cells has been cut to 5% to boost local manufacturing.

- To encourage EV and mobile battery production, capital goods for battery manufacturing are now exempt from customs duty.

- The shipbuilding industry will enjoy a 10-year customs duty exemption on raw materials and components.

Agriculture & Fisheries Support

- BCD on frozen fish paste has been reduced from 30% to 5%, while the duty on fish hydrolysate has dropped from 15% to 5%, supporting the seafood industry.

The Union Budget 2025-26 lays a strong foundation for economic growth, business expansion, social welfare, and infrastructure development. Let me know if you need a tailored strategy based on these announcements! 🚀

Union Budget 2025-26: Summary Table of Key Sectors

This summary provides a quick overview of the key sectors, investments, opportunities, and public impact from the Union Budget 2025-26.

| Sector | Investment | Key Initiatives | Opportunities for Businesses | Impact on Individuals |

|---|---|---|---|---|

| Agriculture & Rural Development | ₹1.5 Lakh Crore | PM Kisan Samman Nidhi, PMFBY, RKVY | Agri-tech startups, irrigation firms, warehouse providers | Better crop yields, stable food prices, rural job growth |

| Clean Energy & Electric Vehicles (EVs) | ₹25,000 Crore | PM Kusum Yojana, FAME III, Green Hydrogen Mission | EV makers, solar energy firms, battery storage companies | More EV charging stations, lower electricity bills, clean energy growth |

| Infrastructure Development | ₹10 Lakh Crore | Bharatmala, Gati Shakti, UDAN, Smart Cities | Construction firms, logistics companies, smart tech developers | Faster transport, improved connectivity, better urban services |

| Education & Skill Development | ₹1.2 Lakh Crore | PM e-Vidya, Skill India, National Apprenticeship Scheme | Ed-tech startups, universities, corporate training providers | Better digital learning, job-oriented skills, more R&D funding |

| Healthcare & Pharmaceuticals | ₹1.8 Lakh Crore | Ayushman Bharat, Digital Health Mission, Pharma PLI Scheme | Health-tech startups, pharma companies, hospital chains | More hospitals, free medicines, digitized health records |

| Digital Economy & AI | ₹2 Lakh Crore | National AI Mission, Digital India, Cybersecurity Strategy | AI startups, cybersecurity firms, cloud computing providers | Improved cybersecurity, AI-driven services, more tech jobs |

| Financial Sector & Banking | ₹3 Lakh Crore | Jan Dhan 2.0, Grameen Credit Score, Banking Digitization | Fintech startups, rural banks, credit rating firms | Easier loans, faster UPI transactions, stronger banking system |

| Urban Development & Housing | ₹2.5 Lakh Crore | PM Awas Yojana, AMRUT 2.0, Smart Cities Mission | Construction firms, real estate developers, waste management startups | Affordable housing, better urban transport, cleaner cities |

| Transport & Logistics | ₹4 Lakh Crore | PM Gati Shakti, Bharatmala, UDAN, Sagarmala | Logistics firms, airline operators, construction companies | Faster travel, improved public transport, cheaper goods |

| Tourism & Hospitality | ₹75,000 Crore | Swadesh Darshan 2.0, PRASHAD, Incredible India 2.0 | Hotels, travel agencies, eco-tourism startups | Better tourism infrastructure, easier visa access, diverse travel options |

| Defence & Security | ₹6 Lakh Crore | Make in India for Defence, DRDO Funding, Cyber Defence | Private defence firms, cybersecurity providers, aerospace startups | Stronger border security, local defence manufacturing, more defence jobs |

| Environment & Climate Change | ₹1.2 Lakh Crore | Clean Tech Manufacturing, Green India Mission, Plastic Waste Management | EV & renewable energy firms, waste management startups, agri-tech firms | Cleaner cities, lower energy costs, better waste management |

This guide provides an in-depth breakdown of key sectors, funding allocations, industry impacts, and actionable insights for businesses and individuals.

1. Agriculture & Rural Development

Investment: ₹1.5 Lakh Crore for Rural & Agricultural Growth

Key Government Schemes & Policies

- Prime Minister Dhan-Dhaanya Krishi Yojana: Enhancing agricultural productivity in 100 underperforming districts.

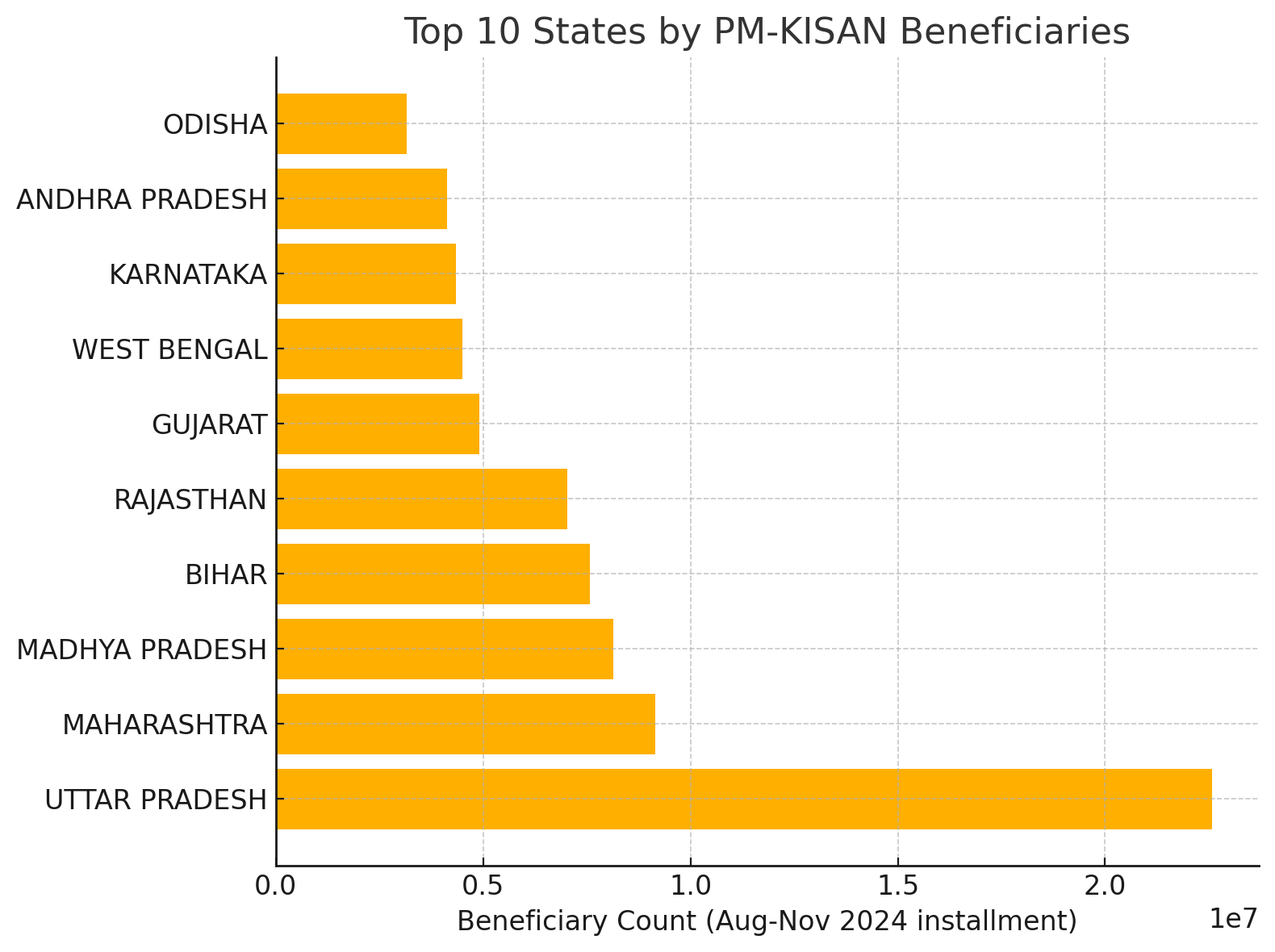

- PM Kisan Samman Nidhi: ₹6,000 annual direct income support for small and marginal farmers.

- Rashtriya Krishi Vikas Yojana (RKVY): Encouraging farmers to adopt modern techniques.

- Pradhan Mantri Fasal Bima Yojana (PMFBY): Providing crop insurance to mitigate financial risks.

Key Budget Announcements

- ₹30,000 crore allocated for irrigation projects under PM Krishi Sinchai Yojana.

- Increase in Minimum Support Price (MSP) for key crops to support farmers.

- ₹20,000 crore for rural storage and food processing units.

Opportunities for Businesses

- Agri-tech startups can develop AI-based crop monitoring and advisory services.

- Irrigation equipment manufacturers will benefit from increased demand.

- Warehouse and cold storage providers can expand operations in rural areas.

How This Affects You

- Better irrigation and storage reduce crop losses and stabilize food prices.

- Higher agricultural incomes create more job opportunities in rural areas.

- Advanced technology adoption makes farming more efficient and profitable.

2. Clean Energy & Electric Vehicles (EVs)

Investment: ₹25,000 Crore for Battery Storage & Renewable Energy

Key Government Schemes & Policies

- PM Kusum Yojana: Subsidies for farmers to install solar panels.

- FAME III: Expanding incentives for EV battery production and charging stations.

- National Green Hydrogen Mission: Promoting hydrogen fuel adoption.

- Production-Linked Incentive (PLI) Scheme: Supporting local EV manufacturing.

Key Budget Announcements

- ₹10,000 crore for the National Green Hydrogen Mission.

- ₹5,000 crore for expanding EV charging stations.

- Subsidies for rooftop solar installations in 10 million households.

Opportunities for Businesses

- EV manufacturers benefit from reduced production costs and incentives.

- Solar panel companies will see increased demand for residential and commercial installations.

- Battery storage firms can explore grid-scale energy solutions.

How This Affects You

- More EV charging stations make electric vehicles a more practical option.

- Solar incentives help lower electricity bills.

- Investments in hydrogen and biofuels could reduce fuel costs in the long run.

3. Infrastructure Development

Investment: ₹10 Lakh Crore for Roads, Railways & Urban Growth

Key Government Schemes & Policies

- Bharatmala Pariyojana: Expanding national highways.

- Gati Shakti National Master Plan: Boosting multi-modal transport efficiency.

- PM Gati Shakti Yojana: Reducing logistics costs.

- UDAN Scheme: Enhancing air connectivity to smaller cities.

Key Budget Announcements

- ₹3 lakh crore for Bharatmala and expressway expansion.

- ₹1 lakh crore for metro rail projects in Tier-2 and Tier-3 cities.

- ₹2 lakh crore for smart city initiatives.

Opportunities for Businesses

- Construction & engineering firms will benefit from increased infrastructure demand.

- Tech companies can develop smart traffic and surveillance systems.

- Logistics firms will see improved transport networks, reducing costs.

How This Affects You

- Faster highways and metro expansion mean reduced travel times.

- Smart city investments improve public services, sanitation, and connectivity.

- Better rail and airport connectivity supports business expansion.

4. Education & Skill Development

Investment: ₹1.2 Lakh Crore for Higher Education & Vocational Training

Key Government Schemes & Policies

- PM e-Vidya Scheme: Expanding digital learning platforms.

- Skill India Mission: Promoting vocational and technical education.

- National Apprenticeship Promotion Scheme (NAPS): Encouraging on-the-job training.

- PM Research Fellowship: Supporting innovation and R&D in universities.

Key Budget Announcements

- ₹30,000 crore for AI-driven smart classrooms in schools.

- ₹50,000 crore for upgrading IITs, IIMs, and AIIMS institutions.

- ₹15,000 crore for vocational training programs under the Skill India Mission.

Opportunities for Businesses

- Ed-tech startups can expand AI-based learning programs.

- Universities and private institutes can access funding for skill development.

- Corporate training providers can benefit from government contracts for workforce upskilling.

How This Affects You

- Better digital learning platforms make education more accessible.

- Skill-based training enhances employability and job opportunities.

- Increased government investment in R&D fosters innovation.

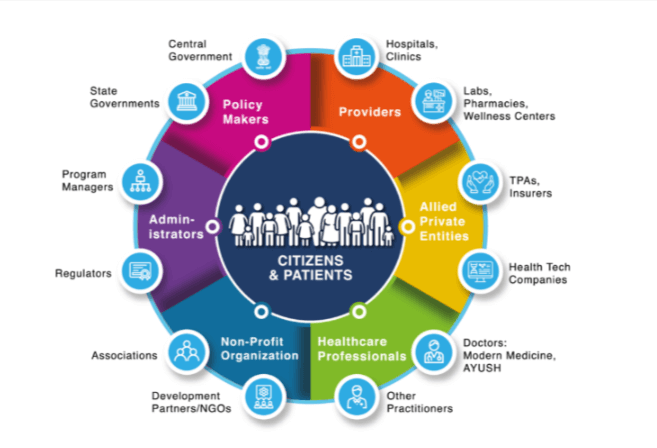

5. Healthcare & Pharmaceuticals

Investment: ₹1.8 Lakh Crore for Drug Manufacturing & Healthcare Infrastructure

Key Government Schemes & Policies

- Ayushman Bharat – PM Jan Arogya Yojana (PMJAY): Free healthcare services for low-income families.

- National Digital Health Mission: Implementation of electronic medical records for better healthcare management.

- Pharmaceutical PLI Scheme: Boosting domestic drug production to reduce import dependence.

- Mission COVID Suraksha: Strengthening India’s vaccine manufacturing capabilities.

Key Budget Announcements

- ₹40,000 crore for new AIIMS hospitals and medical colleges.

- ₹25,000 crore to expand the availability of generic medicines.

- ₹10,000 crore to enhance telemedicine services in rural areas.

Opportunities for Businesses

- Health-tech startups can expand AI-powered diagnostics and remote patient monitoring.

- Pharmaceutical companies will see increased demand for generic drugs and vaccines.

- Hospital chains and diagnostic labs can expand into rural areas with government support.

How This Affects You

- More hospitals and clinics mean improved access to healthcare.

- Free medicines and treatments benefit economically weaker sections.

- Digitized health records make medical services more efficient and accessible.

6. Digital Economy & AI

Investment: ₹2 Lakh Crore for AI, Blockchain & Cybersecurity

Key Government Schemes & Policies

- National AI Mission: Promoting AI research and adoption across industries.

- Digital India Programme: Expanding digital infrastructure to support a tech-driven economy.

- National Cybersecurity Strategy: Strengthening India’s cybersecurity framework.

- Deep Tech Fund: Supporting startups working in AI, blockchain, and robotics.

Key Budget Announcements

- ₹50,000 crore for AI-powered government services to enhance efficiency.

- ₹30,000 crore for cloud infrastructure and data centers.

- ₹20,000 crore for cybersecurity research and protection against cyber threats.

Opportunities for Businesses

- AI companies can collaborate with the government on digital transformation projects.

- Cybersecurity firms will see increased demand for data protection solutions.

- Startups in automation and blockchain can access government funding support.

How This Affects You

- Stronger cybersecurity enhances data privacy and protection.

- AI-driven services improve automation and efficiency in various industries.

- More investment in digital infrastructure creates new tech-driven job opportunities.

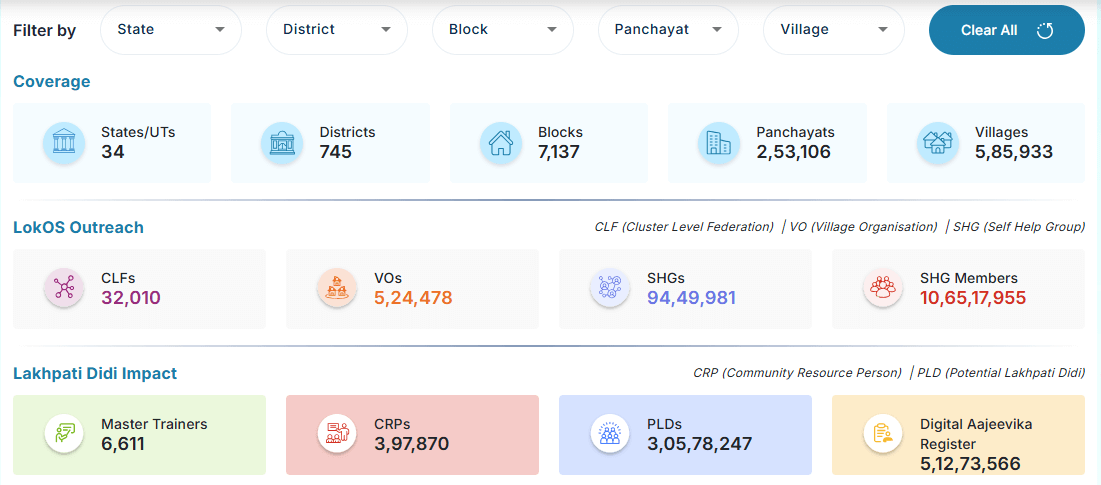

7. Financial Sector & Banking

Investment: ₹3 Lakh Crore for Banking Modernization & Credit Access

Key Government Schemes & Policies

- Grameen Credit Score Initiative: Helping rural entrepreneurs access credit.

- Jan Dhan Yojana 2.0: Expanding financial inclusion for underserved populations.

- Banking Digitization Mission: Promoting UPI and online payments to boost digital banking.

- National Asset Reconstruction Company (NARCL): Managing non-performing assets (NPAs) and bad loans.

Key Budget Announcements

- ₹50,000 crore to support rural businesses and small industries.

- ₹30,000 crore for strengthening digital banking infrastructure.

- ₹25,000 crore for recapitalization of public sector banks to improve financial stability.

Opportunities for Businesses

- Fintech startups can expand digital banking solutions, including UPI-based payment systems.

- Rural banks and NBFCs will benefit from increased lending support.

- Credit rating agencies can gain from the expansion of the Grameen Credit Score system.

How This Affects You

- Easier access to loans for small businesses and farmers.

- Faster and more secure online payments through UPI and digital wallets.

- Stronger banking sector stability with fewer bad loans, ensuring better financial services.

8. Urban Development & Housing

Investment: ₹2.5 Lakh Crore for Affordable Housing & Smart Cities

Key Government Schemes & Policies

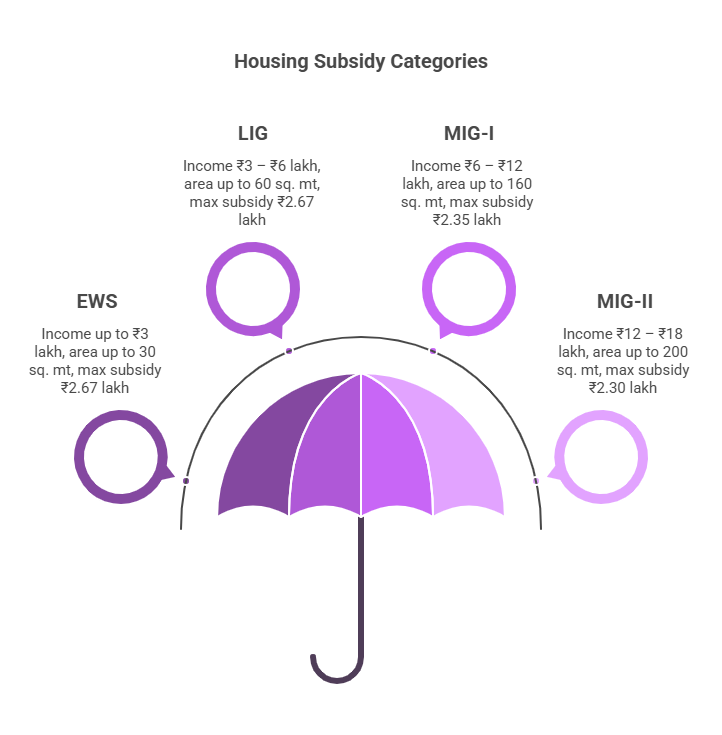

- Pradhan Mantri Awas Yojana (PMAY): Affordable housing initiatives for low-income groups.

- AMRUT 2.0 (Atal Mission for Rejuvenation & Urban Transformation): Enhancing water supply and sanitation in cities.

- Smart Cities Mission: Developing tech-driven and sustainable urban areas.

- Urban Challenge Fund: Supporting the development of sustainable infrastructure projects.

Key Budget Announcements

- ₹1 lakh crore allocated for the expansion of PMAY housing projects.

- ₹75,000 crore for new metro and urban transportation projects.

- ₹50,000 crore for waste management and green infrastructure in cities.

Opportunities for Businesses

- Construction companies can leverage smart city and affordable housing projects.

- Real estate developers can benefit from government-backed housing incentives.

- Green energy and waste management startups can access funding to contribute to sustainable urban development.

How This Affects You

- More affordable housing options in metro and Tier-2 cities.

- Improved urban transport leads to reduced congestion and better connectivity.

- Cleaner, greener cities with improved water supply, sanitation, and waste management systems.

9. Transport & Logistics

Investment: ₹4 Lakh Crore for Road & Railway Network Expansion

Key Government Schemes & Policies

- PM Gati Shakti National Master Plan: Integrating road, rail, air, and port networks for seamless logistics.

- Bharatmala Pariyojana: Expanding highways and expressways to enhance connectivity.

- UDAN Scheme: Improving air travel access for smaller towns and regional connectivity.

- Sagarmala Project: Strengthening coastal and inland waterway transport for better cargo movement.

Key Budget Announcements

- ₹1.5 lakh crore for railway modernization and high-speed rail projects.

- ₹1 lakh crore allocated for highway and expressway expansion.

- ₹50,000 crore for upgrading ports and inland waterways.

Opportunities for Businesses

- Logistics and warehousing companies will benefit from faster transport networks.

- Airline and railway operators can expand into new regional routes.

- Construction and engineering firms will gain from large-scale road and railway projects.

How This Affects You

- Faster travel times and reduced congestion on highways.

- Improved public transport options in major cities.

- Lower logistics costs, leading to cheaper consumer goods.

10. Tourism & Hospitality

Investment: ₹75,000 Crore for Tourism Infrastructure & Cultural Heritage

Key Government Schemes & Policies

- Swadesh Darshan 2.0: Developing 50 new tourism circuits across India.

- PRASHAD Scheme: Promoting pilgrimage tourism through infrastructure improvements.

- Incredible India 2.0: Strengthening India’s global tourism brand and digital marketing efforts.

- Tourism for Employment-Led Growth: Encouraging hospitality startups and tourism-focused businesses.

Key Budget Announcements

- ₹30,000 crore for developing new tourist destinations.

- ₹20,000 crore for upgrading hospitality infrastructure.

- ₹10,000 crore for expanding e-visa facilities and simplifying travel regulations.

Opportunities for Businesses

- Hotel chains and travel agencies can benefit from government incentives for tourism development.

- Heritage tourism operators can capitalize on newly developed historical and cultural sites.

- Adventure and eco-tourism startups can access funding and support for sustainable tourism projects.

How This Affects You

- More affordable and diverse travel options across India.

- Improved tourism infrastructure enhances the overall travel experience.

- Easier visa processing encourages international tourism and boosts the economy.

11. Defence & Security

Investment: ₹6 Lakh Crore for Armed Forces Modernization

Key Government Schemes & Policies

- Make in India for Defence: Promoting domestic manufacturing of military equipment.

- Defence Research & Development Organisation (DRDO) Fund: Supporting innovation in defence technology.

- Border Infrastructure Development Program: Strengthening border security with better infrastructure.

- Cyber Security Defence Mission: Enhancing India’s cybersecurity and cyber warfare capabilities.

Key Budget Announcements

- ₹2 lakh crore for increasing indigenous weapon manufacturing.

- ₹1 lakh crore for AI-driven defence technology and cybersecurity enhancements.

- ₹75,000 crore for border security and surveillance systems.

Opportunities for Businesses

- Private defence manufacturers can secure government contracts for domestic production.

- Cybersecurity firms will see increased demand for defence-related security solutions.

- Aerospace startups can explore applications in military AI and drone technologies.

How This Affects You

- Stronger border security ensures national safety and stability.

- Increased domestic production reduces reliance on defence imports.

- New job opportunities in defence research, development, and manufacturing.

12. Environment & Climate Change

Investment: ₹1.2 Lakh Crore for Sustainable Development & Green Initiatives

Key Government Schemes & Policies

- Clean Tech Manufacturing Initiative: Supporting electric vehicles and renewable energy adoption.

- National Mission for a Green India: Expanding afforestation and reforestation efforts.

- National Adaptation Fund for Climate Change (NAFCC): Funding projects that enhance climate resilience.

- Plastic Waste Management Program: Implementing strategies to reduce plastic pollution.

Key Budget Announcements

- ₹50,000 crore for promoting clean energy adoption and carbon reduction.

- ₹30,000 crore for waste management and pollution control initiatives.

- ₹20,000 crore for coastal and wildlife conservation efforts.

Opportunities for Businesses

- EV and renewable energy companies can leverage government subsidies and incentives.

- Recycling and waste management firms will see increased demand for eco-friendly solutions.

- Agri-tech startups can develop climate-resilient farming solutions for sustainable agriculture.

How This Affects You

- Better waste management and cleaner air lead to improved public health.

- Sustainable urban planning results in greener, more livable cities.

- Lower energy costs as renewable energy adoption increases.

Conclusion

The Union Budget 2025-26 presents a forward-looking vision aimed at strengthening India’s economic resilience, fostering innovation, and improving social welfare. By reducing tax burdens, supporting MSMEs, enhancing infrastructure, and driving digital and financial inclusion, the government is creating an ecosystem for sustainable growth. Investments in agriculture, education, technology, and healthcare will empower key sectors while ensuring inclusive development.

With a balanced approach between fiscal prudence and economic expansion, this budget sets the stage for a robust and self-reliant India. As businesses and individuals adapt to these reforms, the focus should be on leveraging new opportunities for growth, investment, and prosperity.